America has a weight-loss problem and not a small one.

For decades, the country has battled an obesity epidemic so massive that it became one of the leading drivers of diabetes, heart disease, early death, and trillions in healthcare costs.

More than 100 million Americans struggle with obesity or severe overweight.1 For years, doctors had nothing truly effective to offer them.

Then one drug changed everything.

Ozempic®.

What began in 2017 as a simple diabetes injection quietly turned into the biggest blockbuster in modern pharmaceutical history practically overnight.

No one expected it to melt away pounds like it did. No one expected celebrities, CEOs, and everyday Americans to demand it by name.

And certainly no one expected its parent company, Novo Nordisk, to suddenly become Europe’s most valuable corporation.

But that’s exactly what happened.

The numbers are staggering:

- Ozempic® and Wegovy® generated $42 billion in sales last year2

- Analysts now project the GLP-1 Receptor Agonist Market to reach US$193.56 billion by 2032, growing at a CAGR of 17.61%3

- It helped send Novo Nordisk’s valuation surging past $500 billion

One drug, built on the back of a discovery that shocked even seasoned researchers, helped tackle one of America’s largest, most expensive health crises.

Ozempic® didn’t just sell.

It rewrote the pharmaceutical playbook.

And now, just as Ozempic® cracked the obesity epidemic, another little-known company may be on the verge of attacking the other monster destroying American lives and draining the healthcare system:

Heart failure.

Because while obesity affects millions…

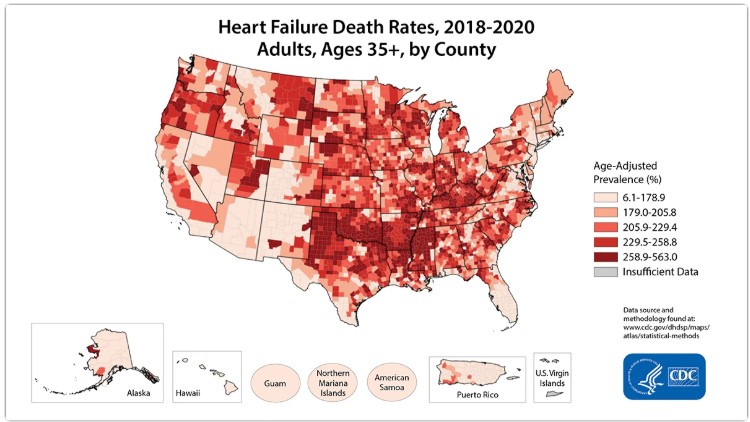

Heart failure affects 6.7 million Americans today4 and kills more of us than anything else.

It’s the #1 cause of hospitalization. The #1 driver of healthcare spending. And the #1 reason Americans die before their time.

And just like obesity a decade ago…

Heart failure has a fatal gap in treatment, but one that a small, emerging biotech may finally be ready to close.

A company most investors have never heard of.

A company developing what could be the first truly novel anti-inflammatory therapy for deadly heart conditions, with data already showing measurable improvements in the structure of the human heart itself.

A company whose intellectual property is protected until 2040 with newly issued US patents,5 a rare competitive moat for a small-cap biotech.

And a company that has just unveiled never-before-seen clinical data at a global forum held by one of the world’s most prestigious cardiology organizations.6

A company whose upcoming milestones could mirror the early days of Novo Nordisk’s rise… before Ozempic® became a household name.

That company is Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL).

While most investors are busy chasing the next diabetes or weight-loss stock, this small Canadian-American biotech is quietly advancing a treatment that targets something even more urgent:

Inflammation inside the heart itself, the fuel behind myocarditis, pericarditis, and millions of heart-failure cases.

And here’s where the story gets remarkable…

They aren’t trying to make the heart beat harder.

They aren’t simply masking symptoms.

Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) is developing a therapy designed to protect the heart from inflammation and prevent structural damage and early clinical data shows it may actually reverse it.

Not in mice.

Not in theory.

But in real patients.

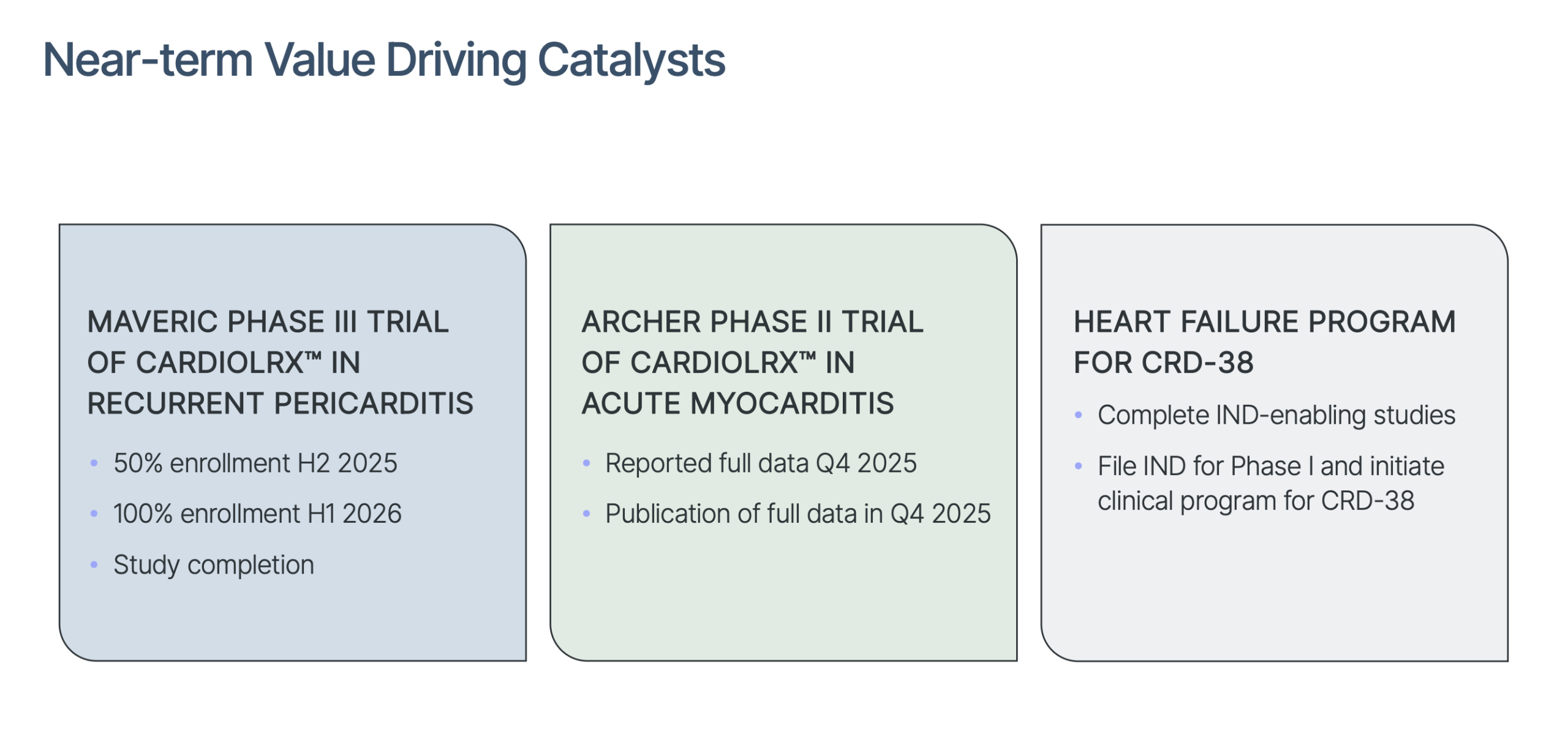

And unlike most early-stage biotechs, Cardiol has already advanced its next-generation heart-failure program, CRD-38, toward an IND submission, with IND-enabling studies underway and human trials expected to begin in early 2027.

This IND pathway creates a second, much larger commercial opportunity running in parallel with its late-stage pericarditis program.

And here’s what sets it apart from nearly every small-cap biotech: Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) is one of the rare companies fully funded into 2027, giving investors exposure to multiple late-stage catalysts without dilution pressure.

8 Reasons

Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) Could Be the Next Major Breakout in Heart-Focused Biotech

1

Targeting a Billion-Dollar Market That’s Already Proven: Recurrent pericarditis is now a validated commercial market. The only approved therapy, rilonacept, costs over $270,000 per year and generated $180.9M in Q3 2025 alone. Cardiol is developing the industry’s first oral, non-immunosuppressive alternative aimed at a US market expected to exceed $1B by 2027–2028.

2

Landmark Phase 3 Trial Fully Funded Through NDA: The pivotal MAVERIC Phase 3 trial is successfully enrolling across 20 top-tier cardiac centers and thanks to Cardiol’s $11.4 million October 2025 financing,8 is fully funded through a planned New Drug Application and into Q3 2027. Few small-cap biotechs have a financed path to pivotal data.

3

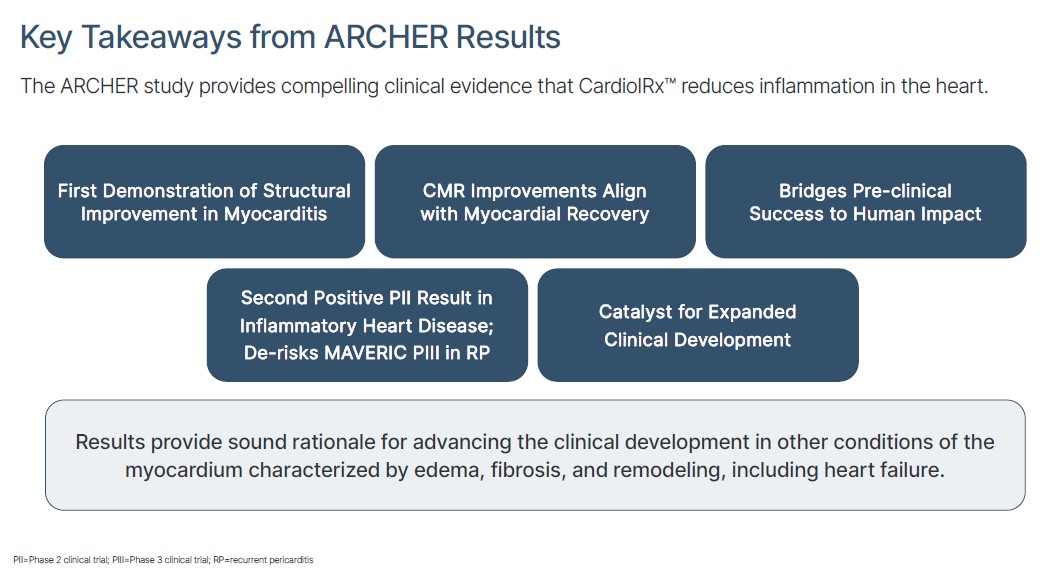

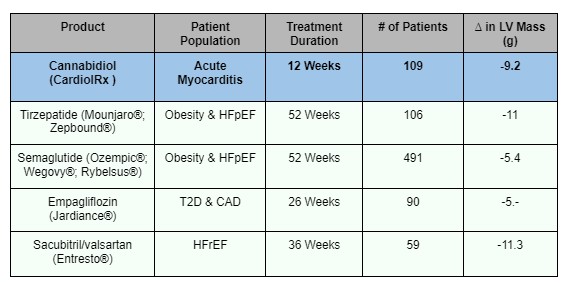

First Drug Ever to Show Structural Improvement in Myocarditis: ARCHER delivered the first clinical evidence that a therapy can reverse structural damage in acute myocarditis. Cardiol’s drug reduced left ventricular (LV) mass by -9.2 grams in just 12 weeks (p=0.01). These full structural and inflammatory results were just showcased by Mayo Clinic’s Dr. Leslie T. Cooper, Jr. at the European Society of Cardiology’s global meeting on myopericardial diseases.

4

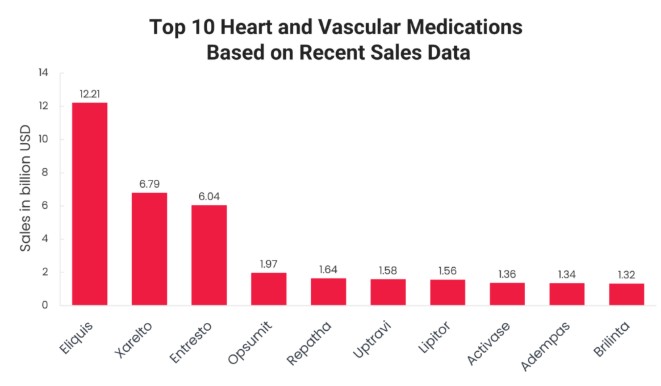

A Treatment Effect Comparable to Multi-Billion-Dollar Blockbusters: ARCHER’s LV-mass reduction rivals or exceeds the impact of Mounjaro®, Ozempic®/Wegovy®, Jardiance®, and Entresto® drugs that each generate billions annually. Furthermore, Cardiol (NASDAQ:CRDL) (TSX:CRDL) achieved this ~4x faster and in patients without obesity, diabetes, or hypertension. These results are sure to drive accelerated interest from cardiology specialists and Big Pharma.

5

Pipeline Expansion Into a Massive Heart-Failure Market: ARCHER’s improvements in inflammation markers (ECV and ICV) and structural remodeling directly support Cardiol’s expansion into heart failure — a condition affecting 6.7M Americans, costing over $40B annually, and where over half of patients still die within five years. CRD-38, the company’s once-monthly heart-failure therapy, is now being accelerated toward human trials in Q1 2027.

6

Orphan Drug Designation Creates a Strong Competitive Moat: CardiolRx™ has FDA Orphan Drug Designation for pericarditis, offering 7 years of US market exclusivity, tax credits, FDA fee waivers, and a streamlined regulatory pathway. This significantly strengthens Cardiol’s competitive position well ahead of commercialization.

7

Backed by World-Class Experts and Institutions: Cardiol’s (NASDAQ:CRDL) (TSX:CRDL) clinical programs are run by leaders from Mayo Clinic, Cleveland Clinic, Johns Hopkins, and Harvard, with a leadership team that includes former Amgen and Eli Lilly executives. Few small-cap biotechs attract this level of scientific and clinical pedigree.

8

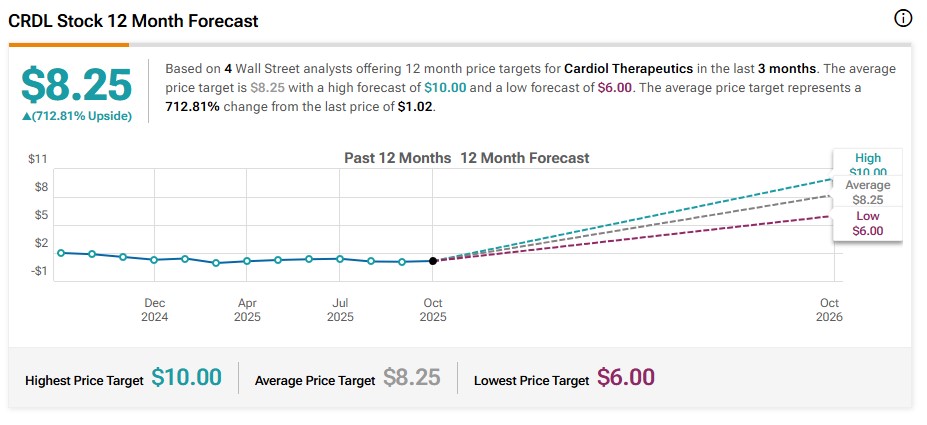

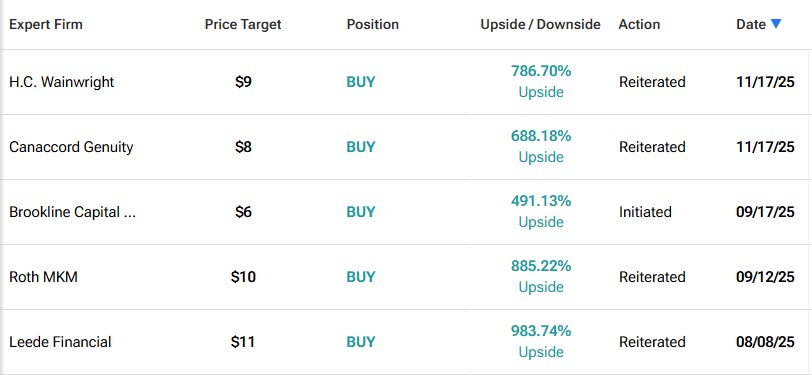

Analysts See 7× to 10× Upside, While It’s Still Under the Radar: All covering analysts are implying roughly 700% upside from recent levels. With two late-stage clinical programs, a next-gen heart failure asset, and funding secured into 2027, analysts believe the market has not priced in Cardiol’s catalysts.

Wall Street Analysts Are Turning Their Attention to Cardiol And Their Targets Are Not Subtle

It’s not just cardiology leaders who are paying attention.

Wall Street has started to notice what Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) is building and the numbers speak for themselves.

Over the past three months, four US firms have issued coverage on Cardiol and every single analyst expects big things.9

And the average 12-month target implies an upside of over 700% from recent levels.10

Some analysts see even more:

These aren’t outlier numbers.

They are independent analysts all converging around the same conclusion: Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) is undervalued.

And analysts aren’t reacting to hype. They’re reacting to clinical progress:

- A Phase 3 trial enrolling ahead of schedule.

- Breakthrough myocarditis data showing the first-ever structural improvement in the disease.

- A rapidly advancing program in heart failure — one of the largest drug markets in medicine.

- And a newly strengthened patent portfolio that locks in protection into the late 2040s.11

Biotech analysts see the setup.

They see the funding runway. They see the catalysts lining up within the next 12–18 months.

Press Releases

- Cardiol Therapeutics Receives U.S. Patent Allowance Broadly Protecting its Heart Drugs to Late 2040

- Cardiol Therapeutics’ Phase II ARCHER Trial Results to be Presented at the European Society of Cardiology Scientific Meeting on Myocardial & Pericardial Diseases

- Cardiol Therapeutics Completes US$11.4 Million Financing and Extends Cash Runway into Q3 2027

- Cardiol Therapeutics Secures US$11 Million Financing and Extends Cash Runway into Q3 2027

- Cardiol Therapeutics to Participate in Fireside Chat at Canaccord Genuity’s 45th Annual Growth Conference

A Breakthrough in Human Heart Tissue and a Late-Stage Program Aiming for the First Major Win

Ozempic® addressed one of America’s biggest metabolic problems. Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) is targeting one of its deadliest cardiac ones.

And unlike most early clinical stories, this is not just speculation.

MAVERIC is Cardiol’s first commercial launchpad. It targets recurrent pericarditis, a painful inflammatory heart condition affecting roughly 38,000 US patients.

Recurrent pericarditis may sound like medical jargon. But this condition represents a quietly valuable market in cardiovascular medicine.

Treatment options are limited. Most doctors cycle patients through NSAIDs, colchicine, steroids, and immune-suppressants, drugs that often come with harsh side effects and frequent relapses on discontinuing treatment.

And until recently, there was only one FDA-approved therapy: rilonacept, priced at a staggering $270,000 per patient annually.12

Despite that sky-high cost, demand continues to grow.

ARCALYST® (Rilonacept) generated $180.9 million in net product revenue in Q3 2025 alone, and since launch, more than 3,825 prescribers have written prescriptions for recurrent pericarditis. Patients stay on therapy for an average of 32 months, making this one of the stickiest, highest-value treatment categories in cardiology.13

It’s a validated, fast-growing commercial market hiding inside a rare disease.

And no company proved that better than Kiniksa Pharmaceuticals.

Before gaining FDA approval for rilonacept in recurrent pericarditis, Kiniksa was a small-cap biotech with limited investor attention.

After approval, its valuation surged past $3 billion, driven almost entirely by this one orphan indication.

Kiniksa proved something that every investor should remember: A single successful orphan drug can build a multibillion-dollar company.

And here’s why that matters to Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) right now:

Cardiol is targeting the same indication, but with a therapy designed to be oral, non-immunosuppressive, and far more accessible than a $270,000 injectable biologic.

Meanwhile, the overall market keeps expanding.

Analysts expect the pericarditis therapies market to reach US$3.2 billion by 2028,14 a timeline that aligns almost perfectly with Cardiol’s Phase 3 readout in 2026 and planned NDA filing shortly thereafter.

Even more striking is how early it still is.

As of Q2 2025, only 15% of the estimated 14,000 US patients with multiple recurrences were actively on therapy, meaning the vast majority of the addressable market remains untapped.15

In other words: 85% of the addressable market remains untapped.

And the only approved therapy is a high-cost biologic with immune-suppressing risks, leaving a massive opening for a safer, simpler, oral treatment to capture share.

Exactly the opening Cardiol’s (NASDAQ:CRDL) (TSX:CRDL) MAVERIC program is designed to fill.

MAVERIC isn’t just a late-stage trial, it’s fully funded right through a planned New Drug Application with the FDA, thanks to the company’s $11.4 million financing completed in October 2025, extending its cash runway into Q3 2027.

And Cardiol Therapeutics is not entering this market cold.

The FDA has already granted CardiolRx™ Orphan Drug Designation (ODD) for the treatment of pericarditis, which includes reduction in the risk of recurrence. 16

ODD provides powerful advantages including potential seven-year marketing exclusivity, exemptions from certain FDA fees, and tax credits for qualified clinical trials, and a faster regulatory path.

This designation not only validates the medical need, it strengthens Cardiol’s (NASDAQ:CRDL) (TSX:CRDL) competitive moat before the drug even reaches the market.

While recurrent pericarditis has just one approved biologic that costs over $270,000 per year, there are still zero FDA-approved therapies for acute myocarditis. Cardiol is among the first to target this population head-on. A gap that ARCHER is uniquely positioned to address.

This is the type of setup investors rarely see.

A small cap with late-stage clinical momentum, unprecedented trial results, a strengthened balance sheet, and new intellectual property extending well into the 2040s.

The company’s lead program, the MAVERIC Phase 3 trial in recurrent pericarditis, is successfully enrolling at 20 of America’s most elite cardiac centers, the type of network normally reserved for large pharmaceutical companies, including:

- Cleveland Clinic

- Mayo Clinic

- Johns Hopkins

- Harvard

- Northwestern

- The DeBakey Heart Center

These institutions do not lend their names lightly.

This is Cardiol’s clearest path to commercialization and a near-term revenue opportunity supported by earlier Phase 2 data showing rapid, durable reductions in pain, inflammation, and flare frequency.

But the company’s most important scientific breakthrough came from a different program.

The First Drug Ever to Show This Effect in Myocarditis And the Gateway to Heart Failure

If MAVERIC is Cardiol’s (NASDAQ:CRDL) (TSX:CRDL) near-term revenue engine, ARCHER is the validation the market hasn’t priced in yet.

ARCHER is the company’s Phase 2 trial in acute myocarditis, a dangerous inflammatory disease of the heart muscle that can quickly spiral into heart failure, transplant, or sudden cardiac death.

And despite being one of the leading cardiac killers of young people, there are still zero FDA- or EMA-approved treatments.

That’s what make the results Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) just delivered so important.18

ARCHER’s cardiac MRI data showed notable improvements in cardiac structure because it delivered a structural change inside the human heart. The full results were presented by Mayo Clinic’s cardiologist Dr. Leslie T. Cooper, Jr., at the European Society of Cardiology Working Group on Myocardial & Pericardial Diseases annual meeting, a leading global forum on myocarditis and pericarditis.

For the first time ever, a drug meaningfully reduced left ventricular (LV) mass in myocarditis with 99% statistical confidence (p = 0.01).

This matters because LV mass is essentially the size and thickness of the heart’s main pumping chamber.

When that chamber swells:

- The risk of death increases

- Hospitalization risk rises

- The progression toward heart failure accelerates

ARCHER demonstrated that Cardiol’s (NASDAQ:CRDL) (TSX:CRDL) therapy didn’t just slow this process, it actually reversed it.

And the result wasn’t subtle.

In merely 12 weeks of treatment, patients saw a meaningful reduction in heart muscle size.

For context, the magnitude of this LV mass reduction (-9.2 grams in just 12 weeks) rivals some of the world’s top-selling drugs, including obesity drugs, diabetes drugs, and blockbuster heart-failure therapies, which often take six months-to-a-year to do it.

Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) achieved its result in one quarter of that time, in a population with no approved treatments.

Even more compelling:

The company also saw improvements in several MRI markers that measure inflammation and heart-muscle injury.

In simple terms, the hearts of treated patients showed less swelling inside the cells and in the surrounding tissue, a strong sign that the drug was reducing inflammation and helping the heart return toward normal structure.

These improvements match what Cardiol previously demonstrated in heart-failure models, including research highlighted in JACC: Translational Medicine, showing the drug’s potential to treat a wide range of conditions driven by inflammation, swelling, and fibrosis.

No other myocarditis drug candidate has ever shown this kind of structural improvement.

Not once. Not in any trial.

Cardiol’s therapy is the first.

That single result changes the trajectory of the entire company, because it shifts the story from a rare inflammatory disease… to one of the largest, deadliest markets in the world.

From Rare Disease to America’s Biggest Killer: Heart Failure

Cardiol’s (NASDAQ:CRDL) (TSX:CRDL) breakthrough doesn’t stop with a rare disease. It leads straight into heart failure, one of the biggest, deadliest, and most expensive conditions in America and a far bigger market in both patients and dollars.

Myocarditis and recurrent pericarditis together affect about ~80,000 people in the US, while heart failure impacts 6.7 million Americans today.19

It’s also one of the most expensive conditions in the system. The US spends around $40 billion a year treating heart failure,20 while the estimated global cost is upwards of $280 billion,21 and that number is growing fast.

This is a market-moving scale.

Top heart-failure drugs routinely generate from $1 billion to more than $12 billion per year.22

And even with the best cardiology drugs available, 53% of patients still die within five years of being diagnosed.

This is the kind of massive, unmet-need landscape that Ozempic® tapped into with obesity, only this time, it’s the heart itself.

Cardiol’s (NASDAQ:CRDL) (TSX:CRDL) data suggest its drug doesn’t just blunt inflammation. It appears capable of directly influencing the structural remodeling that drives heart failure forward, especially in one of its toughest and most expensive segments.

And this is exactly where Cardiol’s next-generation program, CRD-38, comes into play.

CRD-38 is designed to be a once-monthly, subcutaneously administered formulation of Cardiol’s (NASDAQ:CRDL) (TSX:CRDL) therapy, engineered specifically for chronic heart failure. It is designed to improve pharmacokinetics, reduce required dosing, and directly target the inflammatory mechanisms that current heart-failure drugs do not address.

Preclinical models of obesity- and hypertension-induced heart failure, two of the biggest drivers of hospitalization, have already shown that this approach reduces inflammation, fibrosis, and pathological remodeling.

CRD-38 builds on that science and is now undergoing pharmacokinetic testing with IND-enabling work underway. The company expects human trials to begin in 2027.

ARCHER validated the anti-inflammatory mechanism in humans. CRD-38 is the once-monthly version designed to expand that success into the multi-billion dollar chronic heart-failure market.

Insiders Built This Company for Success and Now the Market Is Catching Up

In biotech, skin in the game matters.

And a company’s leadership lends credibility to its efforts.

That’s exactly the situation at Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL).

CEO David Elsley isn’t just a public face. He’s the founder. He owns shares.23 He has spent over a decade shaping the company’s vision, long before CardiolRx™ ever made it into the clinical pipeline.

He’s been through biotech cycles before. He knows how Wall Street works. And he’s not here to flip shares, he’s here to finish what he started.

Then there’s Dr. Andrew Hamer, the company’s Chief Medical Officer and Head of Research & Development.

He spent several years at Amgen, the first and largest biotech company in the world. Before that, he was a practicing cardiologist.

New Board member Dr. Tim Garnett, a distinguished pharmaceutical industry executive with over 30 years’ experience, including two decades at Eli Lilly, where he served as Chief Medical Officer from 2008 until his retirement in 2021.

And when they joined Cardiol, they weren’t following hype, they were following the science.

Cardiol Therapeutics’ (NASDAQ:CRDL) (TSX:CRDL) scientific advisory board and international steering committees includes global leaders in cardiology, including pre-eminent researchers from Cleveland Clinic, Harvard, and major European medical institutions.

Investors often chase the next approval. But the smart ones chase the people who’ve done it before.

With Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL), that’s exactly what you’re getting.

Wall Street Still Hasn’t Priced This In

Cardiol Therapeutics’ (NASDAQ:CRDL) (TSX:CRDL) pivotal MAVERIC Phase III trial is now successfully enrolling across 20 of the top cardiac centers in the US including Cleveland Clinic, Mayo Clinic, Johns Hopkins and Harvard.

This isn’t a small pilot study. This is the kind of infrastructure usually reserved for multibillion-dollar pharma companies, not a $100 million small cap.

And MAVERIC isn’t just a late-stage trial, it’s fully funded right through a planned New Drug Application with the FDA, thanks to the company’s $11.4 million financing completed in October 2025, extending its cash runway into Q3 2027.

Meanwhile, the ARCHER Phase 2 myocarditis study has already delivered something the medical community has never seen before:The kind of results that change how the entire field thinks about inflammatory heart disease.

This is how small companies become multi-asset cardiovascular platforms.

You now have:

- A fully funded Phase 3 trial in a $1B market

- The first ever structural win in myocarditis

- A next-gen heart-failure asset entering clinical development

- Orphan Drug Designation

- A patent estate extended into late 2040

- Analysts implying major upside

This is not a speculative early-stage biotech story.

This is a company with real human data, elite clinical partners, late-stage catalysts, and a clear regulatory path.

Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) is still under the radar, but all the ingredients of a breakout are already in motion.

ARCHER’s database lock is done. The full results are out. But the market has yet to fully absorb what they mean — both for Cardiol’s pipeline and its valuation.

The window to understand the story before Wall Street recalibrates its view is closing.

Subscribe now to get our full research briefing and download the latest corporate presentation.

The countdown has begun.

Don’t find out after the move.