Paytm Stock Dips on SEBI Notice News

Paytm stock experienced a notable drop of up to 8.9% on Monday, the largest decline since February, following reports of regulatory scrutiny. The Securities and Exchange Board of India (SEBI) has issued a show cause notice to Paytm founder Vijay Shekhar Sharma and several board members who were in place during the company’s initial public offering (IPO) 2.5 years ago.

The investigation concerns whether Sharma was incorrectly classified as an employee rather than a founder, which would affect his eligibility for stock options. SEBI is probing the compliance of these employee stock options (ESOPs) with regulations, particularly concerning their disclosure during the IPO.

Paytm’s Response and Ongoing Issues

Paytm has stated that it has already disclosed relevant information about the ESOPs in its financial results for the year ended March 31, 2024, and the subsequent quarter. The company is actively engaging with SEBI and is making representations regarding the matter.

The recent regulatory scrutiny adds to Paytm’s existing challenges, including previous actions taken by the Reserve Bank of India (RBI) earlier this year, which have contributed to a significant 30% drop in the stock value. In response to these issues, Paytm has been focusing on its core businesses, such as digital payments and financial services, while divesting non-core assets like its movie and events ticketing business, which was sold to Zomato Ltd. for $244 million.

Background and Market Impact

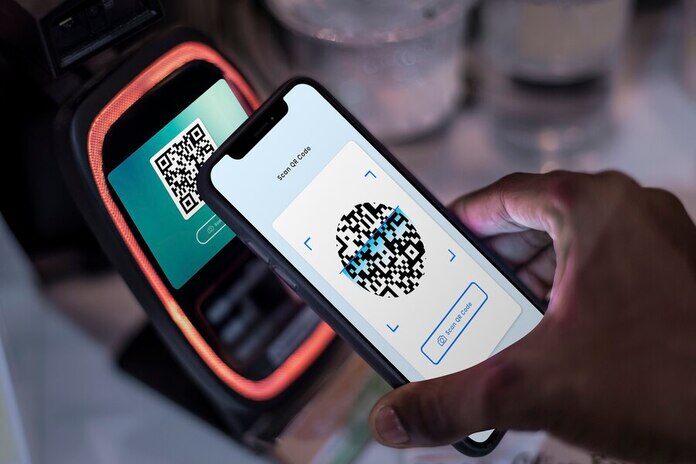

Vijay Shekhar Sharma, who revolutionized fintech in India with Paytm’s mobile wallets and QR codes, faces ongoing challenges as his company deals with a 75% drop from its IPO listing price. Paytm competes with major players like Walmart Inc.’s PhonePe, Alphabet Inc.’s Google, and Mukesh Ambani’s Jio Financial Services Ltd. in India’s competitive digital payments market.

Despite some recovery, Paytm stock closed 4.4% lower in Mumbai. The company continues to navigate regulatory hurdles and market pressures as it seeks to stabilize and grow its core operations.

Featured Image: Freepik