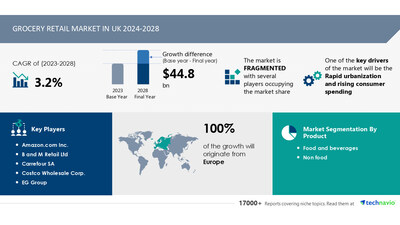

NEW YORK, Nov. 25, 2024 /PRNewswire/ — The grocery retail market in UK size is estimated to grow by USD 44.8 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of almost 3.2% during the forecast period. Rapid urbanization and rising consumer spending is driving market growth, with a trend towards innovative store layouts and offerings to amplify customer experience. However, threat from counterfeit grocery products poses a challenge. Key market players include Amazon.com Inc., B and M Retail Ltd, Carrefour SA, Costco Wholesale Corp., EG Group, EH Booth and Co. Ltd, Farmfoods Ltd., Heron Foods Ltd., HOFER KG, Iceland Foods Ltd., Lidl US LLC, Marks and Spencer Group plc, McCormick and Co. Inc., National Coop Grocers, Ocado Retail Ltd., PROUDFOOT SUPERMARKETS, SPAR (UK) Ltd., Tesco Plc, Waitrose and Partners, and Wm Morrison Supermarkets Ltd..

AI-Powered Market Evolution Insights. Our comprehensive market report ready with the latest trends, growth opportunities, and strategic analysis- View Free Sample Report PDF

|

Forecast period |

2024-2028 |

|

Base Year |

2023 |

|

Historic Data |

2018 – 2022 |

|

Segment Covered |

Product (Food and beverages and Non food), Distribution Channel (Hypermarkets and supermarkets, Convenience stores, Discount stores, Online, and Others), and Geography (Europe) |

|

Region Covered |

UK |

|

Key companies profiled |

Amazon.com Inc., B and M Retail Ltd, Carrefour SA, Costco Wholesale Corp., EG Group, EH Booth and Co. Ltd, Farmfoods Ltd., Heron Foods Ltd., HOFER KG, Iceland Foods Ltd., Lidl US LLC, Marks and Spencer Group plc, McCormick and Co. Inc., National Coop Grocers, Ocado Retail Ltd., PROUDFOOT SUPERMARKETS, SPAR (UK) Ltd., Tesco Plc, Waitrose and Partners, and Wm Morrison Supermarkets Ltd., |

Key Market Trends Fueling Growth

In the UK grocery retail market, shoppers are adopting a blend of traditional and online shopping channels. Traditional retailers, including department stores, specialty stores, hypermarkets, and supermarkets, face competition from e-commerce. The prevalence of smartphones offers an opportunity to merge physical and digital shopping experiences through IoT devices like Beacons. These devices enable location-based services, allowing retailers to target customers precisely. Amid the COVID-19 pandemic, UK retailers and supermarkets introduce various technologies, such as 3D sensor tech, enhancement and metrics, to ensure consumer safety and curb the virus’s spread. Beacons’ adoption in department stores is expected to rise, boosting sales through increased customer interaction, and positively impacting the grocery retail market growth during the forecast period.

The UK grocery retail market is experiencing significant trends driven by convenience, with curbside pickup and home delivery services gaining popularity. Competitive prices remain a key factor, catering to a large population and growing middle class. Urbanization and increasing automation are shaping innovative operating models, including the use of Artificial Intelligence (AI) for personalization and efficiency. AI algorithms analyze purchase history and browsing behavior to provide targeted product recommendations and promotions, enhancing customer experience. Supply chain disruptions, shortages, and imported products pose challenges, while online grocery sales continue to rise due to consumer polarization and cooking at home. Grocery retailers offer private label goods and leverage supplier networks to stay competitive. Supermarkets and omnichannel mass merchandisers like Whole Foods adapt to delivery options and the food cupboard segment. Environmental regulations and urbanization push for blockchain technologies to ensure transparency and traceability.

Insights on how AI is driving innovation, efficiency, and market growth- Request Sample!

Market Challenges

- The UK grocery retail market faces a growing challenge from counterfeit products, particularly in the areas of fast-moving consumer goods (FMCGs) and electronics. Counterfeiters are flooding the market with imitation goods, making it increasingly difficult for consumers to distinguish them from genuine items. This trend is particularly prevalent in online and e-commerce channels. The proliferation of counterfeit products negatively impacts the sales of major retailers and damages the reputation of legitimate manufacturers. Counterfeit brands undercut prices of authentic products, but their quality and durability are inferior. The production costs for counterfeit goods are low, enabling mass production. Consumers are often misled by imitation packaging and product names, especially in rural regions. Moreover, the sale of counterfeit grocery products poses a serious health risk due to unsanitary production conditions and potentially hazardous ingredients. The threat from counterfeit grocery products is expected to intensify, particularly after 2022, due to the expansion of e-commerce and the increasing demand for organic and premium products, which often have higher profit margins. This situation poses a significant hurdle for the growth of the UK grocery retail market.

- In the UK grocery retail market, browsing behavior and targeted product recommendations are key challenges for retailers. Consumers prefer convenience and personalized offers, requiring advanced technology and data analysis. Promotions and customer engagement are essential for sales growth, but supply chain disruptions and shortages can impact stock availability. Imported products, especially fresh produce, face uncertainty due to Brexit and environmental regulations. Online grocery sales are increasing, polarizing consumers between traditional supermarkets and online platforms. Urbanization and consumer preferences for cooking at home drive demand for private label goods and non-food items like clothing and household items. Grocery retailers must adapt to omnichannel mass merchandisers, supermarket business models, and competition from Whole Foods and other niche players. Delivery options, food cupboard segments, and supplier networks are crucial for success. Blockchain technologies offer potential solutions for transparency and traceability. Retailers must cater to diverse consumer needs, including ethnic markets and immigrant communities, while maintaining quality and variety.

Insights into how AI is reshaping industries and driving growth- Download a Sample Report

Segment Overview

This grocery retail market in UK report extensively covers market segmentation by

- Product

- 1.1 Food and beverages

- 1.2 Non food

- Distribution Channel

- 2.1 Hypermarkets and supermarkets

- 2.2 Convenience stores

- 2.3 Discount stores

- 2.4 Online

- 2.5 Others

- Geography

- 3.1 Europe

1.1 Food and beverages- The UK grocery retail market’s foods and beverages segment encompasses a diverse range of products, including fruits and vegetables, dairy, frozen foods, meat, baked goods, snacks, canned foods, and condiments. Popular items within this segment consist of fresh bread, salty snacks, and cereals. This sector has experienced substantial growth due to the increasing preference for snacks and innovative product offerings from vendors in terms of flavors. With rising per capita income, consumers are shifting towards organic and gluten-free options, diverging from traditional products. The demand for frozen snacks, particularly among teenagers, has grown. Vendors are continuously introducing new flavors and health-conscious ingredients to cater to this trend. For instance, General Mills Inc. Offers Organic Grapes Galore Fruit Juice Pops, a certified organic product made from real fruit juice. The dairy product segment comprises milk, milk alternatives, cheese, yogurt, and butter. Plant-based milk beverages have gained significant traction among millennials and lactose-intolerant consumers, fueling sales across various demographics. The revenue from dairy products is projected to expand during the forecast period as vendors introduce an array of new offerings. The growth in the foods and beverages segment will, consequently, propel the expansion of the UK grocery retail market.

Download complimentary Sample Report to gain insights into AI’s impact on market dynamics, emerging trends, and future opportunities- including forecast (2024-2028) and historic data (2018 – 2022)

Research Analysis

The UK grocery retail market is a vibrant and diverse sector, catering to the needs of end consumers in both urban and rural areas. Retail sales in this market have seen consistent growth, driven by the demand for a wide range of products including food and non-food items such as clothing, household items, and greengrocers. In big cities, consumers seek convenience and variety, leading to the popularity of online grocery platforms. Ethnic markets and immigrant communities contribute significantly to the market’s diversity, with a demand for specific products and consumer-oriented features like quality and variety. The supermarket business is dominated by traditional retailers, but omnichannel mass merchandisers are gaining ground with their curbside pickup and home delivery services. Private label goods and supplier networks are key strategies for retailers to differentiate themselves and compete effectively. Cooking at home remains a consumer trend, driving sales of grocery retailers. Online grocery sales continue to grow, with consumer polarization between those who prefer the convenience of home delivery and those who value the sensory experience of shopping in-store.

Market Research Overview

The Grocery Retail market in the UK is a vibrant and dynamic sector, driven by the needs and preferences of end consumers. Retail sales in this industry continue to grow, fueled by the convenience and variety of products offered by retailers. Both traditional grocers and online grocery platforms cater to the demand for non-food items such as clothing and household items, as well as fresh produce from greengrocers and ethnic markets. Big cities and immigrant communities contribute significantly to the market’s growth, with consumer-oriented features like quality, variety, and competitive prices being key drivers. Curbside pickup and home delivery services have gained popularity, particularly in urban areas where time is a precious commodity. The growing middle class and increasing urbanization have led to innovative operating models, automation, and the use of artificial intelligence (AI) to enhance efficiency and personalize the customer experience. AI algorithms analyze purchase history and browsing behavior to provide targeted product recommendations and promotions, while supply chain disruptions and shortages are addressed through imported products and blockchain technologies. Environmental regulations and consumer polarization towards cooking at home have also influenced the market, with private label goods and supplier networks becoming increasingly important for supermarkets and omnichannel mass merchandisers like Whole Foods. Delivery options and the food cupboard segment continue to evolve, offering consumers a wide range of choices and convenience.

Table of Contents:

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation

- Product

- Food And Beverages

- Non Food

- Distribution Channel

- Hypermarkets And Supermarkets

- Convenience Stores

- Discount Stores

- Online

- Others

- Geography

- Europe

7 Customer Landscape

8 Geographic Landscape

9 Drivers, Challenges, and Trends

10 Company Landscape

11 Company Analysis

12 Appendix

About Technavio

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions.

With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contacts

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: media@technavio.com

Website: www.technavio.com/

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/grocery-retail-market-in-uk-size-is-set-to-grow-by-usd-44-8-billion-from-2024-2028–rapid-urbanization-and-rising-consumer-spending-to-boost-the-revenue–technavio-302314959.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/grocery-retail-market-in-uk-size-is-set-to-grow-by-usd-44-8-billion-from-2024-2028–rapid-urbanization-and-rising-consumer-spending-to-boost-the-revenue–technavio-302314959.html

SOURCE Technavio

Featured Image: Megapixl @ Arinahabich08