Shares of Airbnb, Inc. (NASDAQ:ABNB) fell nearly 14% on Wednesday following a forecast for third-quarter revenue that fell short of expectations. The online travel company attributed this revision to slowing demand in the United States and shorter booking windows.

Domestic travel in the U.S. has been under pressure since the beginning of the year, as Americans have become more cautious about travel spending amid concerns about the economy’s health.

Airbnb joins Booking Holdings Inc. (NASDAQ:ABNB) in warning about shorter global booking lead times, which refer to the number of days between the reservation date and actual arrival. This trend suggests that consumers are making last-minute travel bookings due to increased uncertainty and spending caution.

Airbnb’s Chief Financial Officer Elinor Mertz highlighted that the reduction in long booking lead times was a significant factor in the company’s revised forecast. Mertz noted that, although travel had shown resilience post-pandemic, the trends observed by Airbnb, along with similar concerns noted by Booking Holdings—such as softness in Europe, reduced travel spending in the U.S., and normalization of booking windows—might dampen investor sentiment towards online travel stocks.

Jefferies analysts remarked that Airbnb’s disappointing outlook for nights booked, following similar concerns from Booking Holdings, is likely to exacerbate worries about slowing growth. The company anticipates a slowdown in the growth of nights booked for the third quarter, with Jefferies forecasting a year-on-year increase of 6%-8%, down from 8.7% in the second quarter.

Baird Equity Research analysts maintained a neutral stance on Airbnb’s shares as evidence suggests consumers are either cutting back on travel or delaying their travel plans.

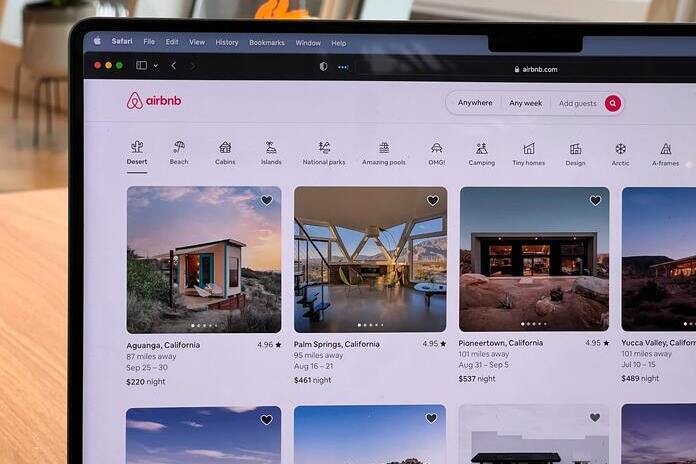

Featured Image: Unsplash