The last AI boom around chatbots minted billion-dollar names like C3.ai and SoundHound. By the time the crowd noticed, the early money was gone.

Now, a new wave is forming. One that could be even bigger.

This time, it’s about AI Agents.

Not chatbots that answer questions. Agents that act. Agents that pay bills, flag contract renewals, read insurance policies, and reward consumers for sharing their own structured data.

And at the center of this shift is a small-cap with something rare in the AI space: real revenues, real contracts, and real profitability at the unit level.

$3B+ Processed and Counting

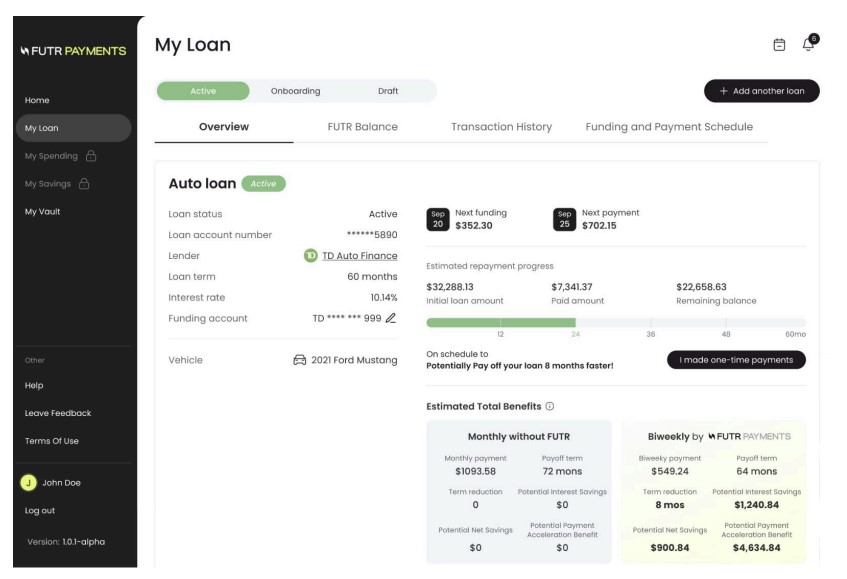

FUTR’s payment rails aren’t theoretical. They’ve already handled more than $3 billion in volume with over 1 million live transactions in the last 12 months alone.¹ Every single one generates revenue.

Recurring Revenue Locked In

Unlike most AI startups still chasing their first dollar, this firm is already scaling from $8M of annual revenue from over 40,000 customers, proving their platform actually works.

Margins Most Tech Firms Dream Of

Gross margins are already running at an incredible 88%, a figure most small-caps can’t match. This isn’t a cash-burning concept. It’s a scaled business ready to layer AI agents on top.

What Sets FUTR Apart

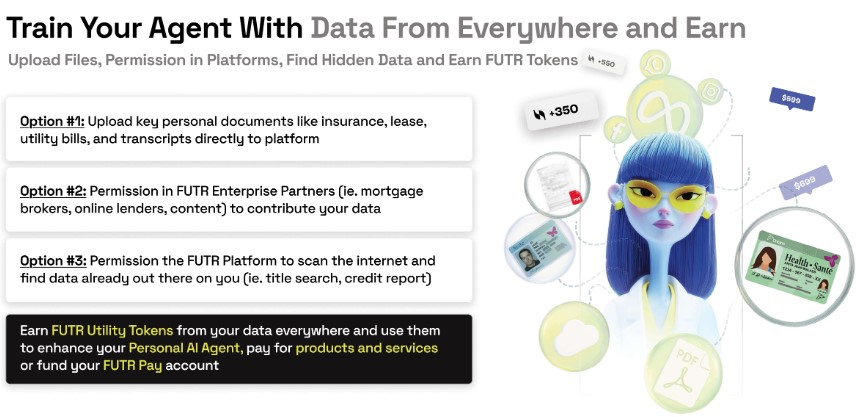

Most tech giants built fortunes by taking your data for free. FUTR flips that model.

Imagine a world where Facebook and Google are sidelined by you because they don’t pay you for your data? Think about it. Getting paid every time you upload something you already need to store, a mortgage, an insurance policy, even a dinner receipt, the value flows back to you instead of Big Tech.

FUTR’s AI Agents are designed to make that possible, turning personal data into a consumer-owned asset.

The Catalyst: Q3 2025 AI Agent Launch

Later this year, The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) will roll out consumer AI Agents built on top of secure, personal data vaults. These agents will be able to analyze documents, take action, and even monetize data on behalf of users.

That’s not just a chatbot. That’s the beginning of a new data economy.

From Payments to Tokens: The FUTR Flywheel

At the core of The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is FUTR Pay. A proven payment engine that has already processed more than $3 billion in volume and over 1 million transactions in the last 12 months alone. Every one of those transactions not only generates revenue, but also produces the most valuable asset in the digital economy: clean, verified data tied directly to consumer behavior.

This is where the story goes from solid to potentially explosive.

FUTR is embedding that payments backbone into a broader tokenized data economy. Through its Master Services Agreement with the FUTR Foundation, the company is integrating both the FUTR Data Protocol and the FUTR Utility Token directly into its AI Agent app.²

Here’s how it works:

- Consumers upload documents (mortgages, insurance, utilities) into their personal FUTR Vault.

- AI Agents structure the data, making it usable and actionable.

- When brands want access, they pay in tokens for time-bound, consented insights.

- Consumers earn rewards in tokens for sharing their data.

- Enterprises contribute enriched data and also earn rewards.

- FUTR takes a commission on every transaction.

This creates a powerful flywheel. Users are rewarded. Brands get precision targeting at lower cost. Enterprises save on acquisition. The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) monetizes every step.

It’s the bridge between the old, collapsing surveillance economy and a new, consent-driven model where consumers finally share in the value of their own information.

With the payments rails already proven, the vault technology licensed for 10 years, and tokens ready to integrate, The FUTR Corporation is positioned not just as an AI company, but as the foundation for a new data economy.

The Data Play: Zero-Party at Scale

This is where FUTR flips the model. Instead of brands scraping users, consumers own their data. When they choose to share it, they get rewarded in the FUTR Utility Token through the FUTR Data Protocol.

- Consumers upload documents → earn tokens for sharing insights

- Enterprises contribute enriched data → also rewarded

- Brands pay tokens for time-bound, verified access

- FUTR takes a commission on every transaction

It’s a flywheel: users win, brands save, enterprises benefit, and FUTR monetizes every step.

This is the bridge between the collapsing surveillance model of cookies and trackers and a new, consent-driven economy where data is structured, verified, and priced by the consumer.

The Bigger Picture

McKinsey estimates generative AI could add up to $4.4 trillion annually to the global economy. Microsoft has embedded agents into Copilot. Salesforce launched Agentforce. Early startups like Character.ai and Perplexity have gone from zero to tens of millions in revenue.

Investors rewarded those companies quickly:

- SoundHound hit a $5 billion valuation

- C3.ai surged into the billions as the first AI pure play

- LightOn IPO’d in Europe as the region’s first generative AI platform

But none of them had what The FUTR Corporation already has $3B processed, recurring revenue locked in, and 88% gross margins.³

Insiders and Leadership

The FUTR Corporation’s (TSXV:FTRC) (OTCQB:FTRCF) leadership includes veteran dealmakers and operators who have scaled and sold companies worth hundreds of millions.

At the forefront is G. Scott Paterson, one of Canada’s most respected financiers. He is the former Chairman of the TSX Venture Exchange and the architect behind Yorkton Securities’ rise into Canada’s leading technology investment bank. Over his career, Paterson has been early and often in spotting disruptive innovation. He co-founded Symbility Solutions, which scaled into a $44 million revenue leader in insurance software before being acquired for $162 million. He also backed and helped guide JumpTV, one of the world’s first internet television platforms, which sold for $250 million long before streaming was mainstream.⁴

Alongside him is Alex McDougall, FUTR’s President. McDougall is one of the most recognized voices in digital assets, payments, and data sovereignty. serves as President of Canada Stablecorp, helped bring the first Canadian dollar stablecoin (Stablecorp’s QCAD) to market in partnership with Coinbase. He also sits on the board of Balance Custody, Canada’s oldest and largest regulated digital asset custodian.

Press Releases

The Valuation Gap

Despite its traction, The FUTR Corporation trades at a fraction of its peers. With a market cap in the tens of millions, FTRC could be one of the most undervalued public AI stories in North America today.

Highlights at a Glance

- $3B+ processed volume and 1M+ transactions completed

- $500K guaranteed quarterly revenue through 2028

- 88% gross margins

- Consumer AI Agent launch in Q3 2025⁵

- Positioned in a $4.4T emerging market

- Leadership team with multi-hundred-million exits

- Low valuation compared to peers

The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) has built the foundation, secured recurring revenue, and is preparing to launch into one of the fastest-growing markets of this decade.

This could be the iPhone moment of AI, and once Wall Street catches on, early recognition of this story may not last long.

Get the full report on this trending AI startup right here.