The Copper Breakout Is Real — and These 5 Companies Could Be the Biggest Winners

Copper is rallying back towards record highs — and the market may still be underestimating what comes next.

Between soaring EV demand, a tidal wave of AI-powered energy infrastructure, and looming US tariffs on foreign copper, the setup has never looked this bullish. Traders are stockpiling. Hedge funds are rotating in. Even US ports have been overwhelmed by copper import front-loading.

And yet, most investors are still focused on the giants — missing the explosive potential building in a handful of high-grade juniors and emerging developers.

This new copper cycle isn’t just about supply-demand imbalance. It’s about finding the next tier of companies poised to deliver resource growth, institutional validation, and massive leverage to rising metal prices.

Here are five copper stocks to keep on your radar in 2025 — starting with the most asymmetric setup in the space.

- Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF)

- Koryx Copper (TSXV:KRY)

- Solaris Resources (TSX:SLS) (OTCQB:SLSSF)

- Arizona Sonoran Copper Company (TSX:ASCU) (OTCQX:ASCUF)

- American Eagle Gold (TSXV:AE)

1. Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF)

The High-Grade Underdog With Potential Billion-Dollar Upside

At just a $31 million CAD market cap, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) might be one of the most overlooked copper-gold juniors in North America. But that’s starting to change — fast.

In December 2024, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) released its NI 43-101 technical report for the B26 polymetallic deposit in Quebec. The result? A nearly billion-pound copper equivalent resource with headline grades that rival much larger names:

- 11.3 Mt Indicated @ 2.13% CuEq

- 7.2 Mt Inferred @ 2.21% CuEq

- Over 553 million pounds Cu, 369,000 ounces Au4

And that’s just from the first 13,500 metres of drilling.

By early 2025, the company had already drilled 30,000 metres,, raised over $31 million, and launched Phase III exploration with another 20,000 metres.

This isn’t speculation. This is execution — backed by serious players like BMO Capital Markets (who also helped fund another copper stocks 16X run), billionaire Frank Giustra, and the Deluce family (Porter Airlines). Insiders have bought over 3 million shares since January 2024 alone.

Recent high-grade hits have turned heads:

- 10.6m @ 11.4% CuEq

- 97.5m @ 1.47% CuEq

- 44.5m @ 2.82% CuEq

- 2.9m @ 8.08% CuEq within 29m @ 1.94% CuEq

There’s a high-grade core of the deposit, containing intercepts such as 10.6m @ 11.4% CuEq— a rare find in today’s market.

But that’s just the beginning – 16,500 metres of drilling has not been included in the current resource—and after a strategic $10 million bought deal financing in early 2025, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) is fully funded through Q1 2027. The next leg of exploration will include:

- Phase III – 20,000 metres of focused drilling

- Infill within the high-grade zone to enhance economics

- Expansion of lateral and down-plunge zones

- Exploration of untested regional targets on the 3,328-hectare property

- Downhole geophysics, litho-structural modeling, and gravity surveys

- Testing of a large gravity anomaly on the eastern side of the property

The setup here checks all the right boxes: high-grade VMS-style mineralization, a Tier-1 jurisdiction in Quebec, and institutional backing from BMO — one of the most respected names in mining finance.

But here’s what really stands out: Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) is still trading under $0.50, despite already outlining a resource nearing 1 billion pounds CuEq (Ind 532.3Mlbs CuEq & Inf 348.8Mlbs CuEq) and delivering some of the highest-grade intercepts in the sector.

For investors hunting for the next big copper story, Abitibi Metals deserves a very close look.

Sponsored

Copper is Rallying — and Insiders Are Loading Up

One tiny explorer is sitting on nearly 1 billion pounds of high-grade copper-gold — and insiders have quietly bought over 3 million shares.

This might be the next big copper play of 2025.

Click here to read the full story and see why investors are watching closely.

2. Koryx Copper (TSXV:KRY)

A Large Copper Asset in a Mining-Friendly Jurisdiction

Koryx Copper (TSXV:KRY) is advancing the Haib Copper Project in southern Namibia—one of the world’s oldest and largest undeveloped porphyry copper deposits. As of August 31, 2024, the project boasts an updated NI 43-101 mineral resource estimate of 414 million tonnes (Mt) Indicated at 0.35% copper (Cu) and 345 Mt Inferred at 0.33% Cu, totaling approximately 5.7 billion pounds of contained copper.

Despite this substantial resource, Koryx’s market capitalization remains around C$72 million, presenting a significant value proposition relative to peers with similar or smaller resources.

The scale of the Haib deposit places it among the largest undeveloped copper assets globally, offering investors rare leverage to rising copper prices. The project is located in Namibia, a politically stable and mining-friendly jurisdiction with modern infrastructure and a transparent regulatory environment—an increasingly important factor for institutional investors.

Koryx Copper (TSXV:KRY) maintains a clean capital structure that enhances its appeal to strategic partners and long-term shareholders. In 2025, the company launched a transformative C$20 million development program, which includes over 55,000 metres of drilling designed to expand and upgrade the existing resource base.

At the helm is CEO Heye Daun, a seasoned mining executive with a strong track record of advancing large-scale resource projects across Africa. Under his leadership, Koryx is moving aggressively to fast-track the Haib Copper Project toward development.

With a massive in-ground resource, clear expansion strategy, and an experienced leadership team operating in a favorable jurisdiction, Koryx Copper offers a compelling copper growth story that remains undervalued by the broader market.

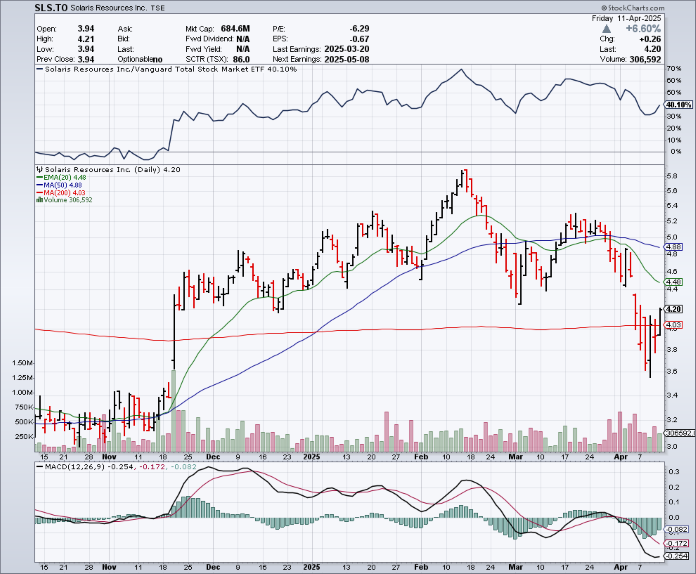

3. Solaris Resources (TSX:SLS) (OTCQB:SLSSF)

The Ecuadorian Giant With Majors Circling

Solaris Resources (TSX:SLS) (OTCQB:SLSSF) is one of the best-known copper exploration stories in South America.

As of July 2024, the Warintza Project boasts an impressive mineral resource estimate of 909 million tonnes in the Measured and Indicated category at 0.53% copper equivalent (CuEq), and an additional 1.43 billion tonnes in the Inferred category at 0.37% CuEq, based on a 0.25% CuEq cut-off grade. These figures position Warintza among the largest undeveloped open-pit copper assets globally.

In 2024, Solaris embarked on an ambitious drilling campaign, surpassing its initial target by completing over 75,000 meters of drilling by year-end. Notable drill results include hole SLS-111, which intersected 90 meters of 1.12% CuEq within 475 meters of 0.46% CuEq from surface, and hole SLS-107, which returned 96 meters of 0.82% CuEq within 543 meters of 0.51% CuEq from surface.

These results underscore the project’s potential for high-grade mineralization and resource expansion.

Beyond drilling, Solaris Resources (TSX:SLS) (OTCQB:SLSSF) has made significant progress in infrastructure development, including the improvement of 25 kilometers of road access connecting the project to the highway grid and the construction of new roads to support drilling activities and future mining operations.

Technical programs, such as geotechnical and hydrogeological drilling, have been completed for key facilities, and metallurgical studies are underway to optimize processing methods.

The stock has pulled back from its highs, now trading at a market cap just over $680 million CAD, but it remains one of the most advanced juniors in the space.

Recent M&A rumors, proximity to infrastructure, and government support make Solaris a strong contender for a future takeout.

It’s not cheap — but it’s de-risked and huge.

4. Arizona Sonoran Copper Company (TSX:ASCU) (OTCQX:ASCUF)

The US Permitted Developer With a Clean Cap Table

Arizona Sonoran Copper Company (TSX:ASCU) (OTCQX:ASCUF) is positioning itself as one of the next copper producers on US soil.

The company’s flagship Cactus Project in Arizona is a past-producing operation with a straightforward path to restarting production. As of 2024, the project hosts 632.6 million tonnes of Measured & Indicated resources at 0.58% copper (7.3 billion pounds) and an additional 474 million tonnes of Inferred resources at 0.41% copper (3.8 billion pounds).

A Preliminary Economic Assessment released in August 2024 outlined a 31-year mine life and projected average production of 232 million pounds of copper cathode annually in the first 20 years.

Unlike early-stage juniors, Arizona Sonoran Copper Company is already deep into permitting, engineering, and infrastructure planning — and holds a key advantage in being located entirely on private land, significantly streamlining the development process.

Trading at a C$292 million market cap, ASCU has received strategic investment from Tembo Capital and Nuton (a Rio Tinto venture), further validating its potential.

It’s not as explosive as a high-grade explorer — but it’s one of the cleanest, most near-term development stories in the US.

Sponsored

US Tariffs Could Ignite the Next Copper Breakout

One small company just revealed nearly 1 billion pounds of high-grade copper equivalent…

And it’s flying completely under Wall Street’s radar.

Click here to see why this could be the next major breakout.

5. American Eagle Gold (TSXV:AE)

Advancing the NAK Copper-Gold Porphyry Project in British Columbia

American Eagle Gold (TSXV:AE) is a Canadian exploration company advancing the NAK copper-gold porphyry project in British Columbia’s Babine District — a well-known region with historical production, strong infrastructure, and year-round accessibility.

In 2025, American Eagle plans an extensive 30,000-meter drill campaign targeting key mineralized zones and newly identified geophysical anomalies within and around the Babine porphyry stock. The program aims to further delineate and expand mineralization, unlocking the potential of this large and complex system.

While early-stage, American Eagle Gold (TSXV:AE) brings a key advantage: it’s backed by Ore Group, the same team behind Arizona Metals (TSX:AMC) — a proven performer in the copper-gold space. That connection adds a layer of credibility and technical expertise often missing at this stage of development.

The company is well-funded, with over $37 million in the treasury and strategic investments from majors like South32 and Teck Resources. Strong local relationships, particularly with the Lake Babine Nation, also position the project for long-term development.

It’s a name that’s flying under the radar — but one that could become more prominent as results from its 2025 drill campaign begin to land.

The Bottom Line

From billion-dollar producers to under-the-radar juniors, the copper trade is heating up fast.

But only one of these names is sitting on nearly a billion pounds of high-grade copper equivalent… backed by institutions… with insiders buying… and a market cap still under $35 million.

That’s why Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) stands out.

The setup is rare. The grade is real. And the upside?

Still massively underappreciated.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers