While Wall Street chases AI and gold makes headlines… silver is quietly setting up for one of its biggest breakouts in decades.

Not someday. Not “maybe.” Right now.

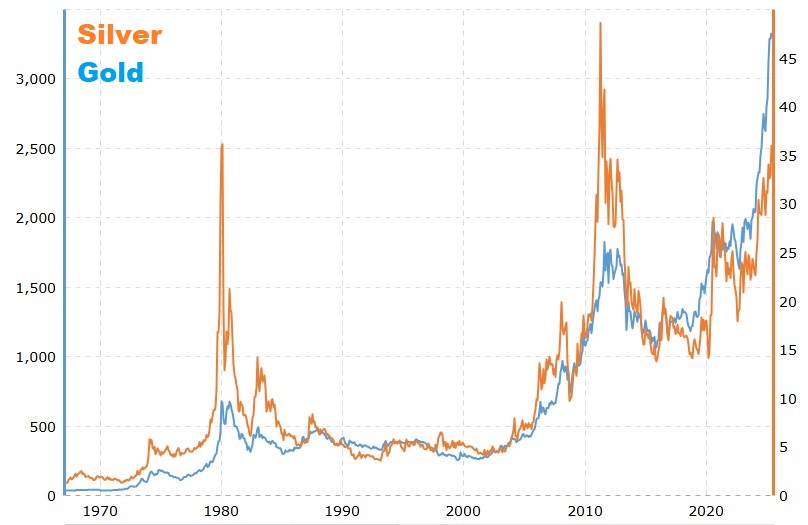

And history shows what happens next:

- In the late ‘70s, silver slingshotted past gold.

- In 2011, silver ran from $18 to nearly $50 — a 175% surge — while gold climbed just 70%.

- In 2020, the pattern repeated again… and it’s now playing out once more in 2025.

The setup? It’s in the numbers.

The gold-to-silver ratio — a key market signal — is hovering near 98:1,1 far above the historical average of 60:1.2

And when that ratio snaps back?

Silver doesn’t just rise. It explodes.

And this time, there’s one company uniquely positioned to ride the wave.

Not a conglomerate mining silver as a byproduct.

Not a pre-production story still years away from cash flow.

But a full-throttle, pure-play silver miner already producing over 30 million silver-equivalent ounces per year3 — with margin upside, institutional leverage, and a fresh acquisition that just changed the game.4

And right on cue, a new catalyst just hit the market — one that could send silver into overdrive.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Trump’s Tariffs Just Lit the Fuse

On April 2nd, President Trump declared “Liberation Day”5 — slapping sweeping tariffs on global imports, with higher rates aimed at China, Mexico, and Europe.

Markets jolted. Commodities ripped. And silver jumped over 5% in 48 hours.

Why? Because silver isn’t just a precious metal anymore — it’s critical infrastructure.6

From EVs and solar to AI chips and 5G, silver powers the sectors America now wants to bring home.

And tariffs just poured gasoline on that reshoring fire.

That’s why demand is spiking. That’s why supply is under pressure.

And that’s why companies already producing — like First Majestic Silver (NYSE:AG) (TSX:AG) — are now in a class of their own.

While others scramble to adjust, they’re already scaling.

Press Releases

- First Majestic Announces Positive Exploration Results at San Dimas

- First Majestic Announces Record Financial Results for Q2 2025 and Quarterly Dividend Payment

- First Majestic Second Quarter 2025 Results Conference Call Details

- First Majestic Produces 7.9 Million AgEq Ounces in Q2 2025 Consisting of 3.7 Million Silver Ounces and 33,865 Gold Ounces; Announces Improved 2025 Production and Cost Guidance and Conference Call Details

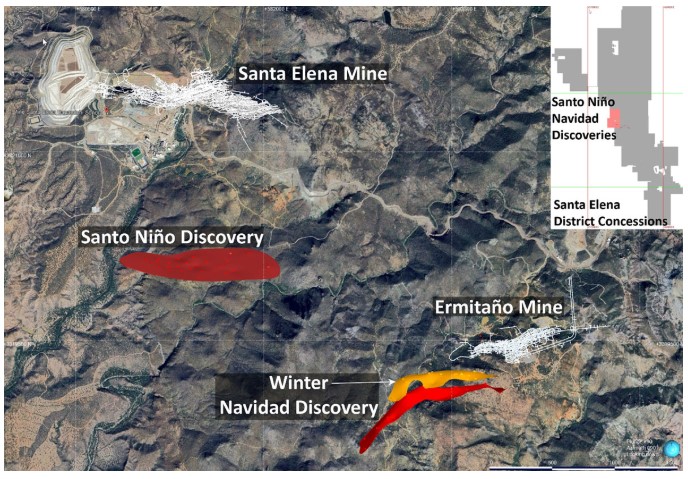

- First Majestic Announces Second Gold-Silver Discovery Within a Year at Santa Elena and Expands High-Grade Mineralization at Navidad

Silver’s Surge Is Just Beginning — And One Miner’s Already Ahead

This isn’t just another precious metals trade.

Silver isn’t only a monetary metal anymore — it’s infrastructure for the AI age.

It’s used in nearly every high-growth sector governments and markets are betting on:

- Electric vehicles use up to 50 grams per unit7

- Solar panels require silver in every single photovoltaic cell8

- AI chips — the kind powering Nvidia’s $3T empire — rely on silver to stay cool and conduct energy with precision9

- 5G infrastructure, robotics, smart grids, data centers — all demand silver at scale

It’s the metal of electrification. Of digital acceleration. Of energy transition.

That’s why silver demand hit a record high in 2024 — and 2025 is already tracking to surpass it.

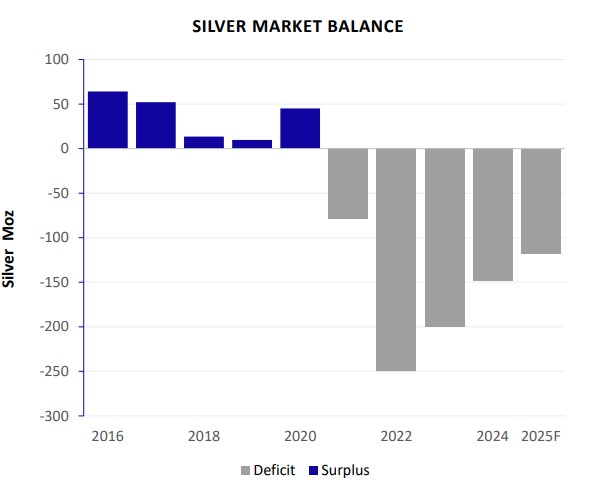

But here’s the rub: production hasn’t followed.

Global silver mine supply peaked in 2016.10 It’s been trending down ever since.

Grades are falling. Capital costs are rising. And the permitting timelines? Brutal — up to a decade in many jurisdictions.

Recycling can’t close the gap. Stockpiles are shrinking.

And in 2024, the world faced a 150-million-ounce deficit — the second-largest shortfall ever recorded.

This is a slow-motion squeeze — and when price finally responds, it won’t be gradual.

That’s why positioning now matters. And First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is already there.

While other miners are scaling back or stuck in permitting, AG is expanding — fast.

- In Q1 2025, they delivered an impressive 7.7 million silver-equivalent ounces

- They’re on track for 30–32 million AgEq ounces this year

- That’s not a 5-year target. That’s happening now

And they’re not stopping. With a strategic acquisition that just supercharged their production base, AG has pulled ahead of the pack — right as the macro pressure builds.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The Deal That Changed Everything — Cerro Los Gatos

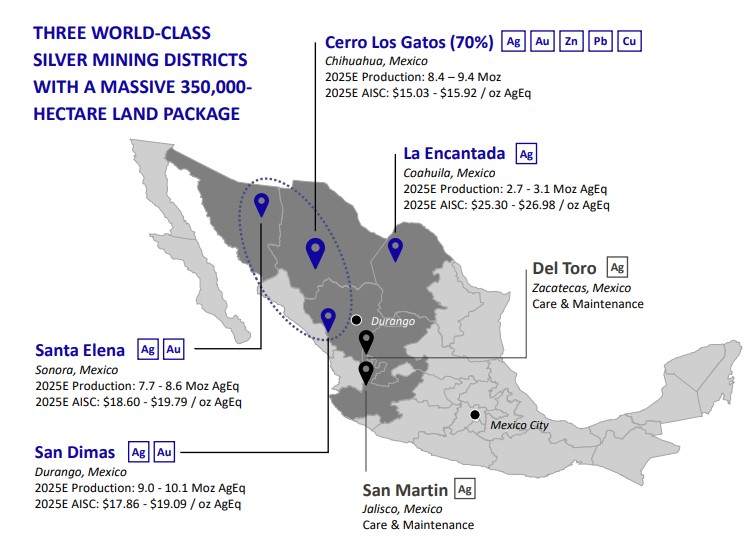

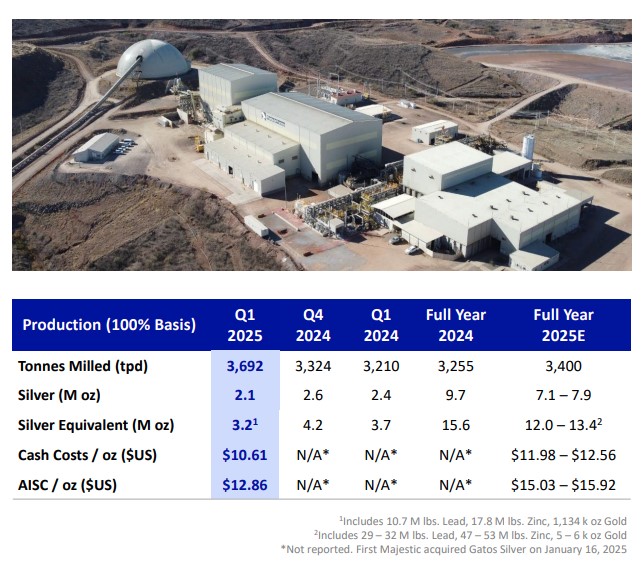

In January 2025, First Majestic Silver (NYSE:AG) (TSX:AG) completed a $970 million all-stock acquisition of Gatos Silver — locking in 70% ownership of Cerro Los Gatos, one of the highest-grade, lowest-cost silver producers in Mexico.11

This wasn’t a development-stage bet. Cerro Los Gatos is already producing:

- 15.6 million silver-equivalent ounces in 2024

- 9.7 million ounces of pure silver

- At all-in sustaining costs expected to be $15.03-$15.92/oz in 2025

Better yet, the mine sits within a massive 103,000-hectare land package — with 14 known mineralized zones and exploration upside for years.12

No royalties. No streams. Just scale, margin, and torque — 70% owned and fully operated by First Majestic Silver (NYSE:AG) (TSX:AG).

In a market starved for new supply, this acquisition didn’t just add ounces…

It added leverage.

Santa Elena: From Mine to Emerging District

Size matters. But in a market like this, efficiency and margin matter more.

And that’s where First Majestic Silver Corp. (NYSE:AG) (TSX:AG) pulls ahead.

In addition to Cerro Los Gatos, the company operates three additional producing mines in Mexico — each uniquely optimized to maximize output, recovery, and profitability.

While Cerro Los Gatos brought scale, Santa Elena brings depth.

What began as a single open-pit mine has evolved into a multi-deposit silver-gold district with 102,000 hectares of prospective ground — most of which remains unexplored.

And in just the past 12 months, First Majestic has proven just how much this district could deliver.

In July 2024, the company announced the Navidad discovery — the first major find in the district since Ermitaño — with a maiden resource of 30 million AgEq ounces. That number is expected to grow meaningfully with ongoing drilling in 2025.

In May 2025, First Majestic (NYSE:AG) (TSX:AG) followed with a fourth discovery: the Santo Niño vein, located just 900 meters from the mill. Early results show broad, high-grade mineralization across more than a kilometer of strike, and — like Navidad — it could be processed using existing infrastructure.13

Early drill results at Santo Niño show broad, high-grade mineralization across more than one kilometer of strike. Like Navidad, it could feed directly into the existing mill with no new capex required.

And unlike most exploration-stage assets, these deposits can be developed fast, using the existing processing infrastructure already in place.

That infrastructure is also a competitive edge.

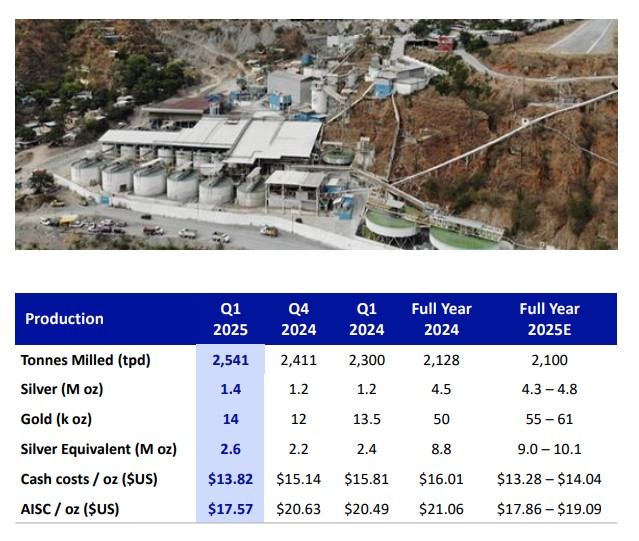

Santa Elena features the first High-Intensity Grinding (HIG) mill ever used by a silver producer — a system that improves leaching and recovery by pulverizing ore to a micron-level slurry. The site also now runs on LNG instead of diesel and incorporates a high-efficiency filtration system to reduce costs and emissions.14

The result?

Recoveries above 92%, and cash costs below $14/oz.

This isn’t just an operation — it’s an emerging silver-gold district with scale, infrastructure, and serious exploration torque still ahead.

Then, there’s San Dimas; one of the richest silver-gold epithermal systems in the country.

While it’s been producing for over two centuries, First Majestic has modernized the site with automation, real-time monitoring, and underground tech upgrades that turn legacy infrastructure into a margin engine.

In Q1 2025, San Dimas produced 2.6 million silver-equivalent ounces15 — with many of its veins still yielding grades over 400 g/t AgEq,16 and some stopes exceeding 1,000 g/t.17

Finally, there’s La Encantada, a 100% silver operation in northern Mexico. Unlike polymetallic mines, there’s no byproduct revenue distortion here — just pure silver ounces.

The site houses a 4,000 tonne-per-day cyanidation mill18 and delivered 560,000 ounces of silver in Q1 2025, a 23% year-over-year increase.

With a renewed focus on processing historic tailings and new ore body development, La Encantada may also unlock low-cost upside the market isn’t yet pricing in.

Together, these assets form the backbone of AG’s production — not just in terms of scale, but in terms of structural profitability.

While many miners are still chasing efficiency, First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is already running at it.

Backed by a Balance Sheet Built for the Breakout

While other miners are cutting budgets or scrambling for capital, First Majestic Silver (NYSE:AG) (TSX:AG) is already fully loaded.

As of Q1 2025, AG holds a record $462.6 million in cash — including $351.3M in cash and equivalents, plus $111.3M in restricted cash.19

That’s not “enough to survive.”

That’s dry powder for strategic moves — exploration, expansion, and opportunistic M&A — right as the silver bull is picking up speed.

And the cash didn’t come from dilution — it came from operations.

In Q1 alone, First Majestic Silver (NYSE:AG) (TSX:AG) pulled in $243.9 million in revenue, up 130% year-over-year.20

More than half of that came from silver. And with prices trending higher, that split is only getting stronger.

Even better? Operating cash flow hit $110 million, up from just $12.6M a year ago.21

Free cash flow: $43.5 million — after taxes and working capital.

This is what leverage looks like when the gears are already turning.

And with Cerro Los Gatos now fully integrated — a high-grade, low-cost mine that’s printing margin at $34 silver — First Majestic isn’t just surviving in this market. It’s ready to lead it.

More Than a Miner — They Mint, Sell, and Capture the Premium

Most silver producers sell raw metal into industrial supply chains — taking whatever the market gives them.

First Majestic Silver (NYSE:AG) (TSX:AG) does it differently.

They’re the only major public silver producer that also owns and operates its own mint.

In 2024, the company launched its 100%-owned facility in Nevada, producing silver bars and coins under its First Majestic Bullion brand.

- Bullion production began in Q1 2024

- Silver coins rolled out in Q3

- Q1 2025 sales hit $7.9 million

- Premiums on retail silver can run 15–40% above spot

This vertical integration means First Majestic Silver (NYSE:AG) (TSX:AG) isn’t just selling silver — they’re monetizing it at the top of the value chain, keeping the margins most miners leave behind.

It’s a built-in pricing edge that gets even stronger when retail demand for physical metal surges — like it did in 2011, and like it’s doing again now.

The Gold Bonus Most Investors Miss

On paper, First Majestic Silver (NYSE:AG) (TSX:AG) is a silver company.

But behind the scenes, gold is quietly boosting their margins.

In 2024, AG produced over 156,000 ounces of gold, accounting for more than 60% of its silver-equivalent output. Most of it came from the Santa Elena and San Dimas mines, where multi-gram gold grades are embedded in silver-rich veins.

With gold trading around $3,300/oz in 2025, those “bonus ounces” add an extra layer of free cash flow — with no additional capex.

Most analysts still model First Majestic Silver (NYSE:AG) (TSX:AG) as a pure silver play. But this gold exposure gives it another lever — and a cushion — in volatile markets.

If silver runs, AG wins.

If gold runs, AG still wins.

If both run? That’s when things get exciting.

The Leadership Behind the Leverage

Markets love numbers. But when things heat up, leadership matters just as much as ounces.

Markets love numbers. But when things heat up, leadership matters just as much as ounces.

First Majestic Silver (NYSE:AG) (TSX:AG) is led by Keith Neumeyer, one of the most respected silver voices in the world — and the founder of both First Quantum Minerals and First Majestic.

He’s called multiple silver bull markets, and he’s not mincing words in 2025 — publicly forecasting triple-digit silver as physical supply tightens and paper markets crack.

Alongside him is Mani Alkhafaji, VP Corporate Development and Investor Relations and a key driver of the company’s recent transformation — including the $970 million acquisition of Cerro Los Gatos.

Mani blends capital markets expertise with operational insight, helping position AG for both near-term growth and long-term scalability.

Together, this team isn’t just mining silver — They’re engineering margin, scale, and strategic positioning for what could be silver’s most asymmetric setup in decades.

The Setup Is Rare. The Window Is Now.

Silver is breaking out.

Gold’s already surged. Industrial demand is at all-time highs. Tariff uncertainty and record budget deficits just lit the fuse. And supply? Structurally broken.

This is exactly the kind of setup that triggered 175%+ silver moves in past cycles.

But the biggest gains never go to the biggest companies.

They go to the ones with:

✅ Production already online

✅ Margin leverage already in place

✅ Growth already locked in

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) checks all three.

Four operating mines. One of the strongest silver-gold blends in the sector. A fast-growing minting business. And leadership that’s been here before.

This isn’t about what might happen in five years.

It’s about what’s already happening — now.

Click here to sign up to our newsletter.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers