This isn’t a drill.

On July 31st, the copper market was shocked as prices dropped sharply from $5.80 per pound to $4.35.

Fortunately, the pullback didn’t last. By late November, copper had surged back to $5.18 per pound, hitting a two-month peak as tightening global supply overshadowed sluggish demand.

Why? Because the price dip doesn’t change the fact that copper remains a strategic asset.

Copper demand isn’t just trending higher, it’s accelerating.

AI data centers, EVs, clean energy infrastructure, and global grid expansion are creating a structural, long-term need that no substitution can replace. Analysts project copper demand could double by the mid-2030s, driven by electrification alone.1

Meanwhile, supply risks are deepening.

Chile’s copper output fell nearly 10% year-on-year in August, the steepest drop since 2023, after an earthquake forced state-owned Codelco to suspend operations at El Teniente.2

Indonesia’s Grasberg mine has also removed an estimated 3% of global supply due to a mudslide, with full recovery not expected until 2027.3

Even Freeport-McMoRan has already cut its 2026 guidance by 35%.4

And with China curbing industrial overcapacity, copper output growth is forecast at just 1.5% in 2025–26, far below the prior 5% target.5

The market is adjusting, but the pressure on North American copper producers is mounting.

And that’s where this junior is positioned perfectly: sitting on high-grade copper in one of the most stable, mining-friendly regions in the world, and set to benefit as the world’s need for copper continues to grow.

This isn’t a bubble. It’s a full-blown supply crisis in the making.

So what happens when copper enters a full-blown supply crisis?

You get a setup that only comes around once every few market cycles, one that could create a massive opportunity for a tiny junior sitting on one of Canada’s highest-grade undeveloped copper-gold deposits.

This company is still trading at a mere C$59.5 million market cap.6

The asset?

A copper-gold VMS deposit with nearly 550 million pounds of copper and 369,000 ounces of gold, combining 532.3 million pounds copper equivalent (CuEq) in the Indicated category and 348.8 million pounds CuEq in the Inferred category.7

That includes 11.3 million tonnes grading 2.13% CuEq (Indicated) and 7.2 million tonnes at 2.21% CuEq (Inferred),8 numbers that rival or exceed the early-stage grades of much larger developers.

The company has already completed 30,000 metres9,10 and is fully funded to Q1 2027 after raising over $45 million, including the recent upsized C$14 million bought deal financing led by BMO Capital Markets,11,12,13,14 the same investment bank who led financing for a 2,500% copper winner.15

In fact, this was the smallest company invited to present at BMO’s 2025 Global Metals, Mining & Critical Minerals Conference—a signal that institutions are circling.15

Insiders? They’ve been loading up, quietly buying over 3 million shares since January.16

And at current copper prices, with gold prices above $4,200, this story is no longer just speculative.

It’s timely and it’s urgent.

One of the Most Undervalued Copper Story in Quebec

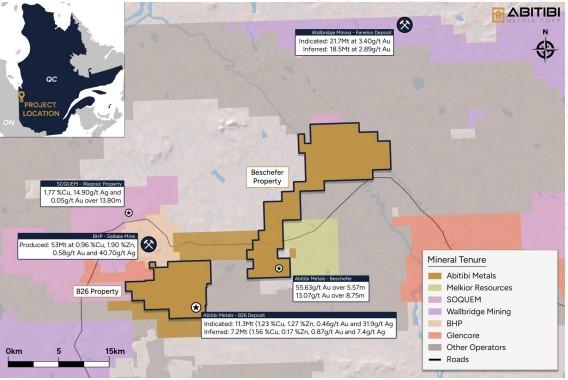

Meet Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF). Tucked away in the Abitibi Greenstone Belt of Quebec, this junior may have just lit the match.

Abitibi Metals controls the B26 copper-gold deposit — a VMS system that’s quietly become one of the highest-grade undeveloped polymetallic projects in North America.

Their latest resource?

A boosted resource of 18.5 million tonnes grading 2.18% CuEq17 (Ind 11.3Mt at 2.13% CuEq, Inf 7.2 at 2.21 CuEq), with a high grade core including 11.4% CuEq intercepted over 10.6 meters. With current metal prices, those credits push the effective grade closer to 2.7% CuEq, including over 2.05 million gold-equivalent ounces.

And the drills keep hitting.

In September 2025, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) reported one of its strongest intercepts yet on hole 269W3: 3.65% CuEq over 21.1 metres within a broader 1.55% CuEq over 69.0 metres, carrying a strong gold credit.18

Step-out holes up to 100m beyond the block model also hit economic grades, confirming expansion potential.

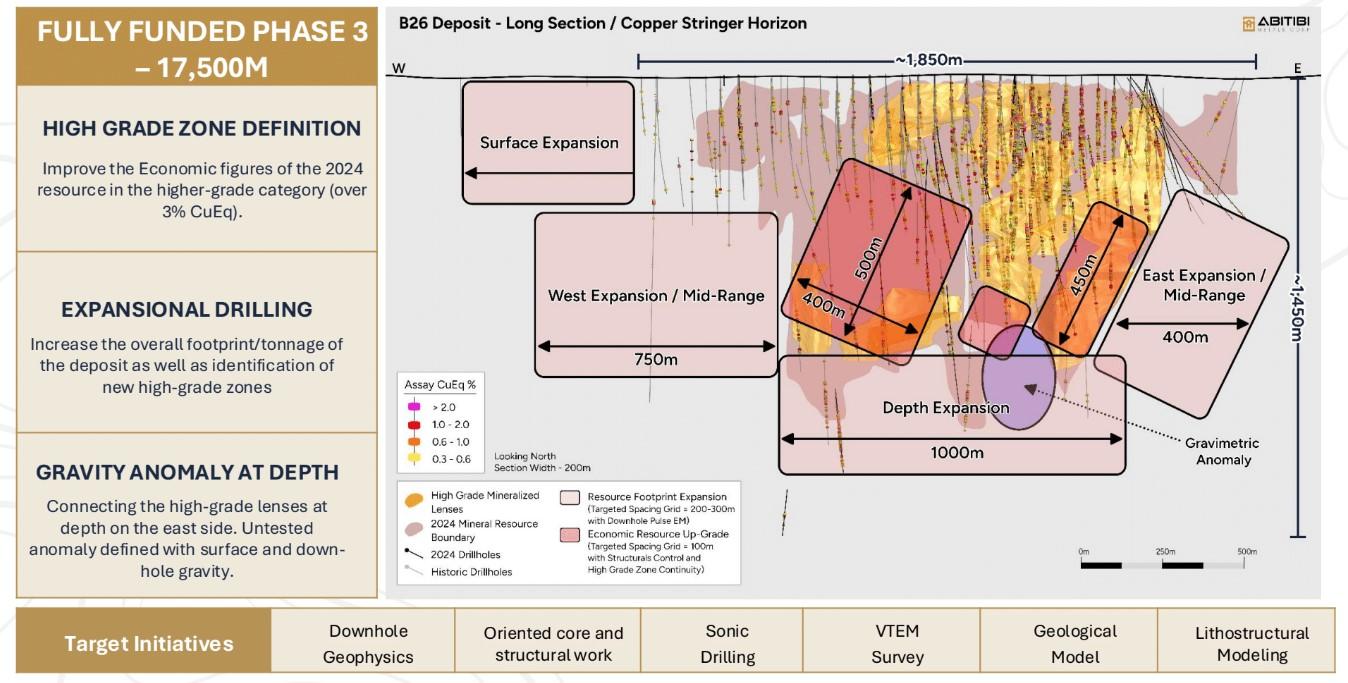

And this is only the first batch of assays from the ongoing 17,500m Phase 3 drill program – the largest in project history.

But here’s what makes it different…

This isn’t a 10-year plan.

The company is fully funded to Q2 2027 and has budgeted an additional 45,000 metres for Phase 4 drilling, set to be deployed in 2026 based on ongoing exploration success.19

It’s early. It’s fast-moving. And it’s flying under the radar.

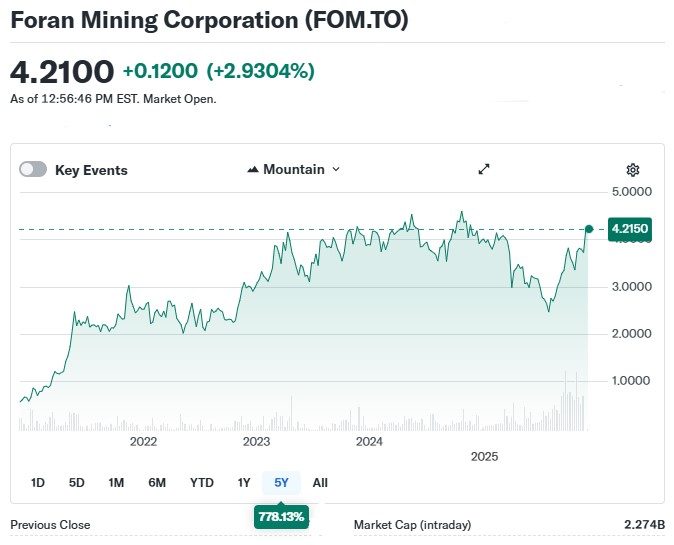

This Was Foran Before It Ran to a $2.2 Billion Valuation

Back in 2020, Foran Mining (TSX:FOM) was trading at just C$0.18, with a market cap under C$50 million.

Today, it’s trading at C$4.00 with a market cap over C$2.2 billion.

That’s a nearly 2,000% return in five years driven by one thing: copper.

Foran’s flagship McIlvenna Bay project is a VMS deposit with solid grade, strong jurisdiction, and clean infrastructure. As copper prices climbed and institutional interest followed, the stock exploded.

Now, investors are asking: what’s the next Foran?

The answer may be hiding in Quebec.

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) just delivered a 920 million pound copper equivalent resource at its B26 deposit, with grades that match or exceed Foran’s early estimates.

It’s sitting on:20

- 11.3 Mt of 2.13% CuEq (Indicated – 1.23% Cu, 1.27% Zn, 0.46 g/t Au and 31.9 g/t Ag)

- 7.2 Mt of 2.21% CuEq (Inferred – 1.56% Cu, 0.17% Zn, 0.87 g/t Au and 7.4 g/t Ag )

- A high-grade core that includes 11.4% CuEq intercepted over 10.6 meters

And the latest drilling is making it bigger.

In September 2025, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) reported a world-class intercept of 3.65% CuEq over 21.1 metres within 1.55% CuEq over 69.0 metres, one of the strongest ever at B26. Step-out drilling extended the deposit footprint up to 100m beyond the block model, confirming growth potential.

Based on the success of hole 269W3 and encouraging visual mineralization observed in subsequent holes, Abitibi Metals has expanded the ongoing Phase 3 program to 20,000 metres21 – the largest in project history.

Since then, the ongoing Phase 3 drill program at the B26 deposit continues to successfully intersect mineralization beyond the current Mineral Resource Estimate (MRE), confirming the expansion of the mineralized footprint.

Highlights:22

- 150m Step-Out Confirms Expansion Potential: Drill hole 1274-25-373-W1 intersected approximately 27 metres of mineralization, including a visually identified potential high-grade core of 7.3 metres of strong copper-gold stringer-style mineralization.

- Western Down-Plunge Growth Confirmed: Step-out drilling intersected mineralization 150 m down-plunge (373-W1) and 100 m (269-W2b), both outside the current model. Three rigs are now advancing this high-grade corridor.

- Open, Expanding System: Phase 3 visuals show strong continuity across the B26 horizon, which remains open in multiple directions, highlighting significant growth potential.

- Strengthening One of Québec’s Most Active Copper Projects: With expansion success across multiple zones, B26 is solidifying its position as one of Québec’s most advanced copper-gold growth stories.

And with funding secured through Q1 2027 and an additional 25,000 metres of Phase 4 drilling already budgeted, Abitibi is positioned for sustained growth.

The upside doesn’t stop at B26. A VTEM survey outlined 8.7 kilometres of untested, high-priority targets, suggesting B26 could be part of a much larger VMS system.

The rocks may tell the story—but it’s the people behind Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) who make this such a compelling bet.

The company just welcomed industry legend Craig Parry to the Abitibi Metals Advisory Committee.23

Parry is a highly accomplished mining executive and geologist with a proven track record of founding, leading, and financing successful resource companies.

Over his career, he has held key roles with IsoEnergy, NexGen Energy, EMR Capital, Tigers Realm Coal, and Rio Tinto and has been instrumental in several major discoveries, including Vizsla’s Panuco-Copala silver veins, IsoEnergy’s Hurricane deposit, and NexGen’s Arrow deposit.

His technical insight and strategic vision come at a pivotal time for Abitibi as we advance one of Québec’s most exciting copper-gold growth stories.

And the kicker?

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is immensely undervalued at just C$59.5 million, nearly the same level Foran was before its breakout.

History doesn’t repeat, but it often rhymes.

This could be the rhyming moment.

Press Releases

- Abitibi Metals 150m Step-Out Extends B26 Western Copper-Gold Zone With 8.16% CuEq Over 3.2m Within 11.0m at 3.93% CuEq, Highlighting Significant Expansion Potential

- Abitibi Metals Welcomes Mining Veteran and Shareholder Craig Parry to Its Advisory Board to Support the Next Phase of Growth

- Abitibi Metals Expands B26 Mineralization: 150m Step-Out Confirms Continued Growth in the Western Down-Plunge

- Abitibi Metals Expands Phase 3 Drill Program to 20,000 Metres Following Final Assays of 4.46% CuEq Over 21.1 Metres from Hole 269W3

- Abitibi Metals Extends B26 Mineralization & Increases Grade: Reports 3.65% CuEq Over 21.1m Within Interval of 1.55% CuEq Over 69.0m

8 Reasons

This $59.5M Copper-Gold Junior Could Be One of the Biggest Breakouts of 2025

1

Nearly 1 Billion Pounds of Copper Equivalent — and Growing: Abitibi’s (CSE:AMQ) (OTCQB:AMQFF) B26 deposit already hosts nearly 550 million pounds of copper and 369,000 ounces of gold—with grades up to 2.21% CuEq. That includes a high-grade zone, positioning B26 as one of the highest-grade undeveloped polymetallic VMS systems in North America.

2

Better Grades. Better Timing. Foran Was Here in 2020: Back when Foran Mining (TSX:FOM) was under C$50M, it had the same mix of grade, jurisdiction, and infrastructure. Foran’s stock went on to deliver a nearly 2,000% return. Abitibi’s B26 now shows intercepts like 11.4% CuEq over 10.6m and 3.65% CuEq over 21.1m, yet trades at only C$59.5M.

3

BMO Capital Markets Is Involved: This isn’t retail hype. BMO brought institutional capital into Abitibi, and even invited them to present at their 2025 Global Metals & Mining Conference as the smallest company on stage. It’s a rare early-stage endorsement from one of the most selective banks in the space.

4

Largest Drill Program in Project History and Fully Funded Through 2027: Abitibi is executing a 17,500m Phase 3 drill program, already yielding world-class results. The company is fully funded into Q1 2027, with 25,000m more budgeted for Phase 4 drilling, ensuring steady newsflow and resource growth.

5

World-Class Drill Results Are Rolling In: Abitibi just reported 3.65% CuEq over 21.1m within 1.55% CuEq over 69m, one of its strongest hits ever, carrying a significant gold credit. Step-out holes extended the deposit footprint up to 100m beyond the block model, confirming growth at depth. These aren’t narrow veins; they’re wide, high-grade intercepts with continuity.

6

Serious Insider Alignment: Insiders have bought over 3 million shares on the open market in 2025.24 The Deluce family (founders of Porter Airlines) owns 30% and the CEO, Jon Deluce, has skin in the game. This isn’t a lifestyle company. It’s execution-focused.

7

Exploration Upside Still Untapped: B26 remains open along strike and at depth, with gravity and VTEM surveys outlining 8.7 km of untested, high-priority targets. The Phase 3 program is the largest yet, and Phase 4 drilling is already budgeted. This isn’t just one deposit, it could be a larger VMS system.

8

Leverage to a Real Copper Supercycle: With disruptions like Indonesia’s Grasberg mudslide removing ~3% of global supply, copper remains tight. B26’s 98.3% recovery25 and high grades make it exactly the kind of Cu-Au system majors want. Just look at Agnico Eagle’s move into Foran Mining, M&A in this space is heating up, and Abitibi checks the boxes.

A Deep Dive Into Abitibi Metals’ High-Grade Copper and Gold Assets

At the center of Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) story is the B26 Polymetallic Deposit, a rapidly expanding, copper-dominant, volcanogenic massive sulphide (VMS) system located in Quebec’s renowned Abitibi Greenstone Belt—just 5 kilometers from the historic Selbaie Mine, which produced over 53 million tonnes of ore over its lifetime.26

In just over a year, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) has transformed this asset from an overlooked legacy property into one of the most aggressively drilled, high-grade copper-gold exploration stories in North America.

Resource Leap: A 62% Jump in Indicated Tonnage

Abitibi’s (CSE:AMQ) (OTCQB:AMQFF) NI 43-101 Technical Report, filed December 2024, confirmed a major resource upgrade:27

- Indicated: 11.3 million tonnes at 2.13% CuEq

(1.23% Cu, 1.27% Zn, 0.46 g/t Au, 31.9 g/t Ag) - Inferred: 7.2 million tonnes at 2.21% CuEq

(1.56% Cu, 0.17% Zn, 0.87 g/t Au, 7.4 g/t Ag)

That equates to 553.9 million pounds of contained copper and 369,000 ounces of gold28—a serious resource base for a company still trading at a $59.5 million market cap.

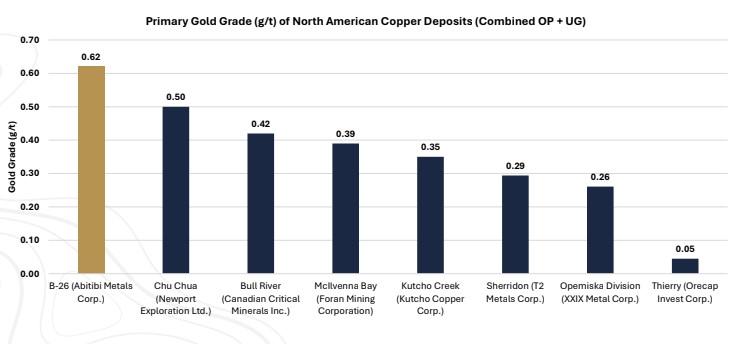

Don’t overlook the gold.

While B26 is a copper-dominant VMS system, it’s quietly emerging as one of the highest-gold-grade primary copper projects in Canada.

Many copper juniors at this stage show little or no gold, but B26 boasts nearly 370,000 oz Au in the current resource and continues to return strong gold credits, including 1.14 g/t Au in the September 2025 intercept. That leverage to a breakout gold market with its spot price now over $4,200 sets Abitibi apart from peers like Foran in their early days.

But that’s just the beginning – 16,500 metres of drilling has not been included in the current resource—and a fully funded 20,000-metre Phase III program is underway in 2025.

A Deposit Defined by Grade

While many polymetallic systems dilute value with lower copper zones, Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) B26 Deposit stands out for its concentration of high-grade intercepts, concentrated in the core of the deposit.

Some of the most compelling drill results include:

- 10.6m at 11.4% CuEq within 61.3m at 2.5% CuEq

- 2.9m over 8.08% CuEq within 29m at 1.94% CuEq

- 7.05m over 3.86% CuEq from 330.8m depth

- 44.5m at 2.82% CuEq (May 2024 release)

- 97.5m at 1.47% CuEq, near surface

- 4.0m at 4.9% CuEq within 17.5m at 2.4% CuEq (deepest intercept to date)

- And most recently, the strongest result yet: 3.65% CuEq over 21.1m within 1.55% CuEq over 69m, carrying a major gold credit and pointing to a higher-grade source at depth.

These results validate the thesis that B26 contains stacked high-grade VMS lenses, many of which are still under-drilled, open at depth, and extend laterally beyond the current block model.

Fully Funded Growth & Exploration Strategy

Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) is fully funded through Q1 2027 and is currently advancing the largest exploration program in the history of the B26 project, with both resource growth and regional discovery in focus.

- Phase III — 20,000 metres of focused drilling (9,060 metres completed to date, assays pending)

- Infill drilling within high-grade zones to strengthen economics

- Step-out drilling to expand lateral and down-plunge mineralization (already hitting 40–100m beyond the block model)

- Phase IV — 45,000 metres budgeted for 2026, providing clear visibility to sustained growth

- Testing of high-priority regional VTEM conductors (8.7 km) and large gravity anomalies identified across the 3,328-hectare property

- Advanced exploration tools including downhole geophysics, litho-structural modeling, and gravity surveys

Ownership terms with SOQUEM (a subsidiary of Investissement Québec) are favorable. Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) can earn 80% over seven years by funding work commitments and issuing milestone payments. SOQUEM is also a shareholder, creating alignment between partners.

Technical Report & Metallurgy: De-Risking the Story

SGS Canada, the authors of the NI 43-101 report,29 estimated copper equivalent values using robust assumptions and metallurgical recoveries:

- 98.3% Cu recovery

- 90.0% Au recovery

- 96.1% Zn recovery

- 72.1% Ag recovery

The deposit’s VMS style, favorable geometry, and known metallurgy provide an ideal foundation for economic modeling and future PEA-level studies.

With a strike length of over 1.6 km and mineralization extending to depths of 800m, B26 is just beginning to show its scale.

High-Grade Hits in Phase II

Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) 2024 Phase II program delivered strong confirmation of B26’s stacked VMS lenses.30 Standout assays included:

- Hole 1274-24-359: 3.86% CuEq over 7.05m and 2.02% CuEq over 16.5m

- Hole 1274-24-360: 8.08% CuEq over 2.9m and 1.9% CuEq over 29m (Zn-Ag-rich VMS zone)

- Hole 1274-24-362: 1.42% CuEq over 33.5m, including 7.10% CuEq over 1.2m

These holes were designed to test underexplored gaps and deeper extensions of known high-grade lenses. The results demonstrated consistent mineralization across a wide footprint, with clear potential for additional stacked zones.

New High-Priority Drill Targets Identified

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) isn’t just drilling deeper. It’s expanding the playing field.

In July, the company announced results from a property-wide airborne VTEM survey that outlined 8.7 kilometres of high-priority regional drill targets across the B26 property.31

These conductors remain largely untested and could point to new stacked VMS lenses or entirely new deposits along the same mineralized corridor.

This isn’t just one deposit. It’s shaping up to be a full-scale copper-gold VMS system.

Phase III: Largest Drill Program in Project History

In July 2025, Abitibi Metals resumed its fully funded Phase III drill program with 20,000 metres planned32 and the majority now completed with results pending.33 The company also announced operational improvements that are boosting drill efficiency, improving core recovery, and accelerating assay turnaround.

This campaign is engineered to deliver high-impact results fast.

New High-Grade Zones Uncovered at Mid-Level Depths

Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) followed that up with another major development. In its most recent update, the company announced that Phase III drilling has already expanded mid-level high-grade copper zones at B26.

That includes standout results like 4.8% CuEq over 4.1 m within 63.2 m at 1.0% CuEq, including 1.78% CuEq over 17.5 m.34

And in September, the strongest result yet: 3.65% CuEq (2.67% Cu, 1.14 g/t Au) over 21.1m within 69.0m at 1.55% CuEq — a world-class intercept that confirms widening grades at depth and points to the potential of a higher-grade source below the current resource.

These results validate that B26 is expanding both vertically and laterally, with stacked lenses delivering grade, scale, and growth.

High-Impact Step-Outs on Deck

Step-out drilling has also intercepted mineralization 40m and 100m beyond the 2024 resource boundary, including hits of 3.41% CuEq over 10m and 1.01% CuEq over 31m. These confirm expansion of the B26 footprint and validate continuity of the western Cu-Au shoot at depth, which remains open down-plunge and along strike.

With 9,060m of the 17,500m Phase III program now drilled and assays pending, momentum is building toward meaningful resource growth. Looking ahead, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is focused on:

- Defining a core resource in the >3% CuEq category

- Expanding mineralization down-plunge and laterally

- Testing high-priority regional VTEM and gravity targets

The deposit remains open in all directions, and 2025 is proving to be another catalyst-rich year.

Project Development Roadmap

With Phase III delivering some of the strongest results in the project’s history, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) has outlined a clear development timeline:

Since optioning the project in late 2023, the company has delivered a major resource upgrade, launched the largest drill program in the project’s history, and secured funding into 2026.

The next steps include a new resource update and initiation of a Preliminary Economic Assessment, milestones designed to position B26 as one of Quebec’s leading copper-gold development stories.

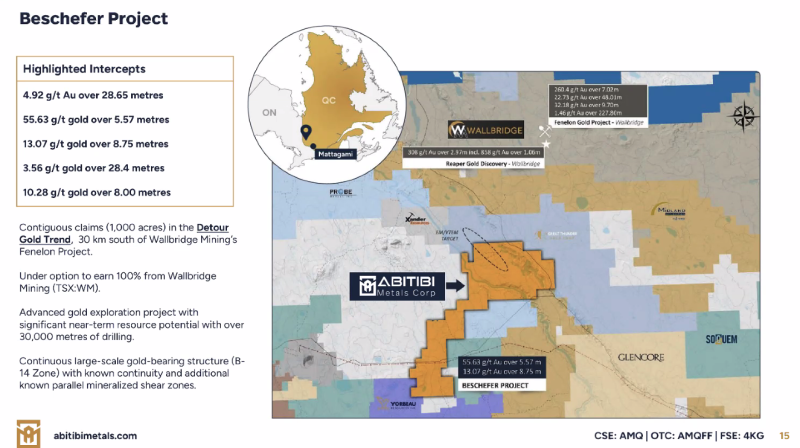

Beschefer Gold Project: A Strategic Gold-Only Lever

While B26 is the flagship, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) also holds 100% ownership of the Beschefer Gold Project, located just outside the Detour Gold Trend.

Though less prominent in the news cycle, Beschefer adds valuable gold leverage to the story, especially as gold flirts with all-time highs.

Past drilling at Beschefer has delivered standout intercepts such as:35

- 55.63 g/t gold over 5.57 metres in hole BE13-038 (including 224 g/t over 1.23m)

- 4.92 g/t gold over 28.65 metres in hole BE-21-02 (including 11.39 g/t over 9.1m)

- 13.07 g/t gold over 8.75 metres in hole B12-014 (including 58.5 g/t over 1.5 m)

- 10.28 g/t gold over 8.00 metres in hole B14-35 (including 86.74 g/t over 0.60 m)

With four modeled zones and historical intercepts showing strong metal factors (>100 g/t x metres), Beschefer remains a compelling secondary asset that could be monetized while B26 remains the core focus.

In sum, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is positioned with:

- A large, high-grade copper-gold resource

- Drill results that rival advanced-stage projects

- A funded, aggressive exploration plan

- Strong alignment with Quebec’s leading provincial exploration fund

- A growing portfolio in the heart of a globally significant mining jurisdiction

With copper nearing record highs and gold breaking out, the timing couldn’t be better.

And with just a $59.5 million market cap, the disconnect between what’s in the ground and what’s priced in is glaring.

This is one of the most overlooked copper-gold plays in the market today.

Why This Tiny Copper Junior Deserves a Closer Look

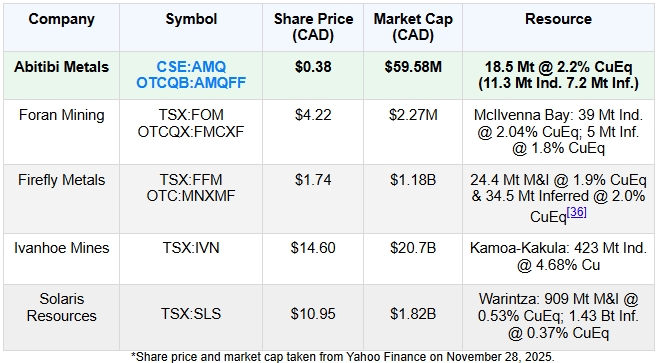

There’s a reason these five companies were chosen for comparison with Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF).

Each represents a different stage of the copper growth curve—from early-stage developer to global producer.

They’ve all delivered incredible value creation for early investors.

And each holds large copper-gold or copper-dominant deposits, with copper equivalent grades typically hovering around 1.5%–3% CuEq.

That’s where Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) starts to look compelling.

At just a C$59.5 million market cap, AMQ already controls a deposit with:

- 18.5 million tonnes at an average 2.18% CuEq

- 920 million pounds CuEq in contained metal

- Nearly 370,000 oz gold and 13M oz silver, giving B26 one of the highest gold credits among North American copper juniors

- A high-grade core which includes 11.4% CuEq over 10.6m

That grade profile is competitive with—if not superior to—Foran Mining (TSX:FOM), which now trades at a $2.2 billion valuation.

And just like Foran, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) is advancing a VMS deposit in a Tier 1 jurisdiction, with strong infrastructure and provincial support (SOQUEM/Investissement Québec).

The comparisons also hold when looking at the project stage.

Back when Foran or Solaris were first defining their resources, their market caps hovered near Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) current levels.

The difference is: AMQ is already sitting on nearly a billion pounds of copper equivalent, before factoring in the fully funded 45,000m of new drilling that could expand that even further.

Ivanhoe represents the next stages of scale and international scope—but they require years of de-risking and hundreds of millions in capital.

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) hasn’t even scratched the surface of its resource growth.

With a clean cap table, insider buying, institutional support from BMO Capital Markets, and copper flirting with all-time highs, this is a classic case of asymmetry.

You’re looking at a company with multi-asset leverage (B26 + Beschefer), one of the highest undeveloped CuEq grades in Canada, and a sub-$60 million market cap.

The Deluce Dynasty Is All In on Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF)

When a legendary business family takes a massive stake in a small-cap copper company… smart money pays attention.

The Deluce family—known for building Porter Airlines and running one of Canada’s most respected family offices—now owns over 27% of Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF).

This isn’t passive ownership. CEO Jonathon Deluce is leading from the front, with insiders scooping up over 3 million shares in the open market since January 2024.

And institutions are following their lead. Delbrook Capital is already on the cap table with more expected as a result of the recent financing.

This elite-level alignment helped fuel over $32 million in capital raised—with zero warrants in the latest rounds.

- It’s a rare setup:

- Backed by a proven family office

- Led by an aggressive, shareholder-aligned CEO

- Supported by institutions that don’t chase just anything

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) isn’t just another junior play. It’s a tightly held, heavily backed copper story… and the Deluce family is putting their name—and capital—behind it.

A Technical and Financial Dream Team

This isn’t a rookie exploration team. Abitibi is led by seasoned mine builders, capital markets veterans, and a technical team with direct experience advancing multi-million-ounce deposits in Quebec and beyond.

More importantly, this is a team that owns stock—and is still buying.

Here are the key names you need to know:

The Copper Breakout Is Here

Copper has rebounded to over $5.00/lb and major traders are now predicting up to $5.70/lb over the next 12 to 24 months.37

And with supply tightening, tariffs looming, and data centers devouring electricity… the setup for copper juniors hasn’t looked this strong in over a decade.

Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) is stepping into this moment with:

- A high-grade copper-gold deposit in mining-friendly Quebec

- 920M lbs CuEq in resource with one of the strongest gold credits in the sector

- A world-class intercept of 3.65% CuEq over 21.1m (Sept 2025), confirming growth at depth

- Fully funded through Q2 2027, with 20,000m Phase III underway and 25,000m Phase IV already budgeted

- Strong insider ownership, including the Deluce family (~30%), and institutional backing led by BMO Capital Markets

This is exactly the kind of asymmetrical setup early-stage investors hunt for.

Now Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) has a comparable deposit, a fresh resource model, deeper backing, and a fraction of the valuation.

That gap won’t last forever.

If you’re looking for the next copper name that could go potentially vertical, consider taking a deeper dive into Abitibi Metals—before the rest of the market catches on.

*All figures in CAD unless otherwise stated.

Full Disclaimer

The B26 Project is at an early stage of exploration & resource development and does not currently have a mineral reserve estimate, feasibility study, or demonstrated economic viability. Any references or comparisons to other mineral projects including Foran Mining’s McIlvenna Bay are intended solely to illustrate potential geological analogues. Such comparisons should not be interpreted as implying that the B26 Project will achieve similar results, development timelines, or economic outcomes.

Projects at more advanced stages may have completed technical studies, established mineral reserves, or be under development or in production, which differentiates them from early-stage exploration assets. There is no guarantee that the B26 Project will advance to a similar stage.