Picture this: You’re sitting at a high-stakes poker table.

The pot is massive.

And you’ve got a royal flush in your hands.

That’s exactly the feeling you’ll get discovering High Roller Technologies Inc. (NYSEAMERICAN:ROLR)—an overlooked rising star in the $210 billion iGaming industry.

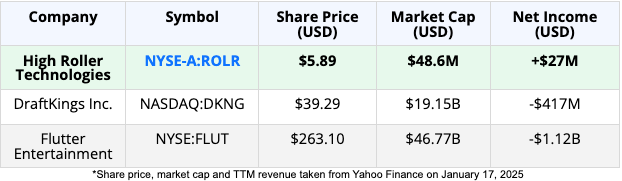

Industry giants like DraftKings and Flutter Entertainment may command multi-billion-dollar market caps, but behind the scenes they’re burning through mountains of cash.

DraftKings reported a net loss of $417 million and a negative EBITDA of $222million in the past year.1

Flutter Entertainment, the world’s leading online sports bettering and iGaming operator, posted a staggering net loss of $1.12 billion over the same period.2

Meanwhile, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) is playing a completely different game—and winning.

High Roller achieved profitability in Q3 2024, all while expanding at a blistering 60% year-over-year growth rate.3

What’s even more impressive is High Roller Technologies Inc. (NYSEAMERICAN:ROLR) is generating 213% returns on marketing dollars—an astonishing figure that positions this revenue powerhouse leagues above its peers.

This is no pie-in-the-sky startup; it’s a lean, efficient machine focused on premium casino players—the big spenders who stick around and drive margins higher.

And with a player retention rate double the industry average, you begin to see why insiders are betting big.

It’s really no surprise that this company was the recipient of the Best Player Retention 2024 at the SiGMA Europe B2C Awards.4

And now, they’re raising the stakes.

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) just secured a strategic foothold in the $12 billion Latin American iGaming market, where growth is projected to quadruple by 2027.

And while competitors are playing catch-up, High Roller’s proprietary AI-powered CMS platform is setting new benchmarks in scalability and efficiency, directly enhancing user experiences and profitability.

The best part? This stock is still flying under the radar—but not for long.

Top 8 Reasons

to Consider High Roller Technologies (NYSEAMERICAN:ROLR)

1

Unmatched Player Retention: High Roller achieves a 20% player retention rate—double the industry average. In a world where loyalty is rare, this company sets the gold standard.

2

Explosive Growth Trajectory: A 60% revenue surge in 2023 and its first profitable quarter in Q3 2024 put High Roller light-years ahead of competitors still chasing profitability.5

3

Proprietary Technology Platform: At the core of High Roller’s success is its advanced, AI-driven CMS, powering over 4,400 games from 70+ leading providers. With seamless scalability, faster load times, and enhanced SEO, this isn’t just technology—it’s a competitive advantage.6

4

Strategic Partnerships: High Roller Technologies Inc. (NYSEAMERICAN:ROLR) The company’s deals with top-tier firms have unlocked access to massive opportunities, including the $12 billion Latin American market. High Roller’s strategic entry here is set to fuel its next growth phase.7

5

Experienced Leadership: With a team boasting over 100 years of iGaming expertise, including a former Nasdaq vice chairman, High Roller’s leadership isn’t just seasoned—they’re battle-tested and laser-focused on execution.

6

Booming Market Opportunity: As the global iGaming market expands from $135 billion to $210 billion by 2027, High Roller’s premium brand strategy positions it to capture substantial market share.8

7

Efficient Revenue Model: High Roller Technologies (NYSEAMERICAN:ROLR) generates 213% returns on every marketing dollar spent,9 outpacing competitors in efficiency.

8

Insider Confidence and Strong Financials: High insider ownership reflects faith in the company’s trajectory.

While industry behemoths burn through cash chasing sports bettors, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) is laser-focused on high-margin VIP casino players—a segment with unparalleled loyalty and profitability.

By combining cutting-edge technology, strategic partnerships, and operational efficiency, High Roller’s lean and efficient model generates superior results.

This isn’t just a smarter approach—it’s a game-changer.

Now, let’s take a closer look at how High Roller Technologies Inc. (NYSEAMERICAN:ROLR) stacks up against its peers.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Crushing the Competition: Why High Roller Technologies Inc. (NYSEAMERICAN:ROLR) Stands Out

Picture this: David versus not one, but three Goliaths. And David’s winning.

While the gambling giants burn through mountains of cash-chasing sports bettors, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) has found the sweet spot – the premium casino player who spends more and stays longer.

Let’s look at how this nimble operator stacks up against the industry titans:

While DraftKings and Flutter struggle to climb out of the red, High Roller is already reaping the rewards of its efficient, high-margin business model.

While DraftKings struggles to achieve consistent profitability in its sports betting segment ($58.5 million Adjusted EBITDA loss in Q3 2024),10 High Roller Technologies just delivered positive EBITDA—a rare achievement in the iGaming sector.

On top of that, High Roller generates $2.13 in revenue for every $1 spent on marketing,11 far outpacing DraftKings’ heavy spending to acquire and retain customers. That’s not just better – it’s a completely different league.

Premium Player Focus

Flutter Entertainment chases every player with a pulse. High Roller Technologies Inc. (NYSEAMERICAN:ROLR) targets the whales – the high-value players who demand the best and aren’t afraid to pay for it. These players stick around twice as long as the industry average.

Insider Confidence

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) management and insiders own over 70% of the company, a testament to their unwavering belief in the company’s long-term success. In contrast, DraftKings12 and Flutter13 insiders have been actively selling shares, raising questions about their confidence in future growth. When the people running the show bet big on themselves, smart investors pay attention.

Technology Edge

Unlike competitors relying on off-the-shelf solutions, High Roller Technologies operates a proprietary AI-powered Content Management System (CMS) that automates essential operations, enhances user engagement, and ensures seamless scalability.

This AI-driven technology isn’t just a backend upgrade—it actively improves player experience, reduces churn, and maximizes lifetime value. It’s a key differentiator in a crowded market, where customer experience directly drives revenue growth.

Undervalued Potential

Despite its superior player retention, profitability, and AI-driven technology, High Roller Technologies boasts a modest market cap of just $48.6 million—a fraction of DraftKings or Flutter Entertainment.

Of course, this valuation gap may not last long. With its efficient revenue model and strategic market expansion, High Roller is poised to rewrite the rules of iGaming.

In an industry where giants like DraftKings are still chasing profitability, High Roller Technologies is already there.

Investors looking for a smarter, more efficient path to iGaming growth should be paying close attention.

Press Releases

- High Roller Technologies Earns Four Nominations at the International Gaming Awards

- High Roller Technologies Enters Strategic Partnership with iConvert to Focus on Player Acquisition

- Top 5 Online Gambling Stocks to Watch in 2025: Tapping into the $150 Billion iGaming Opportunity

- Turning $1 into $2.13: The Hidden iGaming Giant Wall Street Overlooked

- High Roller Technologies Wins Double Honors at the 2024 WN iGaming Summit

A Revenue Model Built for Growth

The beating heart of High Roller Technologies Inc. (NYSEAMERICAN:ROLR) isn’t just another online casino – it’s a highly sophisticated platform built for scalability, efficiency, and sustained profitability

This model is designed to not only capture market share but to redefine industry benchmarks through a combination of cutting-edge technology and strategic market focus.

Proprietary AI-Driven Content Management Platform

High Roller’s foundation is built on a proprietary AI-powered Content Management System (CMS) that automates essential operations, enhances user engagement, and ensures seamless scalability.

Key features include:

-

-

- Real-time targeted promotions and bonuses tailored to individual player behavior to enhance user engagement and retention.

- Operational automation across risk management, fraud prevention, and payment processing.

- Multi-platform optimization across mobile, desktop, and tablet devices.

- Seamless scalability without a linear increase in operational costs.

- Optimized player experiences across mobile, desktop, and tablet platforms, ensuring every user interaction is smooth and responsive

-

By integrating advanced analytics and direct API connections, the platform reduces processing times and amplifies search engine visibility, drawing in high-value players while maintaining operational agility.

Premium Game Portfolio

With 4,400+ games from 70+ providers, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) offers:

-

-

- Top-tier content providers, including Evolution, Pragmatic Play, NetEnt, Red Tiger, and more.

- Strong partnerships with trusted suppliers, ensuring a consistent flow of high-quality content.

- Cross-platform accessibility, delivering seamless experiences on desktop, mobile, and tablet devices.

-

These partnerships allow High Roller to maintain a competitive edge in the online gaming space while offering a superior player experience.

Impressive Player Metrics

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) has demonstrated significant year-over-year growth across key performance indicators, highlighting the effectiveness of its revenue model:

-

-

- Active Users: 51,400 (+77% YoY)

- Average Deposit Per User: $1,500 (+24% YoY)

- Average Revenue Per User (ARPU): $575 (+11% YoY)

- Total Bets: $714 million (+79% YoY)

- Customer Deposits: $74.7 million (+114% YoY)

-

These results are driven by effective marketing strategies, personalized engagement efforts, and a dedicated VIP management team.

Seizing Latin America’s Booming $12 Billion Market

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) is strategically advancing into Latin America, one of the most exciting and rapidly growing regions in the global iGaming industry. With a tailored approach and a technology-driven foundation, the company is poised to capture a significant share of this booming market, which is projected to reach $12 billion in gross gaming revenue by 2028.14

Fruta: The Gateway to Latin America

In December 2023, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) successfully launched Fruta, its second active iCasino brand, specifically designed to cater to Spanish-speaking players.15

Leveraging localized engagement strategies and established marketing channels, Fruta is set to become a recognizable name in the region, offering a seamless and engaging gaming experience.

Timing Couldn’t Be Better

The global iGaming market, valued at $135 billion in 2023, is projected to reach a staggering $210 billion by 2027.16 Latin America’s regulated market is a major driver of this growth, offering immense opportunities for early movers like High Roller Technologies.

But High Roller Technologies Inc. (NYSEAMERICAN:ROLR) isn’t just riding the wave—they’re actively engineering success.

By focusing on high-value players and leveraging their proprietary AI-powered CMS platform, the company captures more revenue per player while keeping acquisition costs lower.

Expansion Fueled by Smart Investments

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) plans to strategically allocate proceeds from its $10 million IPO into:17

-

-

- Accelerating market entry initiatives in Latin America and other key regions.

- Enhancing its AI-driven technology platform to optimize scalability and player experiences.

- Driving player acquisition campaigns tailored to regional markets.

-

This isn’t just another iGaming company—it’s a technology-powered profit engine with a focus on sustainability, scalability, and long-term success.

By combining exceptional player retention, data-driven decision-making, and a laser focus on high-value customers, High Roller Technologies is setting a new standard in how iGaming operators approach emerging markets.

The Latin American market isn’t just an expansion strategy—it’s a catalyst for exponential growth. High Roller Technologies is ready, the infrastructure is in place, and the market is ripe for disruption.

The question isn’t whether they’ll succeed—it’s how far they’ll go.

Stock Highlights & Technical Analysis

Smart investors know the best opportunities often come when insiders are buying heavily – especially near IPO prices. That’s exactly what’s happening at High Roller Technologies Inc. (NYSEAMERICAN:ROLR).

Just look at the recent insider purchases: CEO Ben Clemes scooped up 4,000 shares at $6.48, while CFO Matthew Teinert grabbed 2,000 shares at $6.34. Multiple directors even bought at the $8.00 IPO price.18 When management puts their own money on the line, it’s time to pay attention.

Why This Stock Structure Matters

Here’s what makes this opportunity special: with only 8.2 million shares outstanding and a tiny public float of 1.48 million shares, positive news could send this stock soaring. The majority of shares are locked up tight – insiders and major institutions hold over 70% of the company.

Think about that for a moment. When a company with strong insider ownership, proven revenue growth, and multiple near-term catalysts has such a small trading float, the upside potential can be explosive.

The Technical Setup

Currently trading at $4.17, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) has a market cap of just over $34 million. The RSI of 32.91 suggests oversold conditions – exactly when smart investors start paying attention.

What’s particularly interesting is the minimal short interest of just 1.33% of the float.19 This means there’s little downward pressure from short sellers, and any positive news could trigger significant upward movement.

A Rare Opportunity

Consider these key factors:

-

-

- Management and insiders own over 70% of the company20

- The public float is tiny at 1.48 million shares21

- Insiders are buying at higher prices

- Technical indicators suggest oversold conditions

-

This combination of factors – tight share structure, strong insider ownership, recent insider buying, and oversold technical indicators – creates a compelling setup for potential price appreciation as High Roller Technologies executes its growth strategy.

With multiple catalysts on the horizon, including expansions into new markets, this could be the perfect time to add High Roller Technologies Inc. (NYSEAMERICAN:ROLR) to your watchlist.

Remember, stocks with this type of share structure can potentially move quickly when positive news hits. The time to pay attention is before these catalysts materialize.

The Dream Team Behind the Next Gaming Revolution

Key Directors

This experienced leadership team collectively brings over 90 years of iGaming industry experience, with significant skin in the game through substantial share ownership. Their combined expertise spans technology development, operational efficiency, financial management, and strategic growth in regulated markets.30

8 Compelling Reasons

to Watch High Roller Technologies Inc. (NYSEAMERICAN:ROLR)

1

The Money-Making Machine: Every marketing dollar generates $2.13 in revenue – a level of efficiency that puts competitors to shame. While others burn cash chasing sports betting market share, High Roller’s focus on premium casino players delivers superior margins.31

2

Explosive Growth Trajectory: Revenue grew an impressive 60% in 2023,32 with Q3 2024 marking their first profitable quarter. This isn’t just growth – it’s sustainable, profitable expansion.

3

Proprietary Technology Platform: High Roller’s AI-driven Content Management System (CMS) supports over 4,400 games from 70+ providers, ensuring enhanced scalability, optimized search engine visibility, and seamless multi-platform performance

4

Strategic Expansion: Strategic alliances, including the launch of Fruta.com targeting Latin America, are accelerating market access and expansion

5

Experienced Leadership: Led by a team with 90+ years of combined iGaming experience, including proven leaders with extensive backgrounds in operations, finance, and technology

6

Massive Market Opportunity: The global iGaming market is expanding from $135 billion to $210 billion by 2027. High Roller Techologies Inc. (NYSEAMERICAN:ROLR) is perfectly positioned to capture this growth with its premium brand strategy.33

7

Efficient Revenue Model: High Roller generates approximately $2.13 in revenue for every $1 spent on marketing, significantly outpacing industry averages and reflecting highly efficient capital deployment

8

Tight Share Structure: With only 8.2 million shares outstanding and over 70% held by insiders and institutions, positive news could send High Roller Techologies Inc. (NYSEAMERICAN:ROLR) stock soaring.

Final Thoughts: A Rare Ground-Floor Opportunity

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) isn’t just another gaming company – it’s a precision-engineered profit machine targeting the most lucrative segment of a booming market.

While competitors burn cash chasing sports bettors, High Roller has cracked the code on profitable growth in the premium casino space.

The numbers tell the story: 60% revenue growth, 20% player retention, and $2.13 generated for every marketing dollar spent.34

This isn’t hope and hype – it’s proven execution.

With major catalysts on the horizon in 2025, a tight share structure where insiders own over 43%, and a market cap of just $35 million, High Roller Technologies Inc. (NYSEAMERICAN:ROLR) presents a rare opportunity to get in early on what could become a dominant player in the $210 billion iGaming market.35

Consider this: The company’s current valuation represents just 0.02% of their total addressable market.

As they execute their expansion plans and continue delivering superior unit economics, that gap between market opportunity and valuation could close rapidly.

Smart investors know the best opportunities come when proven execution meets massive market potential.

High Roller Technologies Inc. (NYSEAMERICAN:ROLR) checks both boxes, making it a compelling watch for anyone seeking exposure to the explosive growth of premium online gaming.

Remember, stocks with this type of share structure can move quickly when positive news hits. The time to pay attention is before these catalysts materialize.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers