The Metal Company (NASDAQ:TMC) has recently experienced a notable dip in its stock price, raising questions among investors about its future trajectory. Despite this downturn, there are several compelling reasons to remain optimistic about the company’s long-term prospects.

Firstly, The Metal Company’s strategic focus on sustainable mining practices positions it well in an era where environmental considerations are increasingly critical. The company has invested heavily in reducing its carbon footprint and enhancing its environmental, social, and governance (ESG) standards, appealing to a growing segment of eco-conscious investors.

Moreover, the global demand for metals, driven by rapid advancements in technology and infrastructure development, provides a robust backdrop for the company’s growth. The Metal Company is well-placed to capitalize on this demand due to its diversified portfolio of metal products, which includes essential materials for electric vehicles and renewable energy technologies.

In addition to these industry tailwinds, The Metal Company has demonstrated resilience through its strong financial health. The company’s recent earnings report showed a solid balance sheet and steady cash flow, providing a buffer against market volatility and enabling strategic reinvestment into growth initiatives.

Investors should also consider The Metal Company’s robust innovation pipeline. The company is actively exploring new mining technologies and partnerships that could enhance efficiency and reduce operational costs, thereby increasing profitability over the long term.

Despite the current market challenges, including fluctuating commodity prices and geopolitical uncertainties, The Metal Company’s management remains committed to delivering value to shareholders. The company’s leadership has a proven track record of navigating industry cycles, which bodes well for its ability to overcome present hurdles.

In conclusion, while The Metal Company’s recent stock dip may cause short-term concern, the underlying fundamentals and strategic initiatives suggest a promising future. Investors with a long-term perspective may see the current dip as a potential buying opportunity, provided they have confidence in the company’s ability to execute its strategic vision.

Footnotes:

- The Metal Company’s focus on sustainable mining practices has been a key part of its strategy to attract eco-conscious investors. Source.

- The global demand for metals continues to rise, driven by advances in technology and infrastructure. Source.

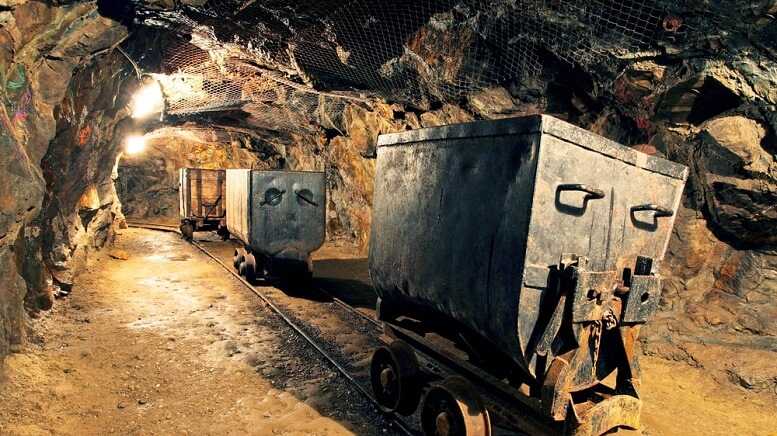

Featured Image: DepositPhotos @ ttstudio