Micron Technology (NASDAQ:MU) has recently been the subject of intense scrutiny as Wall Street analysts weigh in on the company’s prospects ahead of its upcoming earnings report. The semiconductor giant, known for its memory and storage solutions, plays a significant role in the tech sector, and its financial performance is often seen as a bellwether for the industry at large.

Analysts have been closely examining Micron’s strategies, particularly in light of the ongoing supply chain challenges and fluctuating demand for memory products. The company’s ability to navigate these challenges, while maintaining its competitive edge, will be crucial for its future growth.

Despite recent market volatility, many analysts remain optimistic about Micron’s long-term potential. The company’s investments in next-generation technologies, such as 3D NAND and DRAM, are viewed as critical to sustaining its market leadership. Furthermore, Micron’s strategic partnerships and collaborations are expected to bolster its innovation capabilities and expand its market reach.

However, there are also concerns regarding potential headwinds that could impact Micron’s performance. These include geopolitical tensions, which might affect supply chains, and the possibility of reduced consumer spending amid economic uncertainties. Analysts are also keeping a close watch on the competitive landscape, as rival firms continue to innovate and vie for market share.

In terms of financial outlook, Micron’s upcoming earnings report is anticipated to provide insights into its revenue growth and profit margins. Investors are particularly interested in how the company is managing its costs and optimizing its operations to maintain profitability. The market will also be eager to see if Micron’s revenue projections align with Wall Street’s expectations.

Overall, while there are challenges ahead, Micron’s strong foundation and strategic initiatives offer reasons for cautious optimism. The company’s ability to adapt to evolving market conditions and capitalize on emerging opportunities will be key determinants of its future success. As such, Micron remains a stock worth watching for investors looking to gain exposure to the dynamic semiconductor sector.

Footnotes:

- Micron’s financial performance is often seen as a bellwether for the tech sector. Read more.

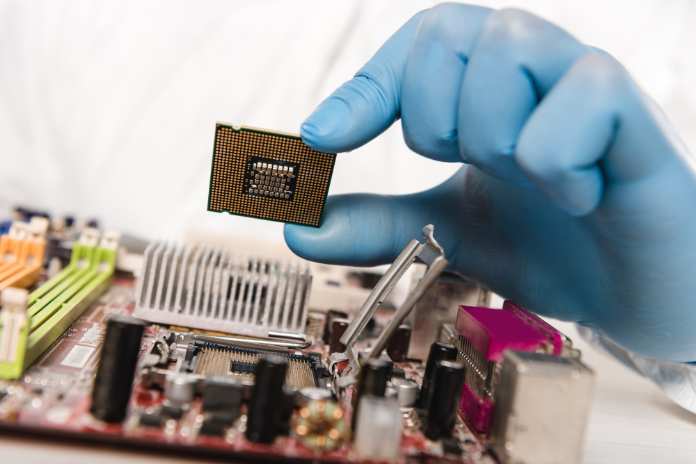

Featured Image: DepositPhotos @ AllaSerebrina