The semiconductor sector experienced a notable boost as Nvidia (NASDAQ:NVDA) led gains in chip stocks, contributing to an overall market rebound. This surge came after a period of volatility, offering investors a welcome respite and signaling potential stability in tech-heavy portfolios.

Nvidia, recognized for its cutting-edge graphics processing technologies, saw its shares rise significantly, reflecting robust demand across various sectors, including gaming, data centers, and artificial intelligence. The company’s performance has been closely watched by analysts, with many optimistic about its future growth prospects.

Apart from Nvidia, other semiconductor companies also witnessed positive movements. Advanced Micro Devices (NASDAQ:AMD) and Intel Corporation (NASDAQ:INTC) recorded gains, buoyed by industry-wide optimism. These developments underscore the pivotal role of semiconductors in the technology infrastructure, driving innovations across multiple industries.

The broader market rally was not confined to semiconductors alone. Gains were observed in other technology stocks, contributing to a more generalized upswing. The rebound was further supported by positive economic indicators, suggesting a more resilient recovery trajectory post-pandemic.

Investors are particularly attentive to Nvidia’s strategic initiatives, including its plans to expand into new markets and enhance its product offerings. The company’s focus on artificial intelligence and machine learning applications is expected to drive significant advancements in various fields, from healthcare to autonomous driving.

However, challenges remain, especially in the form of supply chain constraints that have plagued the semiconductor industry. Companies are actively working to mitigate these issues through strategic partnerships and investments in new manufacturing capabilities.

Market analysts note that while the current upswing is encouraging, sustained growth will depend on resolving these bottlenecks and adapting to evolving technological demands. The potential for new regulations and geopolitical tensions also adds layers of complexity to the market outlook.

Despite these hurdles, the semiconductor sector remains a critical component of the global economy, fueling innovation and driving the digital transformation of industries worldwide. As such, companies like Nvidia are poised to benefit from long-term growth trends, even as they navigate the immediate challenges.

In summary, Nvidia’s recent performance highlights the dynamic nature of the semiconductor industry and its significant influence on broader market trends. Investors and analysts alike are closely monitoring developments, balancing near-term uncertainties with positive long-term prospects.

Footnotes:

- The market rebound followed a period of significant volatility, offering a potential shift towards stability. Source.

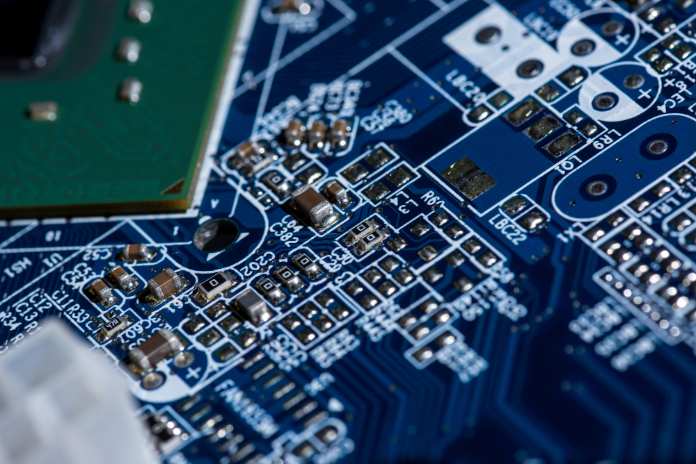

Featured Image: DepositPhotos @ EdZbarzhyvetsky