For all the money flowing into defense — nearly $1 trillion annually1 — the most vulnerable points in America still aren’t protected.

Not the skies.

Not the borders.

The problem? Entry points.

Behind-the-scenes access doors at airports. Side entrances at power plants. Service corridors in stadiums, courthouses, and federal labs. These are the soft targets attackers exploit — and the places standard metal detectors weren’t designed to defend.

But one small company has quietly developed an AI-powered scanning system that could change that.

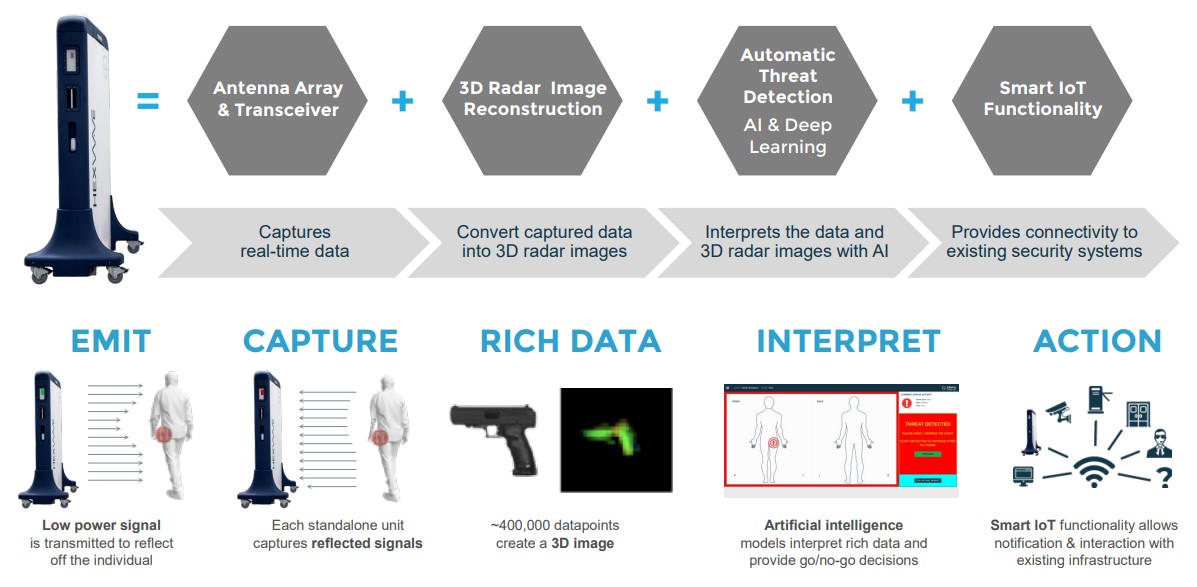

It’s called HEXWAVE — and it does what traditional security can’t.

Using 3D radar imaging and AI, it identifies concealed threats like non-metallic explosives, ceramic blades, and 3D-printed weapons — all in under two seconds, without requiring people to stop or empty their pockets.

This is not theory.

HEXWAVE has already been:

-

-

- Installed at Los Alamos National Laboratory, one of the most secure sites in the US2

- Validated by the FAA-backed Safe Skies Alliance3

- Deployed across courthouses, airports, and corrections systems

- And backed by a $5.7 million TSA contract to modernize aging airport body scanners4

-

Even more telling? In a collaborative trial with US government agencies, military, and NATO partners, the company’s flagship tech demonstrated over 90% detection rates across both metallic and non-metallic threats—outperforming industry benchmarks. 5

Since late 2024, this company has raised over C$16 million,6,7 brought in a new President with CIA and Palantir credentials,8 and doubled its pipeline of government contracts and pilots.

And yet — it still trades at a valuation under $12 million.

That company is Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF).

And its technology isn’t just designed to protect infrastructure…

It may be the only platform that’s already doing it.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

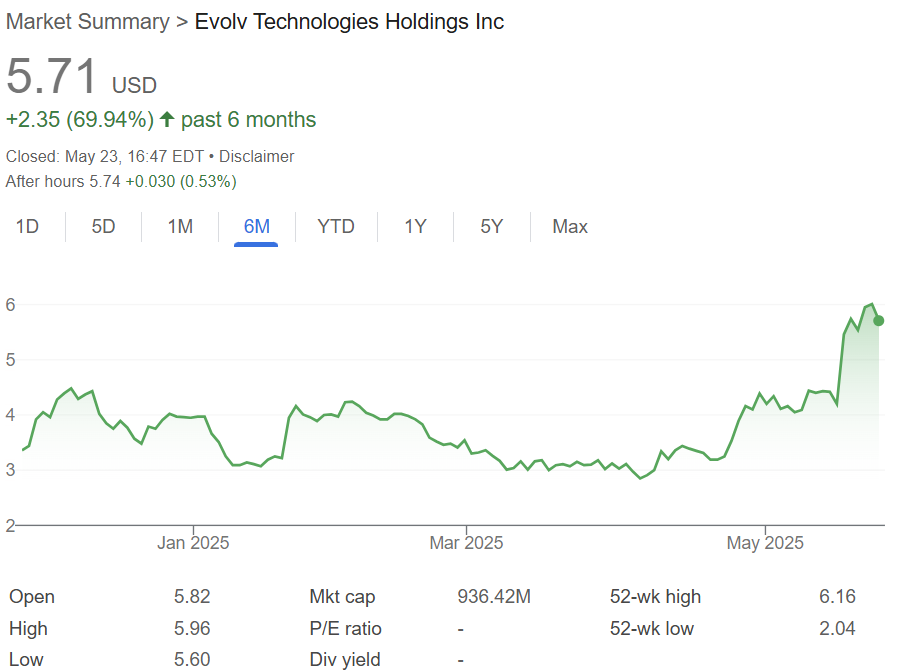

Evolv Made the Headlines. Liberty Landed the Government Contracts

When investors think about AI-driven threat detection, they usually think of one name:

Evolv Technologies (NASDAQ:EVLV) — now trading at over $936 million9 thanks to high-profile deals with stadiums like Wrigley Field10 and Mercedes-Benz Stadium.11

Their product, Evolv Express, uses AI-enhanced metal detection — designed for speed and crowd flow.

But there’s a problem: it only detects metallic weapons, and its accuracy has come under serious scrutiny.

In a 2023 pilot in the NYC subway system, Evolv reportedly missed every actual firearm, while generating a flood of false positives. 12

Regulators have taken notice — and a class-action lawsuit followed.13

Now compare that to a company trading at just $12 million — one that’s already beating Evolv head-to-head in real-world tests.

Press Releases

- Liberty Defense is Pleased to Announce that it has Received a Multi Unit HEXWAVE Order to Screen Aviation Workers for a growing US International Airport

- Liberty Defense Commences Normal Course Issuer Bid to Buy Back Up-to 9.9% of the Publically Traded Float

- Liberty to Participate in Lytham Partners Investor Conference

- Liberty Defense has Appointed The Honorable David Kris to its Newly Formed Strategic Advisory Board

- Liberty Defense Completes Third Party Testing with National Safe Skies Alliance for Aviation Security

Liberty’s HEXWAVE: A Whole New Layer of Security

Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) has developed HEXWAVE — a platform that doesn’t rely on metal detection at all.

Source: Libertydefense.com14

Instead, it uses active 3D radar imaging and AI to detect non-metallic threats: plastic explosives, 3D-printed guns, powder agents.15

And it’s already:

-

-

- Installed at Los Alamos National Lab16

- Validated by the FAA-backed Safe Skies Alliance17

- Deployed in airports, courthouses, and corrections facilities

-

The company has also formed strategic technical partnerships with some of the most respected institutions in science and national security — like MIT, Pacific Northwest National Laboratory, IsoTech, and Viken Detection.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Two Products. TSA Funding. Government Traction.

Beyond HEXWAVE, Liberty is also rolling out HD-AIT — a TSA-funded upgrade to the outdated body scanners currently used in US airports.18

That project is already funded with $5.7 million19 and aligns directly with the TSA’s April 2026 screening mandate.

While Evolv focuses on private venues and sports arenas, Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) is embedding into federal security infrastructure — with SAFETY Act protections already in motion.20

Side-by-Side Snapshot

| Company | Evolv (NASDAQ:EVLV) |

Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) |

| Threat Detection | Metallic only | Metallic + non-metallic (AI radar imaging) |

| Accuracy Issues | Failed NYC subway test21 | >90% detection22 |

| Key Markets | Stadiums, public events | Airports, courthouses, jails, national labs |

| Regulatory Standing | Under FTC/SEC scrutiny | SAFETY Act application submitted |

| Product Line | Single platform | HEXWAVE + TSA-backed HD-AIT |

| Market Cap (May 2025) | ~$936M | ~$12M |

Evolv may have opened the market for walk-through security AI.

But Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) is where the serious institutional traction is happening.

It’s smaller.

It’s faster. It’s portable and has FCC approval for indoor and outdoor usage.

And it’s already winning the tests that matter most.

Wall Street’s still watching the wrong stock.

But that won’t last much longer.

A Federal Mandate Is About to Redefine Airport Security

In April 2026, a TSA mandate will go into effect that could transform physical security across every US airport.23

For the first time in history, all airport employees — not just passengers — must be physically screened every day.24

That means:

-

-

- 500+ commercial airports25

- Thousands of daily scans per site

- And a nationwide need for fast, automated scanning systems that can scale without creating bottlenecks

-

Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) is already positioned.

Palm Springs International Airport recently selected HEXWAVE to screen employees in compliance with the new federal requirements,26 joining Liberty’s growing roster of major airports buying or trialling the technology like Denver International, LAX, Toronto Pearson International27 and JFK.

HEXWAVE can detect what metal detectors miss — including plastic explosives, ceramic blades, and 3D-printed weapons — without slowing down operations.

And while most competitors still focus on consumer-facing venues, Liberty is aligned directly with federal infrastructure — where the money and mandates are going.

The SAFETY Act Advantage: The Certification That Changes Everything

Before any government venue adopts new tech, one question dominates:

“Is it SAFETY Act certified?”

This post-9/11 federal liability program protects buyers from lawsuits in the event of a terrorist attack — and it’s become a silent deal-breaker across US airports, stadiums, and courthouses.28

In March 2025, Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) filed for SAFETY Act designation — a six-month process that, once approved, will make HEXWAVE one of the only AI-driven, millimeter-wave platforms eligible for federal protection. 29

That alone could open dozens of procurement channels that others aren’t even eligible for.

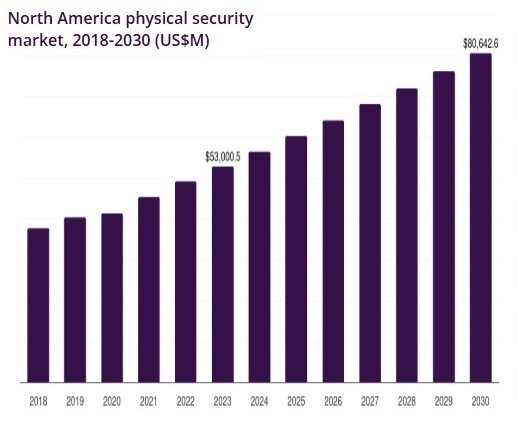

A $80 Billion Market Is Quietly Shifting Toward Liberty’s Tech

While headlines obsess over AI chips and obesity drugs, one of the biggest industrial transitions is playing out in physical security.

According to Grand View Research, the North American physical security screening market is projected to grow from US$56.5 billion in 2024 to over US$80.6 billion by 2030, a 6% CAGR.30

But the growth isn’t in metal detection.

It’s in AI-powered scanning, non-metallic threat detection, and TSA-mandated upgrades — exactly the areas where Liberty is positioned to lead.

Its second product, HD-AIT, is a TSA-funded body scanner upgrade now being delivered for review. 31

These HD-AIT units are set to replace 1,000+ existing airport scanner sites.

That’s a potential nine-figure federal revenue stream — for a company still trading below $15 million.

8 Reasons

Liberty Defense Could Be One of the Smartest Undervalued Stocks on the Market

1

Active US Government Partnerships: Liberty isn’t pitching concepts. It’s already delivering HEXWAVE and HD-AIT to federal clients — including the TSA and Los Alamos National Lab.

2

A Mandate Driving National Rollout: By April 2026, all US airports must screen employees daily — a sweeping federal mandate that will force upgrades at over 400 sites.32

3

Superior Real-World Test Results: In joint trials with US government agencies, military, and NATO partners, HEXWAVETM demonstrated over 90% detection rates across both metallic and non-metallic threats 33

4

Independent Validation at Scale: HEXWAVE has been validated through third-party testing by the FAA-funded Safe Skies Alliance — a rare mark of credibility.34

5

Critical Path to SAFETY Act Protection: Liberty is mid-process in applying for DHS SAFETY Act certification — a gatekeeping requirement for many federal and public deployments.35

6

Built by National Security Insiders: The team includes leaders from Palantir, CIA, DOJ, and Lockheed — including Bryan Cunningham36 and former US Assistant Attorney General David Kris.37

7

Trading at a Deep Discount: Evolv trades at over $936M. Liberty — with more government traction and tech breadth — trades under $12M.

8

Two Platforms, Recurring Revenue: HEXWAVE is selling now.38 HD-AIT is built and TSA-backed. Both include multi-year maintenance and software revenue baked in.

The Deals Are Signed — And This Rollout Is Already in Motion

Most micro-caps pitch potential.

Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) is delivering.

Since late 2023, the company has booked government contracts across corrections, airports, and courts — and its HEXWAVE platform is now in real-world deployment.

It started in 2023 with one of the most secure federal research sites in the country. Liberty delivered multiple HEXWAVE units to Los Alamos National Laboratory, where the technology now helps screen thousands of employees daily.39

Then came Palm Springs International Airport, which selected HEXWAVE to screen employees — directly aligning with the TSA’s April 2026 screening mandate. 40

In Q1 2025, nine more units were shipped to US courthouses and municipal clients — a clear sign Liberty’s gone from prototype to production.41

But it’s not just domestic.

In January 2025, a US-aligned Middle East government, supported by a US military agency,42 began testing HEXWAVE for border and facility protection — a trial potentially tied to a $50 million procurement opportunity.43

And in parallel, the TSA-funded HD-AIT scanner upgrade — Liberty’s second product — is now being assembled and delivered for evaluation.

This is the kind of footprint that typically belongs to a mid-cap defense name — but Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) is still trading like no one’s watching.

A Pattern Is Forming — And the Pressure’s Building Beneath the Surface

While most investors are focused on headlines, the Canadian chart for SCAN.V is telling a different story — one that technical traders know well.

Since late 2024, the stock has been carving out a descending wedge — a classic reversal pattern.

The range is tightening. Volatility is compressing. And volume tells us buyers are still in the room.

Support is holding steady around C$0.33 — the bottom of its 52-week range — even after a 75% year-to-date drop.

But the internals suggest accumulation, not exhaustion.

A Setup Traders Wait Months to Find

The structure isn’t just technical — it’s fundamental.

-

-

- Float remains tight, with insiders and institutions controlling a sizable portion

- Only ~51.6M shares outstanding

- C$16 million in fresh capital closed since December 2024

- And momentum indicators (MACD, RSI) showing early signs of bullish divergence

-

Even long-term moving averages are beginning to flatten — often a precursor to directional resolution when news hits.

This Isn’t Just a Setup — It’s a Trigger Waiting for a Catalyst

This isn’t a pre-revenue biotech hoping for Phase 2 data.

Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) is already:

-

-

- Shipping HEXWAVE units

- Delivering to US airports and labs

- Funded by the TSA

- And validated by Safe Skies and a collaboration between the US government, US military and NATO

-

If the stock pushes above C$0.35–0.38 on volume, the coil could snap — fast.

This Isn’t Just a Team — It’s a National Security Brain Trust

In most micro-caps, leadership is an afterthought.

Not here.

Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) is led by operators who’ve built and scaled real defense systems — for governments, not just prototypes.

-

-

- Bill Frain, CEO — Former SVP at L-3 Security & Detection Systems, where he helped drive global aviation and government deployments before a $1B acquisition

- Bryan Cunningham, President — Former CIA officer and Palantir counsel, with legal roots in the Patriot Act and Homeland Security reforms

- Jeffrey Gordon, Engineering — 35-year veteran of sensing technology with deployments in major US and European airports

- Jason Burinescu, Executive Chairman — Private equity strategist

-

And that’s just the core.

Liberty’s strategic advisory board includes:

-

-

- David Kris, former Assistant Attorney General for National Security

- James Byrne, ex–Deputy Secretary of Veterans Affairs and Lockheed VP

- Mary Beth Long, former Assistant Secretary of Defense

- Linda Jacksta, 35-year CBP veteran and federal perimeter expert

-

And with the TSA’s 2026 mandate looming, the people behind this company may prove just as valuable as the tech itself.

Final Take: This Market Disconnect Won’t Last Forever

Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) isn’t a prototype.

It’s a post-pilot, government-backed rollout — delivering hardware into courthouses, airports, and corrections systems while trading like a speculative AI idea.

It has:

-

-

- Confirmed contracts in high-security facilities

- Third-party validation from Safe Skies

- Direct TSA funding for HD-AIT

- A pipeline supported by top-tier national security insiders

- And a market cap still under CA$20 million

-

👉 Sign up now to download the Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) corporate deck and follow the story before it breaks wide open.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

*All figures in USD unless otherwise stated.