Copper prices recently plummeted from $5.80 per pound to $4.35 after the market reacted to the news about a 50% tariff on copper imports and the uncertainty surrounding global supply chains.

While the price has dipped, the underlying demand for copper remains incredibly strong, driven by electric vehicles, renewable energy projects, and AI infrastructure.

This price drop might seem like a setback for some, but in the long-term, it underscores an urgent need for secure, stable, and high-quality sources of copper.

The US tariff and the challenges in global trade have highlighted the critical importance of projects in politically stable and mining-friendly jurisdictions, like Botswana.

The problem?

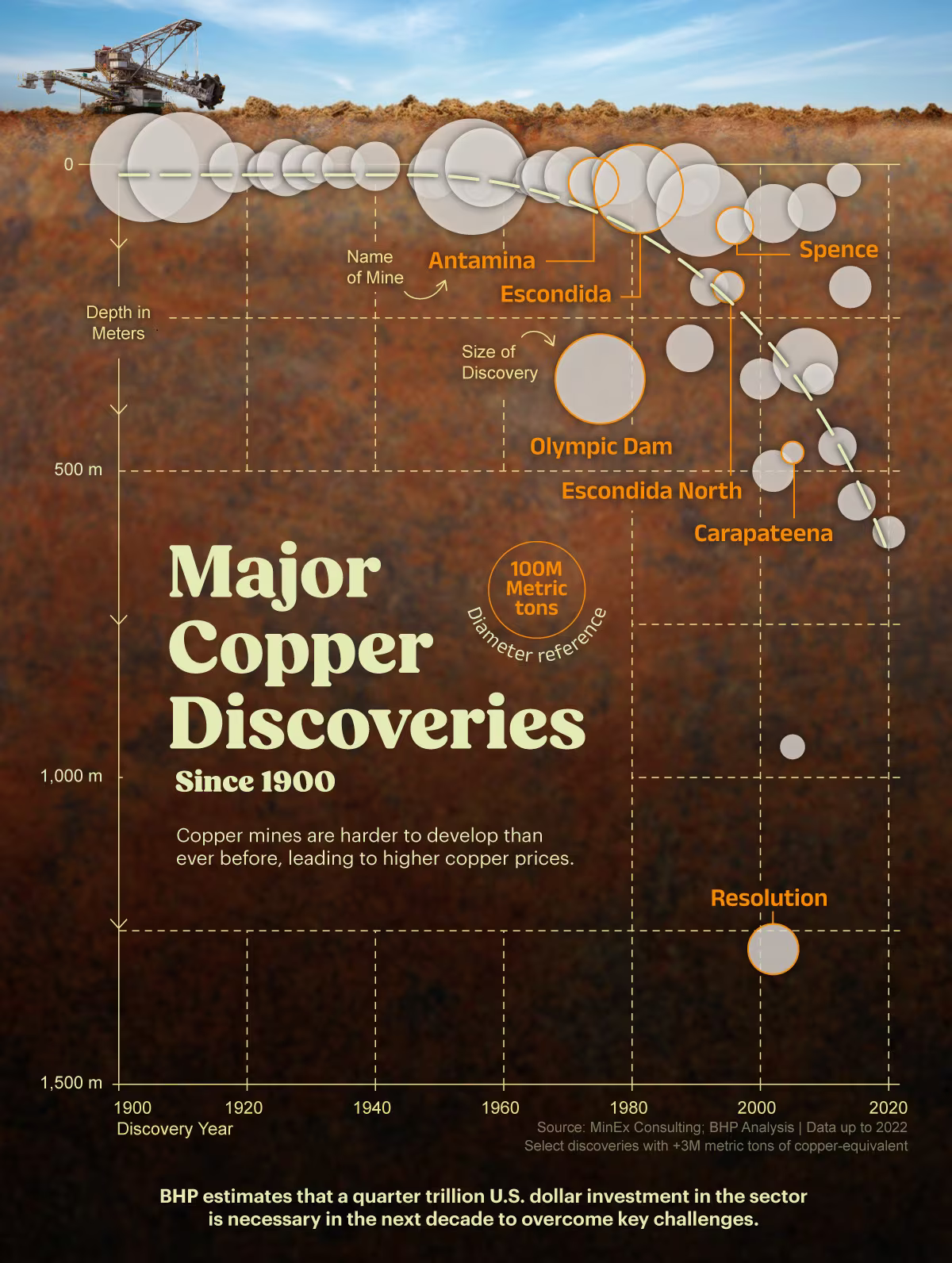

Copper demand is set to double by 2035,¹ but new discoveries have collapsed by more than 80% since 2010.²

Source: bhp.com3

It now takes 16 years on average to bring a new mine online⁴ and most existing production is tied up in unstable regions like Chile⁵, Peru⁶, and the DRC.⁷

That’s exactly where NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) fits in.

With two past-producing mines in Botswana, a politically stable, mining-friendly country, and aggressive drilling already underway at its Selebi deposits.

This is a timing story—and the clock just started ticking a whole lot faster.

Reviving Two Past-Producing Mines at the Center of the Critical Minerals Boom

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM)controls two past-producing mines — the Selebi Mine Complex located in Selebi-Phikwe and Selkirk Mine located outside of Francistown — once owned by a parastatal Botswana mining company.

Current resource:

- Defined high-grade copper-nickel-cobalt resources at Selebi Mine — 18.89 million tonnes (Mt) (Inferred) at 3.51% CuEq, 5.83 Mt (Inferred) at 3.11% CuEq, and 3.00 Mt (Indicated) at 2.92% CuEq⁸

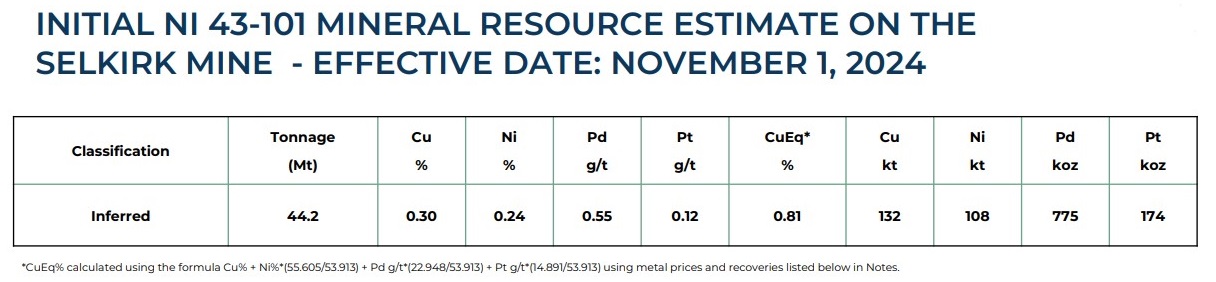

- 44.2 Mt of copper-nickel-palladium-platinum mineralization at Selkirk – averaging 0.81% CuEq , providing large-scale, open-pit potential with valuable PGM credits.⁹

- Expansion drilling is targeting massive conductive zones beyond the current resource boundaries.

But that’s not the only reason NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) stands out.

This isn’t some ten-year dream.

The Selebi North underground is re-opened, exploration drifts are advancing, and drilling is already underway — fully funded by a $67 million recapitalization backed by Frank Giustra and EdgePoint Investment Group.¹⁰

But it’s not just the money that sets NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) apart — it’s the strategic backing behind it.

But it’s not just the money that sets NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) apart — it’s the strategic backing behind it.

Frank Giustra, a serial mining entrepreneur and founder of several mining companies including Wheaton Precious Metals and Goldcorp, has structured and financed world-class mining ventures. He also founded Lionsgate Films, now one of the world’s largest independent film studios. Giustra’s global network, strategic vision, and deal-making acumen have driven billions in market cap growth.

His involvement signals that NexMetals is a serious project positioned for scale and institutional support.

Giustra’s backing is more than financial — it’s about unlocking the full potential of Selebi and Selkirk, turning them into elite assets in one of Africa’s most stable mining jurisdictions.

Meanwhile, at Selkirk, surface drilling and metallurgical studies are laying the groundwork for a second leg of growth, giving NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) not just one, but two major catalysts for value creation.

They’re moving fast.

Resource expansion, concentrate production, and strategic optionality are all on the table in a supply-constrained market.

A Proven Path to Billion-Dollar Value — Right Next Door

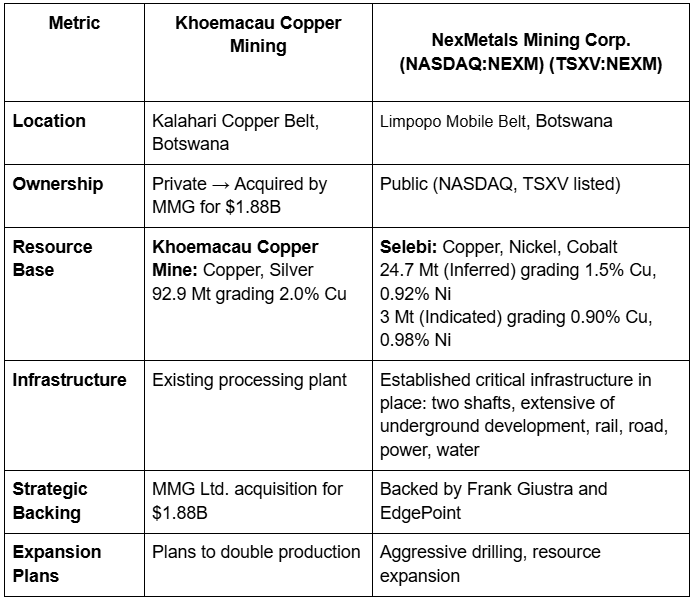

If you want a real-world example of how Botswana’s copper potential can translate into serious value, look no further than Khoemacau Copper Mining.

Khoemacau started small — a private developer working the Kalahari Copper Belt, long before most investors paid any attention to Botswana’s critical minerals potential.

Today?

Khoemacau is producing over 60,000 tonnes of copper per year, with plans to double production by 2027.¹¹

And in March 2024, China’s MMG Ltd. snapped up the company for a staggering $1.88 billion.¹²

The key to Khoemacau’s success?

- High-grade copper discovery zones

- Strong resource growth through targeted drilling

- Existing infrastructure

- A politically stable, mining-friendly environment in Botswana

- Perfect timing — riding the surge in global copper demand

It’s a blueprint that NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is now following — almost step for step.

NexMetals controls two past-producing copper-nickel mines — Selebi and Selkirk — right in the heart of Botswana’s critical minerals corridor.

Here’s how the two companies compare:

8 Reasons

This Overlooked Critical Minerals Play Could Be One of 2025’s Biggest Breakouts

1

Copper is entering a full-blown supply crisis — Major copper discoveries have collapsed by over 80% since 2010, with prices pushing toward all-time highs.¹³

2

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) controls two past-producing, high-grade critical minerals mines: With 68.9 Mt (Inferred) and 3.0 Mt (Indicated) already defined between Selebi and Selkirk¹⁴ — and infrastructure in place — NexMetals has a serious head start most juniors can only dream of.

3

High-grade expansion drilling is already underway: NexMetals is targeting new conductive plates, including a third horizon at Selebi Main and the hinge zone.

4

Fully recapitalized with $67 million in strategic backing: Frank Giustra’s Fiore Management and EdgePoint Investment Group have fully funded NexMetals’ growth.

5

Located in one of the safest, mining-friendly jurisdictions on Earth: Botswana’s stable political environment makes it ideal for long-term mining projects.

6

Early-mover advantage inline with a Nasdaq uplisting — Recently listed on the Nasdaq to unlock a broader investor base.¹⁵

7

Multiple catalysts in motion: Drilling results, resource updates, and strategic developments provide near-term news flow.

8

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is still in the early stages, with potential upside relative to larger peers.

Press Releases

- NexMetals Secures Title to Selebi and Selkirk Assets in Botswana Following Completion of Milestone Payment

- Trump Just Lit the Fuse on a Copper Supercycle and This Junior May Be One of the Best Positioned Plays on the Market

- Trump Just Lit the Fuse on a Copper Crisis and This Junior Developer Could Be One of the Biggest Beneficiaries

- NexMetals Announces C$65 Million Public Offering of Units

- NexMetals Metallurgical Assay Results Confirm Clean Copper & Nickel-Cobalt Concentrates from Selebi Mines

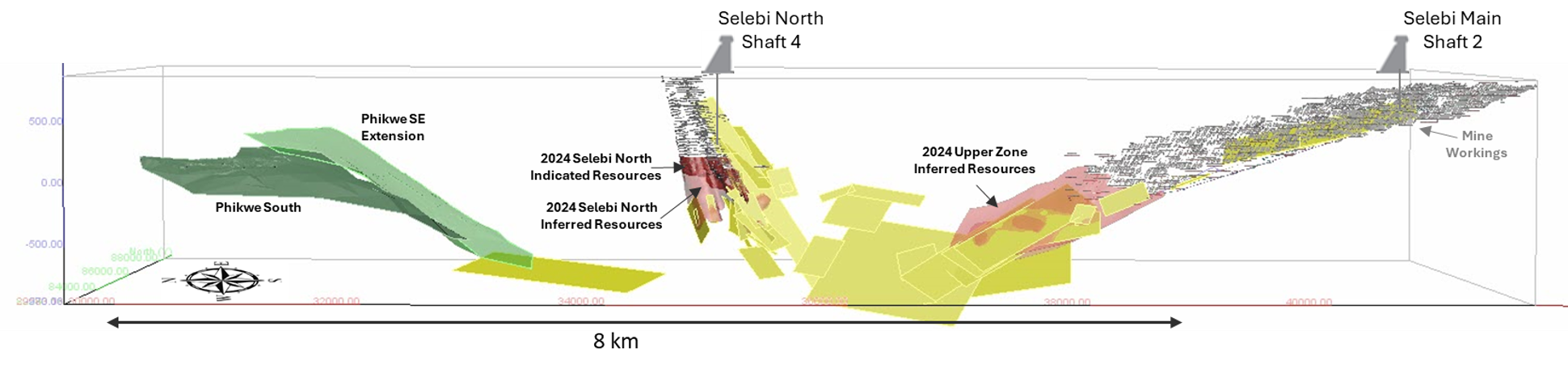

Selebi: A High-Grade Critical Minerals Discovery Hiding in Plain Sight

In a copper market starved for new supply, the Selebi Mine Complex stands out for one reason:

It’s real, high-grade, has already produced millions of tonnes and is getting bigger.

Originally discovered in the 1960s, Selebi North and Selebi Main together produced nearly 40 Mt of copper-nickel ore.

These weren’t speculative deposits— they were revenue-generating mines.

The closure of Selebi wasn’t due to geological reasons or resource exhaustion.

It was caused by the collapse of the former operator’s smelter in 2016, just as metal prices dropped. With no processing options, the government mothballed the complex — leaving millions of tonnes of high-grade material still underground.

Today, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) controls Selebi, and they’re already rewriting the story.

24.7 Million Tonnes Inferred — and Growing Fast

In 2024, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) released a new NI 43-101 MRE confirming:¹⁶

- Selebi Main: 18.89 Mt inferred at 3.51% CuEq

- Selebi North:

- 3.00 Mt indicated at 2.92% CuEq

- 5.83 Mt inferred at 3.11% CuEq

This totals 24.7 Mt (Inferred) and 3 Mt (Indicated) of high-grade copper-nickel-cobalt resources. And this doesn’t include recent drilling.

Recent drilling — 37,113 metres over 85 holes — has already outperformed the model, revealing that the grades are getting better:¹⁷

- 27.55 metres grading 4.97% CuEq

- 13.15 metres grading 4.59% CuEq

- 8.65 metres grading 4.65% CuEq

These assays suggest Selebi’s next MRE could potentially show both increased tonnage and improved grades.

And the growth isn’t slowing down.

In May 2025, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) drilled a major 183-metre step-out, down-plunge from the Selebi North resource — intersecting strong mineralized intervals within a broader 13.50 metre mineralized zone and proving that the system is larger and more dynamic than previously understood.¹⁸

Why This Matters

With high-grade mineralization, ongoing drilling, and existing infrastructure, Selebi is set for rapid expansion, all while copper prices are soaring — making this a critical opportunity that’s still flying under the radar.

Engineering Smarter

NexMetals isn’t just growing the resource. It’s unlocking more value from every tonne.

At Selebi North, the company is deploying X-ray transmission (XRT) pre-concentration technology sorting underground, using existing stopes to strip out waste rock before it even reaches the mill.¹⁹

The results speak for themselves: a 15.2% jump in head grade, 98% copper and nickel recovery, and a leaner, potentially higher-margin operation from day one.

This isn’t theoretical. It’s already working. NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is turning historical infrastructure into a real-time advantage, boosting economics and reducing dilution at the source. In a market chasing high-grade copper, that’s a game-changer.

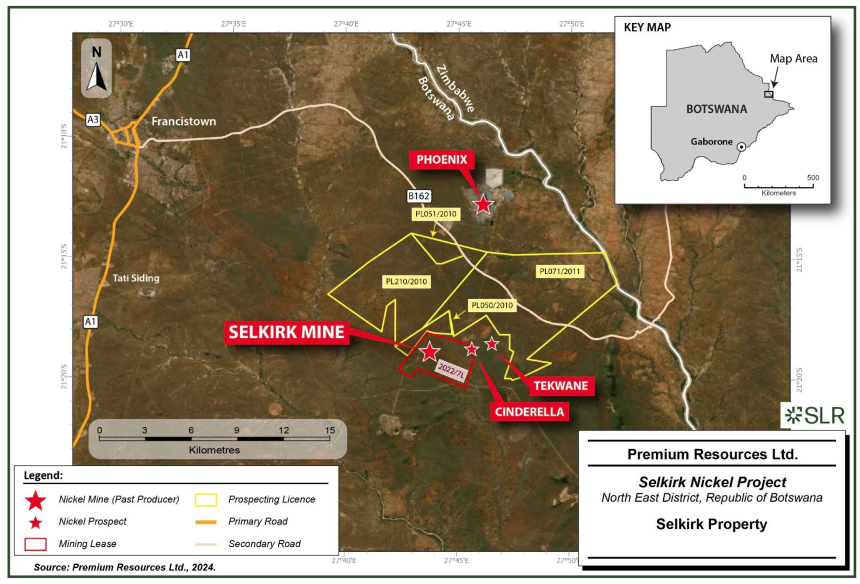

Selkirk: A Second Past-Producing Mine Few Are Watching — Yet

While the market is waking up to the opportunity at Selebi, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) holds a second critical minerals growth engine that almost no one is paying attention to yet.

Located just 75 kilometers north of Selebi, the Selkirk Mine has a rich history — producing over 1 Mt of copper-nickel ore between 1989 and 2002.

But unlike many past-producing mines, Selkirk wasn’t exhausted. The suspension of operations was for the same reasons that Selebi closed — a failure in their shared smelter — not resource depletion.

In fact, historical modeling suggested Selkirk’s resource potential was well over 100 Mt — a scale that today’s modern exploration technologies are only beginning to fully validate.²⁰

Now, with new technologies like XRT pre-concentration sorting and deep imaging available, Selkirk’s potential could be fully realized.

A Large, Near-Surface Polymetallic Resource

In November 2024, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) published an updated NI 43-101 resource for Selkirk, confirming:

- 44.2 Mt (Inferred) at 0.30% copper and 0.24% nickel

- Byproduct credits of 0.55 g/t palladium and 0.12 g/t platinum.

Selkirk’s scale and polymetallic nature provide significant value.

Its near-surface mineralization makes it ideal for low-cost, open-pit mining — an advantage in a world where building new underground mines takes decades.

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is not treating Selkirk like a secondary asset. They’re re-logging core and optimizing metallurgy to improve recoveries.

Excitingly, they’re applying XRT ore sorting technology²¹ to boost head grades by up to 3x, lowering costs and improving operating margins.²²

Strategic optionality gives NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) significant flexibility — and increased growth potential.

A Team Built for Execution — Not Just Exploration

The opportunity at NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) isn’t just about the rocks.

It’s about the team driving the vision forward.

NexMetals’ board is equally impressive. Paul Martin, the former CEO of Detour Gold and interim CEO of Osisko Gold Royalties, knows exactly what it takes to build world-class mines and deliver major shareholder returns. Chris Leavy, former Chief Investment Officer at BlackRock and Oppenheimer Funds, brings powerful Wall Street connections and decades of institutional investment experience.

And with Fiore Management and Frank Giustra’s strategic advice, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) has top-tier backing to navigate the complexities of today’s mining sector.²³

A Timing Story You Need To Put On Your Radar

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is positioned at the heart of a critical minerals boom.

Two past-producing mines, 68.9 Mt (Inferred) and 3 Mt (Indicated) of combined high-grade resources, recapitalized with strategic backing from some of the most successful mining financiers make this an opportunity few juniors can match.

With drilling underway, high-grade expansion, and a new Nasdaq uplisting coming soon,²⁴ NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is on track to deliver massive value — and the window to position early is closing fast.

The time to act is now.

For those paying attention, the opportunity is clear.

Timing is everything.

Click here to sign up to our newsletter.