Taiwan Semiconductor Manufacturing Company (TSMC) has once again demonstrated its dominance in the semiconductor industry by surpassing sales expectations for the first quarter of 2025. This remarkable achievement is largely attributed to the growing demand for artificial intelligence (AI) chips, which continue to be a driving force in the tech sector.

TSMC, the world’s largest contract chipmaker, reported a 12% increase in revenue compared to the same quarter last year, reaching a staggering $20 billion. This growth was significantly fueled by the company’s advanced AI chips, which have become essential components for technology companies seeking to enhance their AI capabilities.

The surge in demand for AI chips is not only a testament to TSMC’s cutting-edge technology but also reflects the increasing reliance on AI across various industries. From autonomous vehicles to advanced data analytics, AI applications are proliferating, and TSMC is strategically positioned to capitalize on these trends.

One of the key factors contributing to TSMC’s success is its investment in research and development. The company has committed to spending a substantial portion of its revenue on R&D to maintain its competitive edge and push the boundaries of semiconductor technology. This investment is already paying off, as evidenced by the company’s ability to meet the evolving needs of its clients with innovative solutions.

Moreover, TSMC has been expanding its production capacity to accommodate the growing demand. The company recently announced plans to build new manufacturing facilities in the United States and Japan, further solidifying its global presence and ensuring a stable supply chain. These expansions are expected to increase TSMC’s production capabilities by 25% over the next two years.

Despite facing challenges such as geopolitical tensions and supply chain disruptions, TSMC has managed to navigate these obstacles effectively. The company’s robust supply chain management and strategic partnerships with key suppliers have enabled it to maintain a steady production flow, minimizing the impact of external factors on its operations.

Looking ahead, TSMC remains optimistic about its growth prospects. The company expects the demand for AI chips to continue rising, driven by advancements in AI technologies and the increasing integration of AI in everyday life. As a result, TSMC is poised to sustain its upward trajectory and reinforce its position as a leader in the semiconductor industry.

Investors have reacted positively to TSMC’s impressive performance, with the company’s stock experiencing a significant uptick. TSMC (NYSE:TSM) shares have risen by 8% following the announcement of its quarterly results, reflecting investor confidence in the company’s strategic direction and growth potential.

In conclusion, TSMC’s ability to exceed sales forecasts underscores the critical role of AI chips in the modern tech landscape. With continued investment in innovation and strategic expansion, TSMC is well-equipped to meet the growing demands of the tech industry and maintain its status as a semiconductor powerhouse.

Footnotes:

- TSMC’s revenue growth was primarily driven by the surge in demand for AI chips. Source.

- The company plans to increase its production capacity by 25% over the next two years. Source.

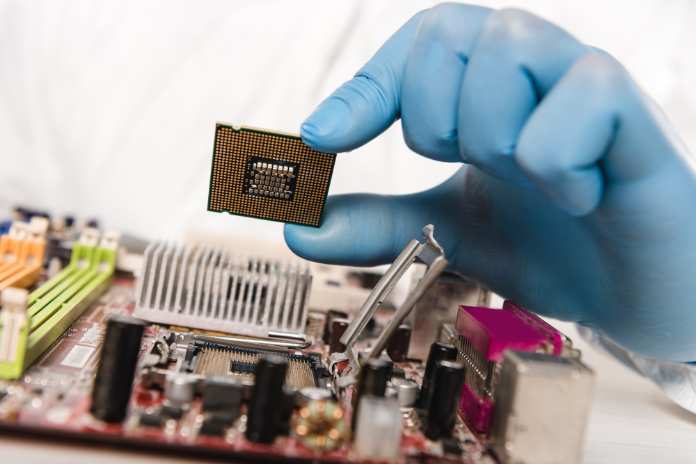

Featured Image: DepositPhotos @ AllaSerebrina