While Wall Street has been distracted by gold, AI, and interest rate roulette…

A different metal — one with a track record of outperforming gold in the second phase of every bull market — is flashing its strongest buy signal in years.

It’s not new. It’s not speculative.

It’s silver.

And this time, the setup could be historic.

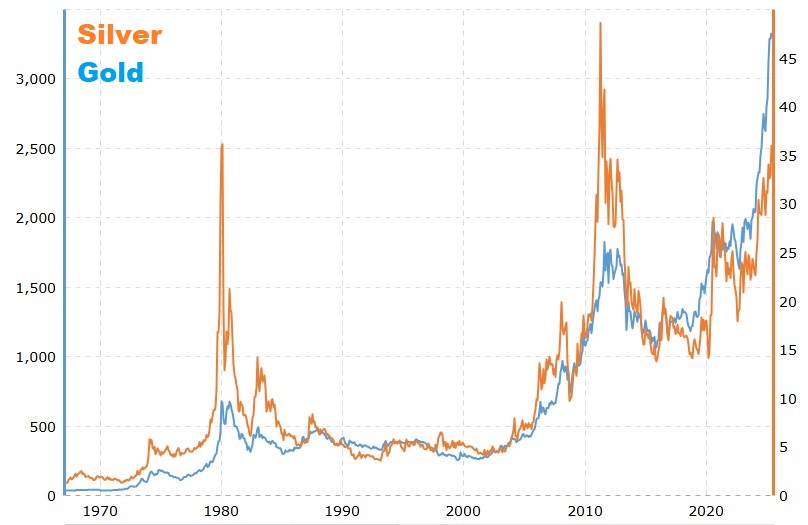

You see, every time silver has exploded in the past, it’s followed the same exact script:

- Gold leads the charge…

- Then silver quietly builds momentum…

- Then it slingshots past gold in a parabolic move that catches most investors flat-footed.

It happened in the late ‘70s.

It happened again in 2009–2011.

And the same pattern is now playing out in 2025.

In fact, this year may be even more extreme — because silver is trading at one of the widest discounts to gold in modern history.

In April 2025, the gold-to-silver ratio shot up to over 100:11 — for the third time in history.

A shocking ratio when compared to the historical norm of 60:1.2

That’s not just a chart anomaly. It’s a once-in-a-cycle signal.

It means silver may be more undervalued relative to gold than it was during the global financial crisis.

And here’s where it gets interesting:

There’s one company that’s built for this exact setup.

Not a gold company that mines a bit of silver on the side.

Not a diversified conglomerate that’ll miss the upside.

This is a full-throttle, high-leverage silver producer… with the numbers, growth, and scale to ride this next wave harder than anyone else.

In fact, it’s already producing up to 31 million silver equivalent ounces per year,3 just inked a major acquisition to increase its footprint,4 and — get this — it still flies under the radar of most retail investors.

The name?

We’ll get there in just a moment.

Because before you understand why this company could become one of the biggest winners in the next precious metals bull run…

You need to see just how rare this setup really is.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Gold Moved First. Silver’s Turn Is Coming — And It Moves Faster, Harder, and Higher

In precious metals cycles, gold is the headliner.

But silver is the surprise act that steals the show.

That’s not speculation — it’s math.

Look back to 2011.

Gold was already flying…

Then the gold-to-silver ratio collapsed.

Silver went vertical — from $18 to $48 in less than 18 months.

Why?

Because the gold-to-silver ratio is the market’s pressure valve.

When it builds too far in one direction… it snaps back.

And in 2025, that ratio is sitting at levels we haven’t seen in over a decade.

That means it takes 98 ounces of silver to buy just one ounce of gold, yet for every one ounce of gold we mine 7 ounces of silver.

But the historical average?

Closer to 60:1 — even lower in bull markets.

In 1980, it dropped to 17:1.5

In 2011, 32:1.6

Every time silver has ripped, the trigger was the same:

A collapsing ratio.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is uniquely positioned for this event.

Why? Because unlike most so-called “silver companies,” they actually produce silver — a lot of it.

In fact, they generate more silver revenue than nearly any other major public miner.7

Silver accounts for 57% of their revenue.8 That’s a big deal.

Because when the ratio reverts — and silver starts to surge — these are the companies that move fastest and furthest.

Gold stocks grind higher.

Silver pure-plays like First Majestic Silver (NYSE:AG) (TSX:AG) have the potential to make big moves.

Just look at the 2011 breakout:

Silver rose 175%.9

First Majestic stock ran 500%.

This is the leverage investors hunt for in the early innings.

And right now, with gold at record highs, the setup couldn’t be more obvious.

But the ratio is only half the story.

The real driver behind the next move?

Tariffs.

Press Releases

- First Majestic Announces Positive Exploration Results at San Dimas

- First Majestic Announces Record Financial Results for Q2 2025 and Quarterly Dividend Payment

- First Majestic Second Quarter 2025 Results Conference Call Details

- First Majestic Produces 7.9 Million AgEq Ounces in Q2 2025 Consisting of 3.7 Million Silver Ounces and 33,865 Gold Ounces; Announces Improved 2025 Production and Cost Guidance and Conference Call Details

- First Majestic Announces Second Gold-Silver Discovery Within a Year at Santa Elena and Expands High-Grade Mineralization at Navidad

Trump’s Tariffs Just Lit the Fuse. But Silver’s Supply Crisis Was Already Building for Years.

On April 2nd, 2025, Donald Trump called it “Liberation Day.”10

The day America slapped massive tariffs on nearly every import — a 10% blanket rate on global goods, and higher ones aimed squarely at China, Mexico, and Europe.

Wall Street panicked. Commodities surged. Gold spiked.

And silver jumped more than 5% in 48 hours.

Why? Because silver’s not just a precious metal anymore.

It’s critical infrastructure in a world racing toward electrification, automation, and self-sufficiency.11

And there’s another catalyst quietly building in the background: record-breaking US deficits.

Just weeks after the tariffs, Trump signed what he called the “Big Beautiful Bill” — a massive infrastructure and stimulus package that is forecasted to add another $2.4 trillion to the US national debt in a single stroke.12

The result?

Ballooning deficits. Weakened dollar. Accelerated flight to hard assets.

Precious metals — especially silver — are suddenly back in the spotlight. And First Majestic Silver Corp. (NYSE:AG) (TSX:AG) didn’t need a policy shift to get ready.

They’ve been preparing for this moment for years — as one of the only large-scale pure-play silver producers in North America.

Now, the world is catching up to what they already knew.

Governments are pouring trillions of dollars into solar, EVs, data centers, AI, and clean energy infrastructure.13

Every one of those sectors consumes silver. And supply can no longer keep up.

EVs use up to 50 grams per vehicle.14 Solar panels need it in every cell.15 And AI chips — the kind powering Nvidia’s $3 trillion empire — rely on silver’s thermal and electrical properties to stay cool and functional.16

Global demand for silver in industrial applications hit an all-time high in 2024,17 and is on pace to beat it again this year.

But supply? It’s broken.

Silver production peaked in 2016.18 It hasn’t recovered since.

And it’s not just a blip — it’s structural.

Mines are aging. Grades are declining. New discoveries are rare.

And it takes well over a decade to bring a new mine online — and in the US, the average is a staggering 29 years19 — assuming you can even get the permits at all.

Meanwhile, silver recycling has flatlined and scrap supply can’t fill the gap.

And above-ground stockpiles? They’re evaporating.

Last year alone, the world faced a 140-million-ounce deficit — the second-largest shortfall in recorded history. And the fourth deficit year in a row.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) isn’t facing that problem.

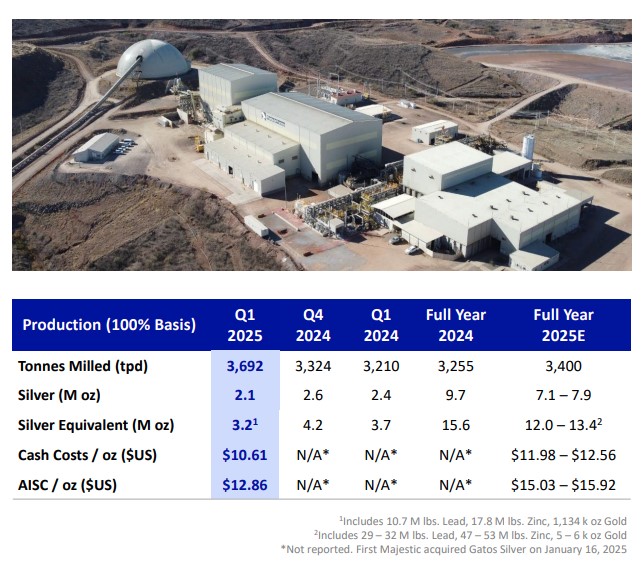

The company just kicked off 2025 with a bang, acquiring Gatos Silver and securing 70% ownership of the Cerro Los Gatos mine, one of the highest-grade, lowest-cost silver producers in Mexico.20

This isn’t a bet on the future. It’s already paying off.

In Q1 2025, First Majestic delivered a delivered 7.7 million silver-equivalent ounces including a record-shattering 3.7 million silver ounces21—and they’re charging ahead with full-year guidance of up to 31 million AgEq ounces, setting the stage for one of their biggest years yet.22

And Cerro Los Gatos is the cornerstone of that growth.

With over 15.6 million AgEq ounces produced in 2024 (including 9.7 million ounces of pure silver), and robust lead and zinc by-products to support margins, the mine is a game-changer. It boosts First Majestic’s production profile, strengthens its cash flow, reduces its cash and all-in sustaining costs, and adds serious depth to its reserve base.

Even better? The project sits in the prolific Los Gatos district, covering more than 100,000 hectares — with 14 known mineralized zones and years of exploration upside still ahead.

This is one of the most significant silver acquisitions in recent years.

That’s the current scale — with operational leverage that expands if silver prices move just 10–20% higher.

While other miners are struggling to raise capital, First Majestic Silver (NYSE:AG) (TSX:AG) now operates four producing mines — high-grade, long-life, and all in Mexico, the world’s #1 silver-producing country.23

So when silver moves — and history points that it will — the companies that already have ounces in hand will be the first to see their multiples grow exponentially.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) isn’t trying to position for the breakout.

They’re already there.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

9 Reasons

First Majestic Could Be One of the Biggest Winners of the Next Bull Run

1

It’s One of the Last True Pure-Plays on Silver: Most “silver” companies rely on gold or base metals for the bulk of their revenue. First Majestic (NYSE:AG) (TSX:AG) generates more of its income from silver than almost any other major producer.

2

Already Producing at Scale — No Waiting, No Guessing: There’s no development or exploration risk here. No “maybe someday” story. AG delivered a record 7.7 million AgEq ounces in Q1 2025 and is on track for up to 31 million AgEq ounces this year across four operating mines.

3

Leveraged Upside When Silver Prices Rise: In 2011, silver rose 175%. First Majestic stock soared over 500%. That’s the power of margin expansion when your costs stay flat and your output scales.

4

Tariffs Just Sparked the Next Breakout: Trump’s April 2025 tariffs triggered a chain reaction. Commodities jumped. Precious metals spiked. But silver — with its industrial and monetary dual role — saw the sharpest move. And with US budget deficits now spiraling even higher, the case for hard assets has gone from strong… to undeniable.

5

Positioned in the World’s #1 Silver Country: Mexico: Geopolitics matter more than ever. AG has four mines in Mexico — the top silver-producing country globally — with long mine life, strong community ties, and expansion capacity. No risky jurisdictions. No surprises. Just ore.

6

Recent Acquisition Supercharged Production: In 2024, First Majestic acquired Cerro Los Gatos — a high-grade, low-cost mine that produced 15.6M AgEq ounces in 2024. It expanded AG’s footprint, boosted margins, and added serious torque.

7

Proprietary Tech for Better Recovery and Lower Costs: First Majestic uses proprietary tech like the only HIG mill in the silver industry, plus autogenous grinding and in-house metallurgical upgrades — driving recoveries above 92% and cash costs below $14/oz at key assets.

8

They Mint Their Own Silver — And Keep the Premiums: First Majestic is the only public mining company with its own bullion brand, FirstMint.com, — selling silver bars and coins directly to investors. That means they capture retail premiums most miners leave on the table.

9

The Setup Is Rare. The Window Is Tight. The Leverage Is Real: This is what most investors miss. Silver bull markets don’t last forever — but when they move, they move fast. In 1979, silver exploded 700% in under a year. In 2011, it surged 175% in just 18 months.

And First Majestic Silver Corp. (NYSE:AG) (TSX:AG) has a history of riding those waves hard. After the 2008 crash, its stock soared over 250% by 2010. In the 2020 rebound, it doubled again as silver spiked off the lows.

Triple Digit Silver Isn’t Hype. It’s Coming Straight From the Top.

When a successful millionaire founder of a silver company goes on record saying silver could hit triple digits per ounce24 — most people roll their eyes.

But, when that founder is Keith Neumeyer, the man who built First Majestic Silver Corp. (NYSE:AG) (TSX:AG) into one of the world’s top primary silver producers, people listen.

At the March 2025 PDAC conference — the world’s largest mining event — he doubled down on his triple digit silver forecast, citing a simple truth:25

“Because we’re burning through more silver than the world can produce.”

Last year’s deficit topped 148 million ounces,26 with 2025 on track to go even higher as demand from solar, EVs, AI, and 5G explodes — and new supply flatlines.

Neumeyer also flagged the paper silver market, where estimates suggest as many as 300 paper claims exist for every physical ounce.27

That kind of leverage can’t hold forever — and when it cracks, prices could reprice violently.

And he’s not alone.

Peter Krauth, former equity analyst and author of The Silver Stock Investor, calls silver “the most asymmetric opportunity in the commodity space,” with $100 to $300 upside over the next decade.28

Willem Middelkoop of the Commodity Discovery Fund sees triple-digit silver as inevitable.29

And even conservative names like David Morgan say silver could break $40 in 2025, with higher levels likely once key resistance levels give way.30

The mainstream is still ignoring it.

But insiders — from producers to hedge funds — are already positioning.

And First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is one of the only names that keeps coming up again and again…

Because they’ve got production, premium assets, and the leadership willing to say what others won’t.

And they’re not just sitting on ounces — They’ve engineered a smarter way to pull more profit from every tonne.

Where Profitability Meets Geology: Inside First Majestic’s Mining Engine

In the world of silver mining, grades matter.

But margins are what build value.

That’s the real advantage most investors miss when they look at First Majestic Silver Corp. (NYSE:AG) (TSX:AG).

Yes, they’ve got scale.

Yes, they’ve got leverage.

But behind those headlines is a more powerful truth: they know how to turn ore into profits better than most of their competitors.

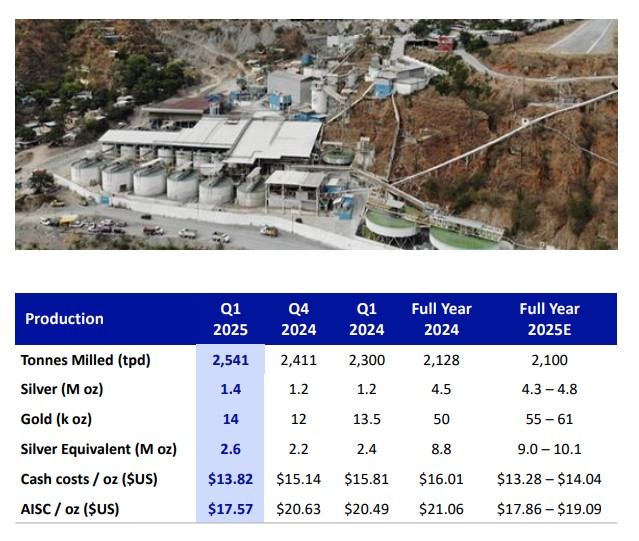

Let’s start with Santa Elena, the site where technology meets scale — and the numbers speak for themselves.

Santa Elena began as a small open-pit operation.

But First Majestic didn’t just take Santa Elena underground — they re-engineered it from the ground up.

Instead of following the industry playbook with conventional ball or SAG mills, First Majestic Silver Corp. (NYSE:AG) (TSX:AG) became the first silver producer to install a High-Intensity Grinding (HIG) mill.

This is no ordinary piece of equipment.

While traditional mills tumble ore with heavy steel balls, the HIG mill operates at far higher speeds and pressures — grinding material into a superfine slurry measured in microns. That’s not just a technical upgrade. It’s a game-changer.

Why? Because finer particles expose more surface area.

More surface area means more efficient chemical contact during leaching — which translates to significantly higher metal recovery rates.

That’s especially critical when processing complex, mixed-metal feedstock from the Ermitaño satellite deposit, which is now the primary source of ore at Santa Elena.

Ermitaño boasts proven and probable grades averaging 5.04 g/t gold and 94 g/t silver, with some zones delivering significantly higher grades, as confirmed by recent drill results.31

And the pipeline just got even stronger.

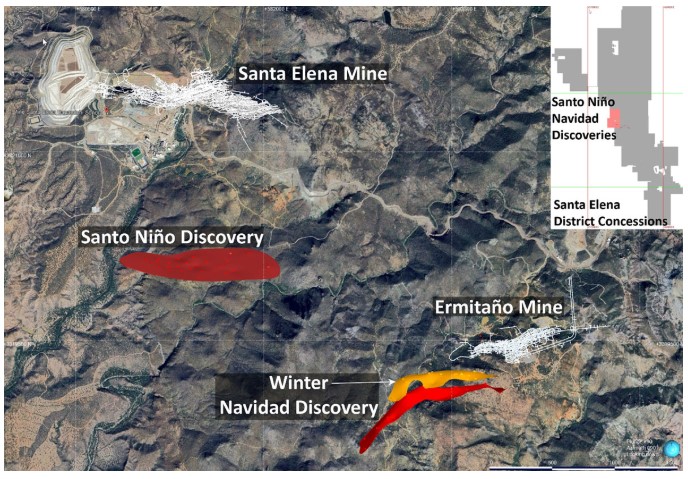

In July 2024, First Majestic announced the Navidad discovery — the third major deposit in the Santa Elena district — with a maiden resource of 29.7 million silver-equivalent ounces. That estimate is expected to grow meaningfully, with aggressive drilling underway in 2025 to test extensions and expand the system.

Less than a year later, First Majestic announced a second major discovery within the Santa Elena district — the Santo Niño vein, located just 900 meters from the processing plant.32

Together with the original Santa Elena deposit and high-grade Ermitaño, these discoveries build out a multi-deposit district that feeds directly into existing infrastructure — with no new capex required to unlock near-term value.

The site also features a new high-efficiency filtration system and has recently converted its energy generation from diesel to LNG — a move that reduces emissions, cuts fuel costs, and supports more sustainable operations.

The result? Over 92% recovery, and cash costs under $14/oz — making Santa Elena one of the most efficient silver operations in the industry.

And with high-grade feedstock like Ermitaño already online — and Santo Niño and Navidad in the wings — those gains are just getting started and this mine is going to be in profitable production for a very long time.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) isn’t just producing more.

They’re producing smarter — and the result is margin expansion that scales faster than spot prices.

But the biggest shift in AG’s story came just this year — with the acquisition of Cerro Los Gatos.

In January 2025, First Majestic completed its $970 million all-stock buyout of Gatos Silver, locking in 70% ownership and full operatorship of one of the highest-grade silver mines in the western hemisphere.33

This wasn’t a development-stage project or a future hope.

Cerro Los Gatos is a fully producing, cash-flow-generating mine — delivering approximately 9.7 million ounces of silver and 15.6 million AgEq ounces when accounting for byproducts such as zinc and lead.

The average silver grades at Cerro topped 261 g/t in Q1 2025, with cash costs under $11/oz and all-in sustaining costs of just $13/oz — meaning it’s printing money at today’s $34/oz silver price.

But here’s the real kicker:

This mine is just one part of a much larger land package — over 103,000 hectares of unexplored silver-rich ground, now fully controlled by First Majestic.34 Veins remain open, district-scale targets are mapped, and no material royalties or streams limit AG’s upside.

In short: Cerro Los Gatos didn’t just add ounces.

It added torque, margin, and growth — instantly.

And now, it stands as one of the four core assets powering AG’s production base.

Then there’s San Dimas — one of the crown jewels of Mexico’s silver belt.

San Dimas has been in production for over 250 years. But First Majestic is still just getting started.

The current mine plan draws from over 100 known veins, many with grades well over 400 grams per tonne silver-equivalent,35 with some stopes exceeding 1,000 g/t.36

In Q1 2025 alone, San Dimas produced 2.6 million silver-equivalent ounces.37

But the real story is what’s under the surface — where AG continues to hit new high-grade zones with recent drilling along the Perez and Sinaloa-Elia veins, proving the system still has plenty of room to grow.38

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) has modernized San Dimas with advanced underground automation — including real-time monitoring, autonomous tramming systems, and ventilation-on-demand.

It’s not just a historic mine.

It’s a data-driven operation that’s squeezing more efficiency out of every shift underground.

Finally, there’s La Encantada — AG’s northern Mexico wild card.

Located in Coahuila, this mine produces 100% silver — a rarity in a sector where polymetallic plays dominate.

La Encantada has produced for decades but is now entering a new phase as First Majestic Silver (NYSE:AG) (TSX:AG) reinvests in exploration and processing optimization.

Q1 2025 production came in around 560,000 ounces, and with a fully built 4,000 tpd mill and a renewed focus on recovering silver from historic tailings, the operation is poised for growth the market may be overlooking.39

And here’s why all of this matters to investors right now:

First Majestic’s combined production from these mines totals more than 30 million silver-equivalent ounces annually.

That’s not a development-stage estimate.

It’s not “if things go well” guidance.

It’s what they’re doing — now.

And they’re doing it at a consolidated all-in sustaining cost (AISC) of $19-21/oz,40 while spot silver hovers near $34.

That’s a 40%+ gross margin at today’s prices.

But what happens if silver potentially runs to $50… or Neumeyer’s triple digit forecast?

That’s where AG’s structural efficiency kicks in.

Because the infrastructure is already built and every additional dollar in silver price goes almost entirely to the bottom line.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) doesn’t have to dilute shareholders to expand.

They don’t need another drill campaign to prove they have value.

They’ve already done the hard work.

Now, with the silver setup tightening and institutional money starting to return to the space, AG’s torque on rising prices could be unmatched.

The Only Major Silver Miner That Mints Its Own Metal — and Keeps the Premiums

While most silver producers sell their output into the wholesale market — at or near spot prices — First Majestic Silver (NYSE:AG) (TSX:AG) plays by a different set of rules.

They don’t just mine silver.

They mint it, brand it, and sell it directly to retail buyers through their own online store: FirstMint.com.

They mint it, brand it, and sell it directly to retail buyers through their own online store: FirstMint.com.

In 2024, the company took this model to the next level — launching its 100%-owned minting facility in Nevada, USA.

Production began with bullion in Q1 2024 and expanded to silver coins by Q3 2024, all led by industry veterans with over 20 years of experience.

That means while other miners are settling for spot pricing, First Majestic is capturing full-stack value — including retail premiums on bars, coins, and rounds.

These margins aren’t small. In periods of heightened demand or special editions, silver products often sell at 15–40% above spot, and First Majestic Silver (NYSE:AG) (TSX:AG) gets to keep that premium in-house.

In Q1 2025 alone, this minting business generated $7.9 million in direct sales — a fast-growing revenue stream that scales with investor appetite for physical silver.41

So while spot silver may be rising, AG’s realized price per ounce could be even higher — thanks to this under-the-radar operation that no other major public silver miner offers at scale.

The Gold Bonus Wall Street Keeps Ignoring

Most investors think of First Majestic Silver Corp. (NYSE:AG) (TSX:AG) as — well — a silver company.

And on paper, they are.

That’s how they market themselves.

That’s how they’re indexed.

That’s how they’re categorized in institutional models.

But under the hood, there’s something else quietly supporting the balance sheet — and positioning the company to ride two precious metals bull markets at once.

Gold.

In 2024, First Majestic Silver (NYSE:AG) (TSX:AG) produced 156,542 ounces of gold,42 representing approximately 61% of its total silver-equivalent production.

That gold production number will stay strong even with the addition of Gatos — gold continues to represent a massive chunk of output from their Santa Elena and San Dimas operations.

At Santa Elena, the Ermitaño deposit isn’t just feeding silver into the HIG mill — it’s delivering multi-gram-per-tonne gold grades.

In fact, the gold content is what’s helping drive margins well beyond what silver alone could support.

At San Dimas, the story’s the same. The mine is officially listed as silver-dominant, but several of the highest-grade zones in current production — including the Perez, and Roberta veins — contain gold-silver blends that provide additional upside with zero capex required.

And it’s not just output. It’s pricing power.

With gold hovering around $3,300/oz in 2025, these “bonus ounces” add an extra layer of free cash flow that most investors — and even some analysts — aren’t baking into forward multiples.

Together, they give First Majestic Silver Corp. (NYSE:AG) (TSX:AG) a dual exposure setup with the flexibility to thrive across cycles.

If silver spikes — AG runs.

If gold surges — they still win.

And if both break out at the same time?

That’s when this story stops being a value play… and becomes a momentum rocket.

In the Race for Silver Alpha, One Name Stands Out

When silver surges, the trade isn’t to chase size.

It’s to chase torque.

And in a sector where the biggest names are often the slowest to move, investors looking for upside need to ask: Who’s actually positioned to re-rate the fastest when silver breaks out?

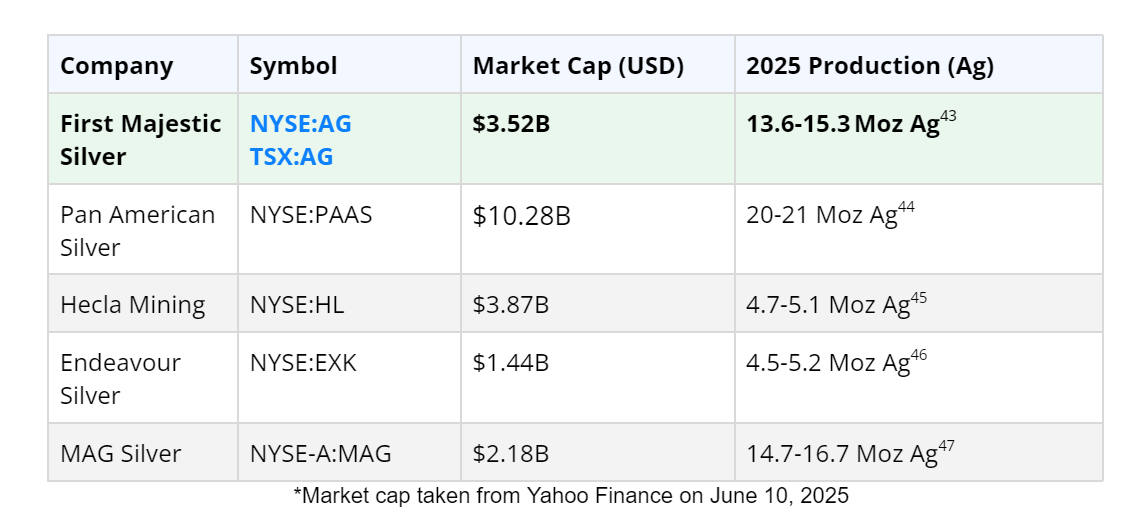

Now let’s decode the table:

Pan American Silver is the giant — but it’s already widely-owned by institutions, tied to a complex global portfolio of polymetallic mines, and not exactly nimble. Silver makes up only ~20% of revenue after making the $2.1B acquisition of MAG Silver.

Hecla Mining has a strong US base, but its production guidance is less than half that of AG — and it’s still trading at a higher market cap.

MAG Silver has elite-grade rock but no full ownership of its only mine. No operational control. No leverage on expansion. Just sold to Pan American.

Endeavour Silver is still waiting on Terronera to come online — it’s pre-ramp, pre-margin, and priced accordingly.

Now compare that to First Majestic Silver Corp. (NYSE:AG) (TSX:AG):

- Fully producing — Four major mines already online, optimized, and scalable

- Tech-driven — only player with a High-Intensity Grinding mill for higher recoveries

- Dual metal upside — strong gold output accounting for ~33% of revenue boosts margins quietly behind the scenes

- Lowest market cap among top producers per ounce of silver-equivalent

- Still trading at just 1/4 the size of Pan American — but with more silver exposure as a percentage of total output

That’s what smart investors look for:

Production now, margin leverage today, and market cap room to run.

Led by a Founder Who Knows How to Build and Defend Value

At the helm of First Majestic Silver (NYSE:AG) (TSX:AG) is a name nearly every silver investor already knows.

Keith Neumeyer, Founder, President, and CEO — and one of the most vocal and respected advocates for silver in the global market.

Keith Neumeyer, Founder, President, and CEO — and one of the most vocal and respected advocates for silver in the global market.

He built First Quantum Minerals from the ground up. He founded First Majestic in 2002. And he’s been ahead of the curve every time silver has broken out over the past 20 years.

Beside him is Mani Alkhafaji, VP Corporate Development and Investor Relations and one of the key architects behind First Majestic’s recent transformation.

Alkhafaji has played a pivotal role in driving AG’s growth strategy, capital market positioning, and the $970 million acquisition of Cerro Los Gatos — one of the biggest silver deals of the decade. He brings both financial depth and operational insight, helping to align near-term cash flow with long-term vision.

Together, Neumeyer and Alkhafaji blend entrepreneurial leadership and institutional strategy — a combination that’s rare in a sector defined by either builders or bankers, but not often both.

This isn’t just a management team.

It’s a forward-looking engine that knows how to build, scale, and defend value — with conviction.

This Window Won’t Stay Open for Long

Silver is waking up.

Institutions are rotating back in.

And tariffs, tightening supply, and record demand are creating the exact kind of pressure cooker that’s fueled silver’s biggest runs in history.

And the ones with scale, technology, and margin leverage tend to lead the charge.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) isn’t just another miner.

It’s one of the only pure-play silver producers with fully operational mines, proprietary technology, and dual exposure to both silver and gold — at a time when most of its peers are either bloated or still years from production.

If you want to be positioned before the next wave of capital hits… now is the moment to act.

We’ve prepared a full breakdown of this story — including First Majestic’s latest corporate presentation deck and how it fits into our top silver trade ideas for this cycle.

But it’s only available through the Trading Whisperer newsletter.

👉 Subscribe now to get instant access to the full corporate deck and our exclusive trade ideas — updated weekly, straight from the desk of a top Wall Street hedge fund trader.

Don’t wait for CNBC to catch on.

Get ahead of the crowd — and see why First Majestic Silver Corp. (NYSE:AG) (TSX:AG) may potentially be the best-positioned silver play in the entire market.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers