In a world fixated on drones, missiles, and cyber warfare, the most overlooked vulnerability isn’t in the air — it’s at the door.

Airport back entrances. Stadium employee hallways. The side doors of courthouses, power plants, and even federal buildings.

It’s not how enemies think we’d defend ourselves.

It’s how they know we won’t.

And it’s why some of the biggest names in national security — including former US Department of Justice officials, CIA operatives, and Defense Department insiders — are rallying behind a radical solution built not for offense… but for defense.

Not the kind you see on the battlefield.

The kind that quietly scans every single person walking into America’s most vulnerable locations — in under 2 seconds — and flags concealed threats no metal detector could ever detect.

Plastic explosives. 3D-printed ghost weapons. Powder-based agents. Non-metallic knives.

This is the next generation of threat detection.

Not built by a defense giant. Not funded by a Silicon Valley VC.

But developed by a small, under-the-radar AI company that’s already:

-

-

- Delivered systems to secure Los Alamos National Laboratory — one of the most tightly guarded facilities in the US1

- Earned third-party validation from the FAA-backed Safe Skies Alliance2

- Been deployed at US and international airports, courthouses, and correctional facilities.

- And just received a critical contract from the TSA to upgrade America’s aging body scanners for the first time in over a decade.3

-

It’s also raised over C$16 million since December 20244,5 — and appointed a former CIA officer and Palantir executive as President.

Even more impressive?

In joint testing with US agencies, military, and NATO partners, this company’s technology hit 90%+ detection rates—beating industry standards and proving it’s mission-ready.6

So, why is a company this advanced still trading at a market cap of just $11.8 million?

And what’s going to happen when investors finally connect the dots between its Pentagon-grade advisory board — which includes former national security officials and Lockheed Martin execs — and its breakthrough platform that’s already being delivered?

The answers could point to one of the most compelling AI-powered security investments in a long time…

And it all starts with a platform called HEXWAVETM.

That company is Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF).

With a market cap hovering near just $11.8 million, Liberty Defense may be one of the most overlooked physical security and AI surveillance stocks trading on the public markets today.

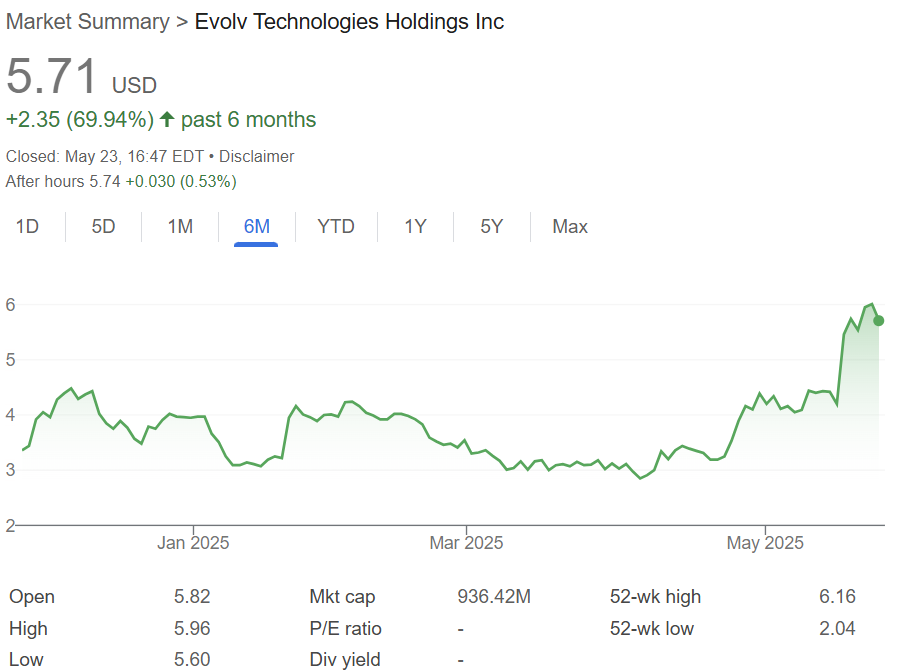

But if you’re familiar with Evolv Technologies (NASDAQ:EVLV) — the billion-dollar security scanner company whose tech is already being installed in US stadiums and transit systems — what you’ll see next might surprise you.

Because Liberty’s HEXWAVETM isn’t just competing in this space.

It’s outscanning it.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Why Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) May Leapfrog Evolv — at 1/60th the Valuation

When investors talk about AI-powered threat detection, one name dominates the conversation:

Evolv Technologies (NASDAQ:EVLV).

They’ve made headlines with stadium deployments, partnerships with sports franchises, and a surge in investor interest around AI security.

Their flagship product — Evolv Express — uses AI-assisted metal detection to screen people walking into public venues like Wrigley Field7 and Mercedes-Benz Stadium.8

As of May 2025, Evolv trades at a market cap of over $936 million.9

But here’s what most investors are missing…

Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) may offer a faster, more advanced, and government-backed alternative — using a completely different approach to threat detection.

And they’re doing it at a valuation of under $11.8 million.10,11

Let’s break it down:

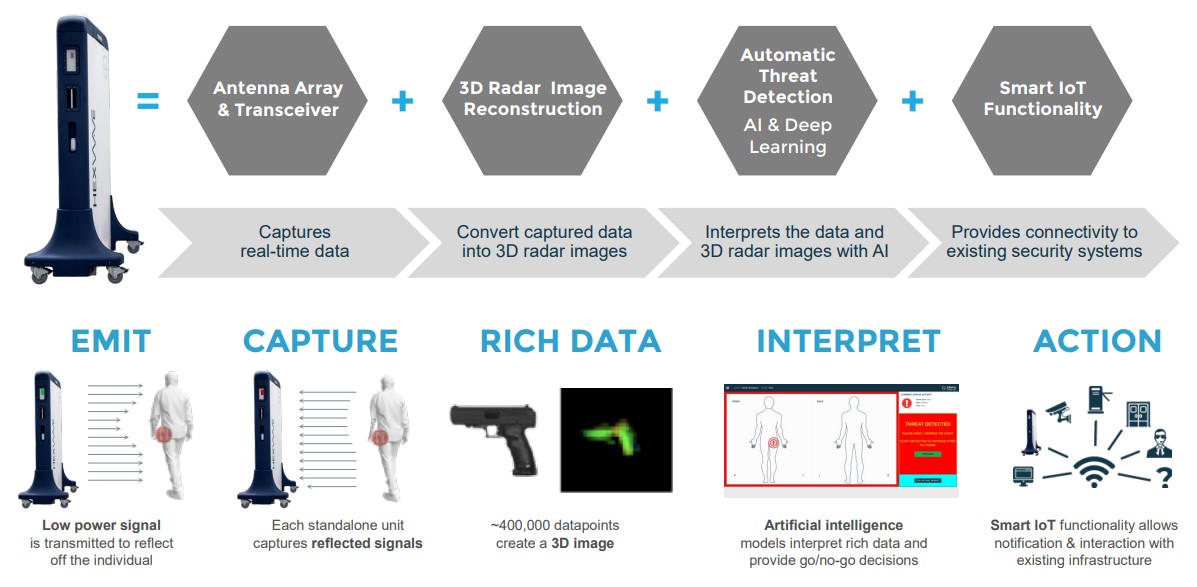

While Evolv uses passive sensors and magnetometers to detect metallic weapons, Liberty Defense’s HEXWAVETM system is built around active 3D radar imaging, millimeter-wave technology, and real-time AI classification — allowing it to detect non-metallic threats like plastic explosives, powder-based agents, and 3D-printed ghost weapons.12

Source: Libertydefense.com13

And Evolv’s limitations are well documented:

In a 2023 pilot program in the New York City subway system, Evolv’s scanners failed to detect a single actual firearm, while triggering numerous false positives.14

The company has since been subject to regulatory scrutiny and a class action lawsuit for allegedly overstating performance capabilities. 15

Meanwhile, Liberty Defense’s HEXWAVETM system completed third-party testing through a collaboration between US government agencies, US Military and NATO countries—achieving over 90% detection rates across 400 scans with individuals using more than 25 types of metallic and non-metallic concealed threats.16

And while Evolv markets itself as a commercial security solution, Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) is already delivering systems to high-security government institutions like Los Alamos National Laboratory (featured in the movie, Oppenheimer), which screens over 17,000 employees.17

On top of that, Liberty has formed strategic technical partnerships with some of the most respected institutions in science and national security — including MIT, Pacific Northwest National Laboratory, IsoTech, and Viken Detection.

These collaborations help refine HEXWAVE’s threat-detection capabilities and expand its readiness across diverse, real-world operating environments — from correctional facilities to critical infrastructure.

Even more compelling? Liberty has received $5.7 million in TSA funding to develop a second platform18 — the HD-AIT scanner — designed to upgrade the outdated “arms-up” machines currently installed in over 1,000 US airports.19

That system is already built and now being delivered to TSA for testing.20So while Evolv expands across sports venues and entertainment spaces, Liberty Defense quietly prepares for federal-level adoption and regulatory protection under the US DHS SAFETY Act.21

And now look at the valuation gap:

-

-

- Evolv Technologies (NASDAQ:EVLV): $936 million

Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF): $11.8 million

- Evolv Technologies (NASDAQ:EVLV): $936 million

-

That’s a 98.3% discount — for a company that’s more advanced in detection, has two integratable technologies broader in use cases, and further along in federal partnerships.

Press Releases

- Liberty Defense is Pleased to Announce that it has Received a Multi Unit HEXWAVE Order to Screen Aviation Workers for a growing US International Airport

- Liberty Defense Commences Normal Course Issuer Bid to Buy Back Up-to 9.9% of the Publically Traded Float

- Liberty to Participate in Lytham Partners Investor Conference

- Liberty Defense has Appointed The Honorable David Kris to its Newly Formed Strategic Advisory Board

- Liberty Defense Completes Third Party Testing with National Safe Skies Alliance for Aviation Security

Evolv Technologies vs. Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF)

| Feature | Evolv Technologies (NASDAQ:EVLV) |

Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) |

| Threat Detection | Metallic only (magnetometer + AI filtering) | Metallic & non-metallic (3D radar + AI) |

| Performance Issues | Missed real firearms in NYC subway test22 | >90% detection accuracy23 |

| Validation | Stadium partnerships, private clients | TSA, Capitol Police, Los Alamos, national labs |

| Use Case Focus | Public venues, entertainment | Government, infrastructure, courts, corrections |

| Regulatory Alignment | Subject to FTC and SEC scrutiny | Applied for DHS SAFETY Act protection |

| R&D Pipeline | Single product (Evolv Express) | HEXWAVETM + TSA-funded HD-AIT scanner |

| Recurring Revenue | Yes | Yes — AI updates + multi-year maintenance deals |

| Advisory/Leadership | Commercial tech executives | CIA, DOJ, Lockheed Martin, Palantir, Raytheon insiders |

| Market Cap (May 2025) | ~$936 million | ~$11.8 million |

Evolv may have opened the door to AI threat detection.

But Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) just walked through it — with better technology, stronger partners, and deeper government traction.

And it’s not just Evolv that Liberty is outperforming. Just look at how HEXWAVE stacks up to other competitors:

This isn’t just a catch-up story.

It’s a market realignment waiting to happen — and the market hasn’t priced it in yet.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The $1 Trillion Shift That Could Redefine Physical Security — And It Begins in April 2026

In April 2026, the Transportation Security Administration (TSA) will implement a sweeping mandate that’s been years in the making — and it could reshape the physical security landscape for decades.24

For the first time in US history, all airport employees — not just passengers — will be required to undergo daily physical screening. 25

The reason? Insider threats.

Thousands of workers access secure airport zones each day with little more than a background check and a swipe card.

But with rising concerns about internal smuggling, terrorism, and criminal infiltration, that old model is crumbling.

Now imagine the scale of that transformation:

-

-

- Over 500 US commercial airports26

- 100,000+ workers per day at major hubs alone

- Most locations will need multiple scanning units just to maintain operational flow

-

And Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) — through its HEXWAVETM platform — is already being used in this exact application.

In fact, Palm Springs International Airport recently selected HEXWAVETM specifically for employee screening as part of its TSA compliance strategy,27 joining Liberty’s growing roster of major airports like Rochester International, Toronto Pearson International,28 and Manchester-Boston Regional.

This is just the beginning.

Because HEXWAVETM doesn’t just detect traditional metal-based weapons… it detects non-metallic threats that metal detectors completely miss.

And while Evolv and other competitors may still be chasing limited-use applications, Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) is aligned with federal-level mandates that are about to drive explosive demand.

But that’s only part of the story.

The SAFETY Act Could Be Liberty’s Trojan Horse Into Stadiums, Airports, and Government Deals

Before any major airport, stadium, or public venue commits to a new security system, they ask one question first:

“Is your product SAFETY Act certified?”

The SAFETY Act (Support Anti-terrorism by Fostering Effective Technologies) is a federal law created after 9/11 to protect venues and suppliers from liability in the event of a terrorist attack. 29

Without SAFETY Act coverage, many agencies won’t even consider new screening systems.

That’s why Liberty Defense’s (TSXV:SCAN) (OTCQB:LDDFF) March 2025 announcement was such a big deal:

The company has now officially applied for SAFETY Act designation, and is undergoing a 6-month certification process — supported by strategic partner Aluma.30

Once approved, HEXWAVETM will become one of the only next-gen, AI-powered security platforms eligible for deployment across US federal, state, and municipal venues with full terrorism liability protection.

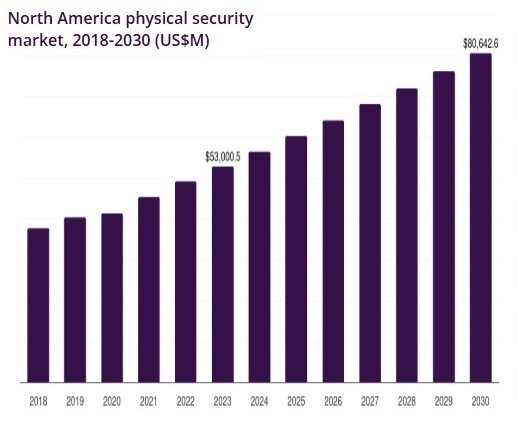

Physical Security Is Quietly Becoming a $80 Billion Juggernaut

While investors chase chipmakers and GLP-1 weight-loss stocks, one of the biggest industrial transformations is happening almost entirely under the radar:

The global physical security market.

According to Grand View Research, the North American physical security screening market is projected to grow from $56.5 billion in 2024 to over $80.6 billion by 2030, a 6% CAGR.31

And here’s what makes this so powerful:

Most of the growth isn’t from more metal detectors.

It’s from non-metallic detection, AI analytics, and federally mandated upgrades across infrastructure, aviation, corrections, and public venues.

That’s Liberty Defense’s (TSXV:SCAN) (OTCQB:LDDFF) home field.

And with its second TSA-funded product — the HD-AIT body scanner upgrade kit — now being delivered for evaluation,32 the company could soon hold a two-platform stronghold on both airport and facility security globally.

The HD-AIT unit could soon replace 1,000+ existing scanners in the US alone — meaning the company is looking at a significant federal revenue stream.

In a market this size… a $11.8 million market cap doesn’t just look small.

It looks like a mispricing — especially considering they’ve also raised over $16 million in the past 6 months alone.

And with daily employee screening becoming a legal requirement, terrorism-related liability shifting under the SAFETY Act, and new technology outpacing old scanners by a mile…

Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) could be the most important physical security stock Wall Street hasn’t woken up to yet.

8 Reasons

This AI Security Story Could Be One of the Most Undervalued Breakout Setups of the Year

1

Backed by the US Government: Liberty Defense Holdings Ltd.’s (TSXV:SCAN) (OTCQB:LDDFF) two flagship technologies — HEXWAVETM and HD-AIT — are being deployed, developed and tested in partnership with federal agencies, including the TSA, Capitol Police, and Los Alamos National Laboratory

2

Massive Mandate Tailwind: By April 2026, the TSA will require daily physical screening for all airport employees in the US — a mandate affecting 500+ airports and creating immediate demand for next-gen security platforms.

3

Proven Tech in Real-World Testing: In joint trials with US government agencies, military, and NATO partners, HEXWAVETM demonstrated over 90% detection rates across both metallic and non-metallic threats—outperforming industry benchmarks and confirming its readiness for high-security environments.33

4

Validated by Independent 3rd Parties: HEXWAVETM was successfully evaluated by the FAA-funded National Safe Skies Alliance at a major US airport, confirming its effectiveness at detecting both metallic and non-metallic threats34

5

Positioned for SAFETY Act Certification: The company is undergoing the US Department of Homeland Security’s SAFETY Act application process — a critical insurance-style liability shield that most venues require before adopting new counterterrorism technologies35

6

Led by National Security Heavyweights: Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) has attracted top-tier insiders from Palantir, CIA, DOJ, and Lockheed Martin — including Bryan Cunningham (Palantir’s former counsel)36 and David Kris (Former US Assistant Attorney General for National Security)37

7

Undervalued vs. Billion-Dollar Peers: Despite broader capabilities and deeper government traction, Liberty trades at a fraction of the valuation of Evolv Technologies (NASDAQ:EVLV) — currently valued at over $936 million, while Liberty Defense sits under $11.8 million.

8

Two Revenue Engines with Recurring Potential: With sales already booked for HEXWAVETM,38 and HD-AIT now rolling into production, Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) is building dual product lines, both with hardware + recurring software + maintenance revenue models — a structure designed for long-term cash flow.

The Contracts Are Signed. The Rollout Has Already Begun.

When investors hear “micro-cap,” they usually assume it means pre-revenue.

But that’s not the case here.

While most security tech stories on the public markets are still stuck in testing mode, Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) is already shipping units, installing systems, and securing deals with some of the most tightly guarded institutions in North America.

It started with one of the most secure federal research sites in the country.

In 2023, Liberty delivered multiple HEXWAVE units to Los Alamos National Laboratory, where the technology now helps screen thousands of employees daily.39

Then came aviation.

With the TSA’s 2026 mandate looming — requiring every US airport to implement daily employee screening — Palm Springs International Airport selected HEXWAVE for its internal security gates.40

Momentum continued into early 2025, when Liberty shipped nine additional HEXWAVE units to a mix of US courthouses, municipal sites, and direct channel partners.41

It was proof that HEXWAVE was moving from prototype to production — and being trusted by agencies that don’t gamble on unproven technology.

But what’s happening internationally may be even more significant.

In January 2025, a key US ally in the Middle East, working alongside a US military technical agency, selected Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) for a live HEXWAVE demonstration at multiple high-security facilities. 42

The intent: evaluating the system for border and government infrastructure deployment.

The trial was positioned as part of a broader $50 million procurement evaluation — with US military advisory backing. 43

And that’s before factoring in the company’s second platform — HD-AIT, funded with $5.7 million from the TSA, which is now being assembled and delivered for testing.

HEXWAVE is already operational inside jails, airports, courthouses, and international high-security sites.

Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) has real contracts. Real deliveries. And a pipeline that looks more like a mid-cap than a micro-cap.

The Chart Is Setting Up a Classic Technical Reversal — And Almost No One’s Watching

While most investors are watching headlines… sharp traders are watching the tape.

And right now, Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) is quietly building what could be a breakout moment in the making.

The pattern?

A descending wedge — one of the most reliable reversal formations in technical analysis.

The structure has been building since late 2024:

-

-

- Lower highs as sellers step down aggressively

- Flat support around C$0.32–$0.33, showing clear buying interest

- Tightening price range, with volatility compressing into an apex

-

In plain English: the stock is coiling.

And when these coils snap, they don’t fizzle — they potentially move fast.

As of May 23, 2025, Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) is trading at $0.35 — the very bottom of its 52-week range.

But despite a more than 75% drop year-to-date, the volume profile is telling a different story.

Accumulation is happening under the surface.

Why This Technical Setup Could Be a Potential Launchpad

Here’s what adds fuel to the coil:

-

-

- Only ~51.6 million shares outstanding — with a float likely far tighter

- Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) just closed C$16 million in new capital since December 2024, giving it breathing room for growth

- MACD and RSI show deeply oversold conditions — but bullish divergence is starting to form44

-

Even the moving averages — which still flash red across 20-day, 50-day, and 100-day timeframes — are showing signs of flattening.

This kind of setup often precedes a re-rating… especially when a news catalyst is pending.

And that’s exactly what could happen next.

Because this isn’t a biotech waiting for FDA approval.

This is a government-backed AI tech company…

…that’s already secured TSA contracts, delivered to Los Alamos National Lab, completed FAA-funded Safe Skies testing, and is now shipping product.

Tight Chart. Tight Float. Fat Tail.

With the stock compressing near $0.24 — and news flow expected in the coming weeks — Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) may be approaching a classic pivot.

It has:

-

-

- A tight trading range

- A rising institutional base

- A $16M war chest

- And a clear roadmap of federal and global demand

-

That’s the kind of setup traders wait months for.

If volume steps in and Liberty Defense (TSXV:SCAN) pushes above the C$0.35–0.38 range with authority?

The coil could snap.

And the story shifts from undiscovered to undervalued breakout.

Bottom line: This isn’t just a stock with a setup.

It’s a government-backed AI story trading like no one’s paying attention.

That doesn’t last long.

The Most Overqualified Team in Security Tech? This Micro-Cap Might Have It.

In small-cap investing, leadership often makes or breaks the story.

Sometimes, it’s a former consultant with a PowerPoint. Other times, it’s a real operator with a billion-dollar exit.

But rarely — almost never — do you get this.

Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) isn’t run by junior engineers or career execs with padded resumes.

It’s led by people who’ve built and sold national security systems… advised presidents… and held top posts inside US intelligence.

That’s not speculation. It’s on the public record.

Here’s who’s behind Liberty Defense (TSXV:SCAN) (OTCQB:LDDFF) — and why that matters more than ever right now.

But That’s Just the Start. The Bench Runs Deep.

The Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) strategic advisory board reads like a national security summit:

-

-

- David S. Kris — Former US Assistant Attorney General for National Security, appointed under President Obama. He was the DOJ’s top national security lawyer and a legal architect of modern surveillance reform. He joined Liberty’s advisory board in May 2025.49

- Mary Beth Long — First woman confirmed by the US Senate as Assistant Secretary of Defense. She chaired NATO’s High-Level Group on Nuclear Policy and advised multiple presidents on international threat containment. She joined Liberty’s advisory team in April 2025.50

- James M. Byrne — Former Deputy Secretary of the US Department of Veterans Affairs, Byrne currently serves as Vice President of Ethics & Business Conduct at Lockheed Martin. A US Marine Corps veteran and former Associate General Counsel at Lockheed Martin, Byrne brings deep expertise in federal operations, ethics, and national security oversight.51

- Linda Jacksta — A 35-year veteran of US Customs and Border Protection, Jacksta is a recognized national expert in transportation and perimeter security, and a recipient of the Presidential Rank Award.52

-

In a market this size — and with mandates as sweeping as the TSA’s 2026 employee screening rule — having Washington on your side isn’t optional. It’s everything.

Liberty Defense Holdings (TSXV:SCAN) (OTCQB:LDDFF) doesn’t just have a product.

It has a war room.

Final Takeaway: The Market Isn’t Watching. But It Should Be.

Strip away the noise — the defense jargon, the government acronyms, the industry buzzwords — and what you’re left with is a story that’s hard to ignore.

Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) isn’t a concept. It’s a company with:

-

-

- Real contracts already signed — with correctional systems, airports, and courthouses

- A technology platform validated by National Safe Skies Alliance (Safe Skies), tested against billion-dollar peers, and proven to detect threats they missed

- A second TSA-funded platform (HD-AIT) in final build stage, targeting a federal upgrade cycle that could touch over 1,000 scanners

- Government alignment through the SAFETY Act and a leadership bench that includes CIA officers, DOJ lawyers, and senior executives from Lockheed Martin and Palantir

- Two active revenue streams, a growing backlog, and international demand already underway

- And all of this trading at a valuation below CA$20 million

-

This is what asymmetry looks like.

It’s a small company.

With a big mandate.

And a product portfolio already inside the gates of US airports, jails, labs, and government offices.

Compare that to Evolv Technologies (NASDAQ:EVLV) — trading at nearly $1 billion, with narrower tech, heavier competition, and no direct TSA contract.

Liberty Defense is being priced like a pre-commercial AI startup.

But it’s operating like a public-sector rollout that’s already begun.

The chart is coiling. The mandate is coming. The contracts are already booked.

And the next leg of this story won’t be told in quiet press releases — it’ll be told in order flow, media attention, and a re-rating the market hasn’t priced in.

Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) is a name worth watching.

Closely.

Because stories like this don’t stay quiet forever.

Sign up below to:

-

-

- Get immediate access to the Liberty Defense corporate deck

- Receive weekly trade ideas from our analyst desk, including AI, biotech, and deep-value small caps

- Stay ahead of market-moving catalysts with early alerts, chart setups, and institutional watchlist moves

-

We only send you the best ideas — the ones we believe have the tightest setups, the biggest disconnects, and the most asymmetric upside.

No fluff. No junk. Just the trades we’re watching right now.

This is one of them.

📥 Sign up now to get the Liberty Defense Holdings Ltd. (TSXV:SCAN) (OTCQB:LDDFF) presentation — and never miss the next breakout.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

*All figures in USD unless otherwise stated.

Bill FrainCEO & Director

Bill FrainCEO & Director Bryan CunninghamPresident

Bryan CunninghamPresident Jeffrey GordonVP of Engineering

Jeffrey GordonVP of Engineering Jason BurinescuExecutive Chairman

Jason BurinescuExecutive Chairman