For years, Silicon Valley giants have gotten rich off one thing: your personal data.

Google is worth $2.5 trillion. Meta is worth another $2 trillion. Together they’ve built empires on the backs of billions of users.

And the consumer never saw a dime.

Think about that for a moment. Every search. Every like. Every click. Big Tech packaged it, sold it, and kept the money.

And investors rewarded them with market caps larger than the GDP of most countries.

Well that’s all about to change.

What if, instead of giving up personal information for free, users get rewarded for it?

Instead of data being locked away in corporate silos, it’s structured, valued, and put back into the market through personal AI agents.

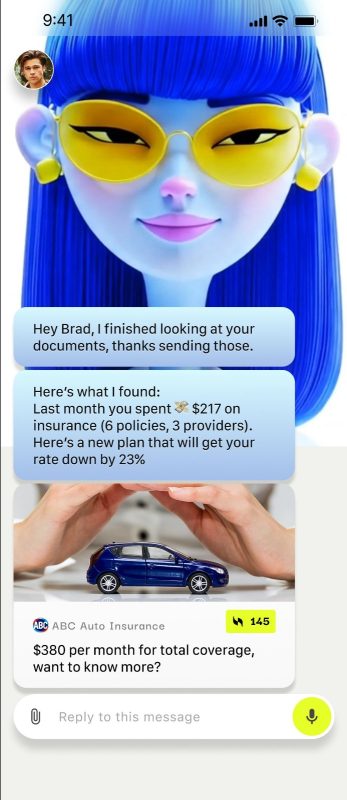

These agents can read bills, scan contracts, and turn unstructured information into actionable intelligence. They can trigger payments, negotiate offers, and deliver value back to the user.

That is the opportunity almost no one on Wall Street is talking about.

And here’s the kicker: this isn’t a pre-revenue startup making promises.

That company is The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF), the first publicly traded company built to flip the $2 trillion data economy upside down.

While Google and Meta kept every penny, FUTR is giving power back to the consumer. Its AI agents don’t just organize your documents, they turn them into money-making machines.

Here’s why this is different: FUTR isn’t an idea on a whiteboard. It’s already live.

More than $3 billion has been processed across its platform.¹ And the financials back it up.

Even before the app is launched and the token is publicly traded, FUTR has already generated more than $8 million in revenue over the last 12 months from its payment technology—a core part of the app experience.

For its fiscal year (ended June 30, 2025), The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) reported record revenue of C$8.35 million, with gross margins of 90%. ²

And from April 2025 through until October 2025, the company raised over $11.7 million of equity, strengthening the balance sheet and setting the table for growth initiatives.

That’s what makes FUTR so compelling: it’s a newly listed, small-cap AI story with real revenue, industry-leading margins, and a clear line of sight to profitability — a rare combination in today’s market.

The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is already charging ahead at full speed. The company just entered the public markets in April, secured a US OTCQB listing by July, and by September, it already had its first analyst report: a 20-page initiation from Research Capital Corporation. Read the full report here.

While other AI companies trade in the billions with revenue multiples from 8-60x, the market simply hasn’t recognized what FUTR is doing yet. It’s still trading at a US$23 million value, with a ~4x multiple. The upside is obvious.

Most small-cap stocks wait a year or more for that kind of recognition, but FUTR did it in a matter of months.

On top of that, the company is expanding that momentum with a new national partnership that increases its auto-retail footprint by 400%.

And for investors, this is the rare chance to get in early before Wall Street catches on to a company that could rewrite the rules of AI, data, and consumer power.

The Age of AI Agents

I know what you’re thinking… Another chatbot?

Wrong. This isn’t some gimmick that spits out trivia or summarizes Wikipedia pages.

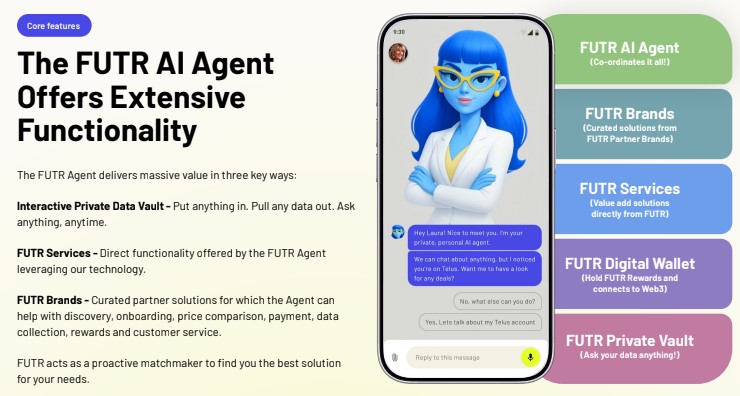

The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) has already launched the closed beta for its flagship AI Agent App, a real assistant that does the work that matters and pays consumers for it.³ FUTR has three key differences from other agent apps:

- FUTR Acts – Other AI Agents can tell you things when you ask and maybe order you food. FUTR proactively solves life’s most annoying and complex tasks.

- FUTR Protects – Other Agents have no vault, no persistent memory and no data accountability. FUTR keeps your data fully segregated and puts you in full control.

- FUTR Rewards – Other Agents business model is to collect data and monetize it behind the scenes. FUTR pays you for every piece of data contributed.

This is not a theory. This is not hype. Closed Beta is live now. The full rollout is coming in 2026. You can get access here.

This AI Agent is built to handle life’s most painful chores.

It reads your mortgage and warns you before renewal. It scans your insurance policy and highlights gaps. It flags bills before they’re due and pays them automatically through FUTR Payments.

FUTR has already surpassed 1,000,000 transactions and more than US$3 billion million in payments volume,⁴ giving it millions of real consumer data points to feed into its AI Agent App. And a ten-year license to FutureVault’s enterprise-grade technology gives this company the backbone for a data engine no one else can match.⁵

The best part? Consumers save 20–30 minutes a day, and they get paid when they choose to share the data that powers it.

Every user gets a personalized AI Agent, a secure digital vault that structures their data, and a multi-chain wallet embedded directly in the app to store FUTR Utility Tokens on Coinbase’s BASE blockchain.

Tokens are earned instantly for chatting with the agent and providing data, training their AI Agent, and choosing to engage with brands.

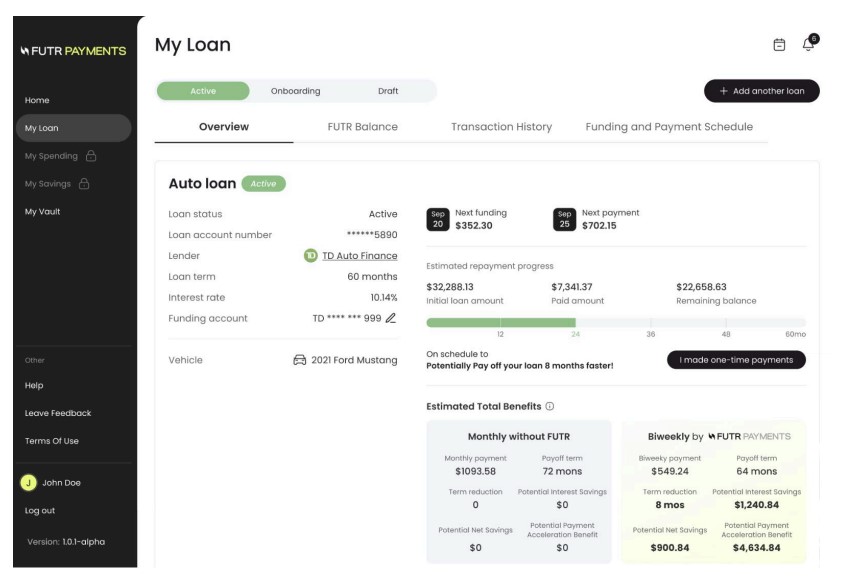

And now, The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is pushing its advantage even further with the release of Payments 2.0, the new engine behind its entire financial ecosystem.⁶

This engine has already served over 300,000 consumers sourced from 260 auto dealers. It is connected to over 1,500 US banks and is making payments to over 900 US lenders. With this new technology those numbers are poised to grow significantly.

Dealers get faster onboarding, instant savings insights, and a clean, automated portal that replaces slow legacy systems. FUTR gets a stronger foundation for intelligent finance and a larger stream of recurring payments revenue. Payments 2.0 turns a proven business line into a scalable growth pillar and sets the stage for the AI Agent to take over even more high-value financial tasks.

And now The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is expanding that momentum with a new national channel partnership with TaxMax, instantly extending its reach into hundreds of US dealerships and increasing its auto-retail footprint by roughly 400%.

This partnership gives dealers a simple, flexible bi-weekly payment solution that reduces delinquencies and boosts customer satisfaction, while positioning FUTR to roll out even more services across one of the most trusted dealer networks in the country.

For investors, this is the catalyst: the moment when The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) shifts from being a proven payments company into a consumer AI data play with exponential monetization upside.

Monetizing the Data, With Consumers in Control

Here’s how it works.

Consumers upload their documents. FUTR’s (TSXV:FTRC) (OTCQB:FTRCF) vault structures the data. The AI agent makes it usable. And when brands want access, they pay.

But unlike the old world of hidden surveillance and tracking cookies, here the consumer is in control. They choose to share their data, for a set time, with consent. And when they do, they’re rewarded.

The engine that makes this possible is the FUTR Data Protocol and the FUTR Utility Token, announced in partnership with the FUTR Foundation.⁷

The protocol sets the price of access. The token is the medium of exchange.

- Consumers earn tokens for contributing valuable data.

- Enterprises can contribute enriched data and earn rewards.

- Brands spend tokens to buy time-bound access to insights and leads.

- And The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) takes a commission on every brand purchase and data transaction.

It’s a flywheel. Users get rewarded. Brands get precision targeting. Enterprises contribute and save on acquisition costs. And The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) earns revenue every step of the way.

Why This Could Be Disruptive

Think about the shift.

For years, advertisers have chased people with irrelevant ads based on cookies and click trails. That model is broken. Regulators are killing it. Consumers are blocking it. Costs are rising while accuracy drops.

The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) flips the model.

- Data comes directly from the consumer, verified by real documents and transactions. It’s structured, timely, and consented.

- Brands pay less for higher-quality leads.

- Consumers finally share in the value of their own information.

That’s why The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) could be the bridge between the old, collapsing surveillance economy and a new, consent-driven data economy.

And with seasoned dealmakers like G. Scott Paterson and Alex McDougall at the helm, The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) has both the technology and the leadership to seize this moment.

The market hasn’t caught on yet, but when it does, investors who recognized the opportunity early could be holding one of the most compelling AI data stories we’ve seen to date.

FUTR’s President Alex McDougall recently joined Sam Kamani on the Web3 with Sam Kamani Podcast to discuss how AI agents are reshaping data monetization and why FUTR is positioned at the center of this shift.

Press Releases

8 Reasons

Investors Should Be Watching The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF)

1

Billions Already Processed: Over $3 billion has already moved through the FUTR Pay platform, with tens of millions of dollars in interest saved for its consumers.⁸ The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is not a concept. It is an operating business with proven scale.

2

Sticky Recurring Revenue:FUTR Payments helps consumers pay off loans faster, saving interest. That means that their customers aren’t just making one payment and leaving, they are using the rails monthly for years at a time leading to a strong recurring revenue base.⁹With the launch of FUTR Payments 2.0, FUTR is primed for major growth in this high margin business.

3

Record Financial Performance: For Fiscal 2025, FUTR reported record revenue of C$2.2 million with gross margins of 90%.¹⁰ The company also raised over $11.7 million of equity, strengthening the balance sheet and setting the table for growth initiatives. Few small-cap fintechs or AI companies can match that combination of growth and profitability at the unit level.

4

The AI Agent Launch in Q1 2026: This is the real catalyst. The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) will roll out its consumer AI agents in the Q3 of 2025.¹¹ Each user gets a personal data vault, digital asset wallet and AI agent that can read bills, analyze contracts, and trigger payments.¹²

5

Monetizing Consumer-Controlled Data: This is where FUTR’s story goes from good to potentially explosive. The company isn’t just launching AI agents to organize documents, it’s embedding an entire data economy into its platform. FUTR has signed a Master Services Agreement with the FUTR Foundation to integrate the FUTR Data Protocol and FUTR Utility Token directly into its AI Agent App.¹³ The secret weapon? FUTR holds 150,000,000 tokens on its balance sheet, which provide extra potential upside for the stock.

6

The AI Agent Megatrend:McKinsey estimates generative AI could add $4.4 trillion a year to the global economy.¹⁴ Early consumer AI apps like Character.ai and Perplexity have already hit tens of millions in revenue. FUTR is positioned to ride this adoption wave with a unique hook: payments and data rewards built in.

7

The Team Behind the Vision: G. Scott Paterson, former Vice Chair of the TSX, built Yorkton Securities into Canada’s top tech bank and sold companies like Symbility Solutions and JumpTV for hundreds of millions. President Alex McDougall, a recognized voice in digital assets and payments, sits on the board of Balance Custody, the country’s largest regulated digital asset custodian and helped bring the first Canadian dollar stablecoin (Stablecorp’s QCAD) to market in partnership with Coinbase. And CEO Michael Hilmer has raised over $1B to build fintech and SaaS platforms. This is a team with a proven record of building, scaling, and exiting.

8

Newly Public and Already Covered by Analysts: The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) only listed in April, secured a U.S. OTCQB listing by July, and by September, was already covered by Research Capital Corporation with a Speculative Buy rating and a $3.00 price target. Most small-cap companies wait a year or more for analyst coverage — FUTR did it in a matter of months. That speed of recognition highlights how quickly this story is accelerating.

How Big Is the AI Agent Opportunity?

Wall Street is finally waking up to the fact that generative AI isn’t just another software trend. It’s an economic shockwave. McKinsey estimates AI could add $2.6 to $4.4 trillion every year to global output.¹⁵

And at the heart of this surge are not chatbots, but AI agents, systems that perceive context, make decisions, and take action.

The adoption curve is already in motion. Microsoft has rolled agent capabilities directly into its Copilot platform, letting enterprises create custom digital workers for finance, supply chain, and customer service. Salesforce followed with Agentforce, which became generally available this year.¹⁶ PayPal is also revamping its tech stack to enable agentic payments, introducing its Agentic AI Toolkit to developers.¹⁷ Within months, companies had built more than 10,000 autonomous agents to handle tasks that used to require whole teams of staff.¹⁸ Governments are piloting AI agents to streamline compliance and benefits delivery.

Analysts see the same trajectory. Gartner projects that a third of enterprise software will include agentic AI by 2028, up from almost nothing in 2024.¹⁹ That’s not a gradual shift, it’s a platform reset.

And it isn’t just the enterprise side. Consumer adoption is happening just as fast.

Startups like Character.ai²¹ and Perplexity AI²² have gone from zero to tens of millions of users and meaningful revenue in less than two years.

Voice agents, multimodal assistants, and task-specific bots are now a mainstay of accelerator programs and venture rounds. Venture firms like a16z note that entire classes of startups are being built purely around voice and agent-based models.²³

All of this points to one conclusion. Agents are shaping up to be the “iPhone moment” of this AI cycle – the product that carries the technology from hype to mainstream habit.

This is where The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) enters the picture.

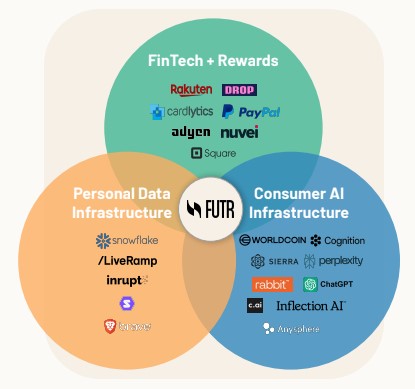

FUTR isn’t chasing general chatbots. It is building consumer AI agents anchored to the three things that matter most: payments, personal data infrastructure, and real AI intelligence.

Why does that matter?

Because the biggest budgets flow where advice turns into action. A chatbot that tells you your mortgage renewal is coming up is interesting. An AI agent that reads the document, triggers the payment, and serves you a refinance offer is worth real money. And when that data is structured, verified, and consented through a personal vault, brands will pay a premium to access it.

The market is forming quickly. Spending is accelerating. And unlike most startups chasing this space, The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is already public, already generating revenue, and preparing to launch its own consumer AI agents into what could be one of the fastest-growing categories in tech history.

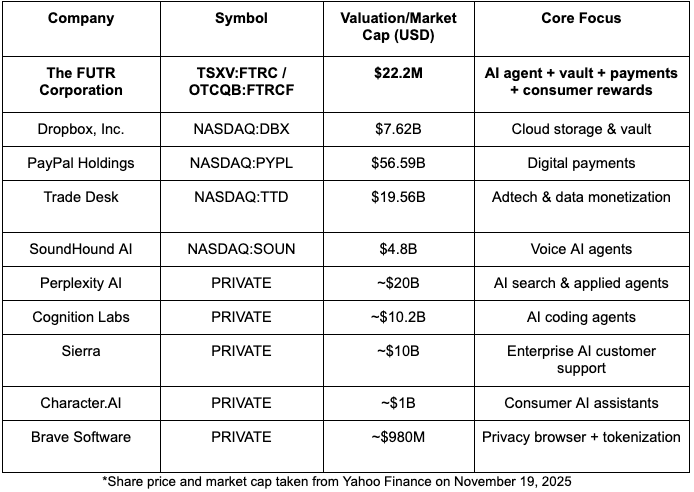

Wall Street Is Paying Billions for Pieces of the Puzzle. FUTR Puts It All Together.

When it comes to AI, storage, privacy and data, investors have already shown they are willing to pay billions for companies that solve even one part of the problem. Whether it’s cloud storage, AI agents, consumer data, or intelligent automation, investors consistently assign premium valuations to companies tackling a single vertical.

AI-first companies like Perplexity, Cognition, and Sierra have reached multi-billion-dollar valuations for a single category of intelligence.

Consumer-facing AI platforms like Character.AI and Inflection command huge valuations based purely on engagement and conversational agents.

Data privacy and tokenization leaders like Brave Software approach a billion-dollar valuation just for browser-based control.

And reward engines like Honey, which was bought by PayPal, built a $4 billion business simply by helping consumers earn cashback online.²⁴

The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is the first public company to combine a personal data vault, AI agents, payment rails, and consumer rewards into one integrated platform.²⁵

And the comps show how undervalued it is.

Dropbox (NASDAQ:DBX) proved that hundreds of millions of people want a single place to store their documents. Investors rewarded it with a multi-billion-dollar valuation. But Dropbox never added payments, AI intelligence, or consumer rewards.

PayPal (NASDAQ:PYPL) showed that consumer payments platforms can scale globally, moving hundreds of billions in volume and earning Wall Street’s trust. But PayPal doesn’t layer in consumer-controlled AI or data monetization.

Trade Desk (NASDAQ:TTD) proved that platforms turning consumer data into targeted advertising can capture premium valuations close to $20B. But it never gives consumers a cut of the monetization.

SoundHound AI (NASDAQ:SOUN) validated that applied AI agents are real businesses. Voice-driven agents helped it win partnerships in autos and healthcare, driving it to a nearly $5B valuation. But it is enterprise-first, not consumer-first.

Meanwhile, the new wave of AI-first companies, including Perplexity, Cognition, Sierra, Character.AI, Inflection, Cursor, have each reached multi-billion-dollar valuations by solving just one piece of the digital consumer experience.

The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is the only public company that merges all of these value drivers into one platform:

- A vault consumers trust

- Payment rails that already process high volumes

- AI agents that work on behalf of the user

- Reward mechanics that return value to the consumer

- Data tokenization that keeps ownership in the user’s hands

With 1M+ transactions and US$380M+ in payments volume already processed, a Closed Beta AI Agent App live today, and a market cap of less than US$23M (~4× revenue), FUTR is positioned as the next evolution in data monetization. Comparable companies trade at 8× to 60× revenue. The gap is obvious.

The Window of Opportunity

The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) just delivered record fiscal 2025 revenue of C$8.35 million with staggering 90% gross margins.²⁶

And the traction doesn’t stop there. FUTR has already surpassed 1,000,000 transactions and processed more than US$3 billion million in payments volume. It’s already connected to 1,500 US banks, 900 lenders and 260 auto dealers. That means millions of consumer data points are already in motion, actively fueling its AI Agent App. Add in a 10-year license to FutureVault’s enterprise-grade technology and you’ve got the backbone for a data engine no competitor can match.

This is the kind of proof you rarely see in a company this new. FUTR only listed in April, yet it’s already stacking up milestones most small caps can’t touch for years.

Now comes the true catalyst: the launch of consumer AI agents that don’t just chat, they act — saving people 20–30 minutes a day, paying them when they choose to share their data, and giving brands the precision targeting they’ve been begging for.

Most investors are still chasing chatbot hype. They haven’t even seen this story yet. But when the market wakes up, it won’t take long for Wall Street to realize that a newly listed company with real revenue, near-90% margins, and millions of transactions already processed is sitting on one of the most disruptive AI data plays of the decade.

For those who get in early, The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) could be a generational opportunity.

The window is open. But it won’t stay open forever.

From Hundreds of Millions in Exits to the Next AI Breakthrough. Why This Team Gives FUTR an Unfair Advantage

Every breakthrough company has one thing in common. A team that knows how to turn vision into execution.

That’s why the leadership behind The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) matters so much. This isn’t a group of academics tinkering in a lab. These are seasoned operators with track records of scaling fintechs, building platforms, and closing exits worth hundreds of millions.

Start with G. Scott Paterson. In Canadian markets, his name is synonymous with technology finance. As Chair of the Toronto Stock Exchange, he helped shape the ecosystem for emerging growth stories. At Yorkton Securities, he built Canada’s leading tech investment bank. He co-founded Symbility Solutions, which scaled into a $44 million business before being acquired for $162 million. He was also behind JumpTV, a pioneer in streaming long before Netflix, which was sold for $250 million. Few financiers have been this early, this often, in spotting disruptive tech. And now he’s backing FUTR.

Next is Alex McDougall, FUTR’s President. McDougall is one of the most recognized voices in digital assets, payments, and data sovereignty. serves as President of Canada Stablecorp, helped bring the first Canadian dollar stablecoin (Stablecorp’s QCAD) to market in partnership with Coinbase. He also sits on the board of Balance Custody, Canada’s oldest and largest regulated digital asset custodian. Today, he’s applying that expertise to build FUTR’s data protocol, token economy, and AI agent strategy.

Together, Paterson and McDougall give The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) something rare in the AI market: a team that has already built, scaled, and sold companies that knows exactly how to execute on the next disruption.

Don’t Miss the Next Breakthrough

AI agents are shaping up to be the “iPhone moment” of this cycle. Entire industries are being rewired. Consumer data is becoming the most valuable commodity of the digital age. And The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) is positioned at the center of it with payments, vaults, and AI agents ready to launch.

The groundwork is laid. The leadership is proven. The market is forming right now.

To fully understand this opportunity, it’s important to see the story in detail — from the corporate deck to each new release as it’s announced.

Subscribe to our newsletter today to receive the latest corporate presentation from The FUTR Corporation (TSXV:FTRC) (OTCQB:FTRCF) and stay informed with every news release the moment it goes live.

Make FUTR part of your due diligence and be first to see how this breakthrough unfolds.

*all figures in USD unless otherwise indicated