The technology sector often experiences volatility, particularly during market corrections. However, these periods can provide opportunities for savvy investors to acquire high-quality stocks at discounted prices. Notably, companies with robust business models and innovative technologies are poised to rebound strongly once the market stabilizes.

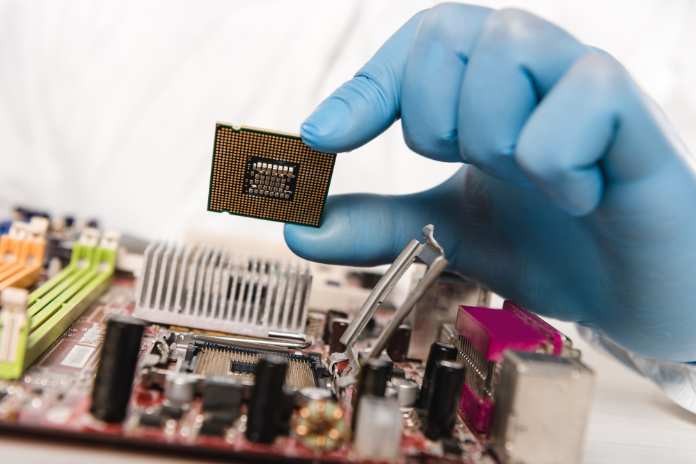

One such company is Advanced Micro Devices (NASDAQ:AMD), which has consistently demonstrated its prowess in the semiconductor industry. With a focus on high-performance computing and graphics solutions, AMD has carved out a significant market share, challenging industry giants like Intel and NVIDIA. As demand for semiconductor components continues to grow, driven by advancements in AI and machine learning, AMD is well-positioned to capitalize on these trends.

Moreover, Microsoft’s (NASDAQ:MSFT) strong foothold in cloud computing through Azure makes it another attractive investment during a market downturn. The shift towards remote work and digital transformation has accelerated the adoption of cloud services, and Microsoft stands to benefit significantly from this ongoing trend. Its diversified portfolio, including software, hardware, and gaming, also provides a stable revenue base to weather market fluctuations.

Investors should also consider Alphabet (NASDAQ:GOOGL), the parent company of Google, which continues to dominate the digital advertising space. The company’s investment in artificial intelligence and quantum computing, alongside its core search and advertising business, positions it for long-term growth. Despite short-term market pressures, Alphabet’s strategic initiatives and financial strength make it a compelling choice for investors seeking exposure to technology.

During market corrections, it’s crucial for investors to focus on companies with solid fundamentals and a track record of innovation. By doing so, they can leverage the temporary downturn to build a strong portfolio poised for future gains. While the market may be unpredictable in the short term, the potential for growth in the technology sector remains robust, driven by continuous advancements and an increasing reliance on digital solutions.

Footnotes:

- Advanced Micro Devices (NASDAQ:AMD) is a leading player in the semiconductor industry. Source.

- Microsoft’s (NASDAQ:MSFT) cloud computing services are a significant growth driver. Source.

- Alphabet (NASDAQ:GOOGL) continues to lead in digital advertising and AI investments. Source.

Featured Image: DepositPhotos @ AllaSerebrina