Nickel just might be the most misunderstood metal in the world.

The media talks about lithium. Hedge funds chase copper. But the metal at the core of the EV and battery revolution — the one with the fastest demand growth — is sitting quietly in the corner, waiting to explode.

And when it does, history shows it moves fast.

Just ask the traders who got steamrolled in 2022 when nickel spiked 250% in a matter of hours1… or the investors who rode nickel juniors like FNX and LionOre to life-changing gains in the 2000s.

Now, with Indonesia tightening exports2 and the US pushing hard for domestic critical minerals,3 another nickel supercycle may be right around the corner.

And there’s one company at the center of it all — a name most investors have never heard.

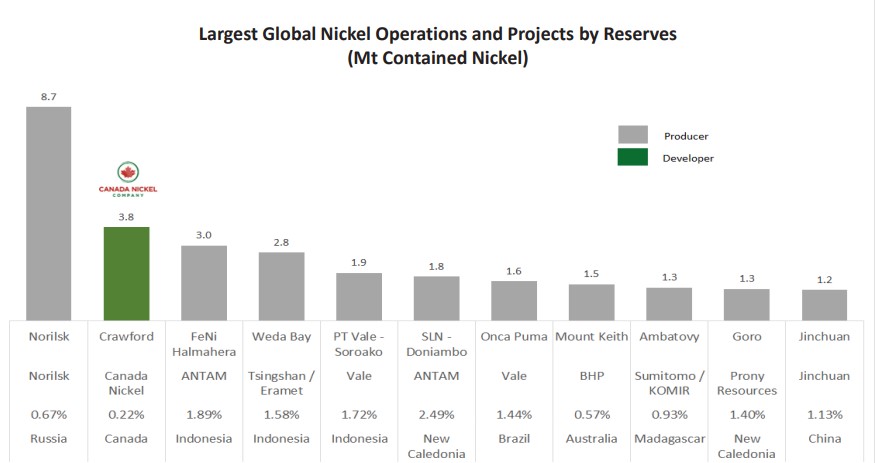

This Canadian developer, Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF), already has the second largest nickel reserve and resource globally.4

But that’s just the beginning.

Canada Nickel is unlocking what could become the largest nickel sulphide district in the world — with 25X the footprint of their flagship deposit.

And they’re not doing it alone.

They’ve quietly lined up a dream cap table:

-

- Samsung SDI5 (one of the world’s biggest battery makers)

- Agnico Eagle6

- Anglo American

- And even direct capital from the local First Nations, Taykwa Tagamou Nation

That kind of backing isn’t typical in junior mining.

Neither is the fact that they’re the first in Canada to file under new critical mineral permitting laws… or that they’ve secured $1 billion in LOI’s from Export Development Canada and another top-tier financial institution.7,8

It’s not just a nickel story anymore.

It’s a government-backed, ESG-aligned, carbon-negative metals story — at the exact moment the world’s supply chains are desperate for it.

The stock is still trading for just $0.91 a share.

That disconnect won’t last.

Because this isn’t some early-stage hopeful drilling a single hole in the bush.

This is Canada Nickel Company Inc. (TSXV:CNC | OTCQX:CNIKF) — and what they’re building in northern Ontario could rewrite the global nickel supply map.

Here’s why…

The World’s #2 Nickel Reserve Is Already Permitted, Carbon-Ready, and Institutionally Held — And Still Completely Ignored by Wall Street

Back in 2007, a bidding war broke out over a Canadian nickel developer most investors had never heard of.

It wasn’t Tesla or some battery startup. It was a raw resource play — and the prize was underground.

BHP Billiton and Norilsk Nickel went head-to-head. The final acquisition price? $6.8 billion.9

That company was LionOre Mining — and the deal shocked the market.

Why? Because LionOre was largely overlooked until it was too late. The company had size, jurisdiction, and infrastructure — but little fanfare.

Sound familiar?

Today, a new project is emerging in the same country, with more scale, better ESG credentials, and a strategic edge LionOre never had.

This time, the story includes:

- The 2nd largest nickel reserve on Earth

- A clear path to becoming the 3rd largest nickel sulphide operation globally

- A proprietary carbon capture system that could unlock hundreds of millions in tax credits10,11

- And a valuation so disconnected from its fundamentals, it’s practically begging for institutional re-rating

But unlike 2007, the market isn’t going to stay distracted forever.

Because this time, the playbook is already being written — in Ottawa, Washington, and Beijing — where critical minerals are now a matter of national security.12

And at the center of this new nickel war is Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) — with a footprint big enough to anchor a supply chain, and a business model engineered for government partnership.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Crawford: A Critical Mineral Superpower in Waiting

Crawford isn’t a drill play.

It’s already proven.

In fact, by nickel reserves, Canada Nickel Company’s Crawford now ranks as the 2nd largest nickel resource on the planet with 2.56 billion tonnes at 0.24% nickel (Measured and Indicated) and 1.69 billion tonnes at 0.22% nickel (Inferred)13— only behind Norilsk in Russia.14

And in terms of projected production?

Once operational, Crawford is expected to become the 3rd largest nickel sulphide operation globally outside of Russia and China15, with a 41-year mine life and scalability well beyond the current plan.16

This is no small feat.

But size isn’t the only thing that matters.

The nickel sector has been plagued by cost blowouts, subscale deposits, and ESG black eyes — especially from high-emission laterite projects in Indonesia and the Philippines.

Crawford is built differently:

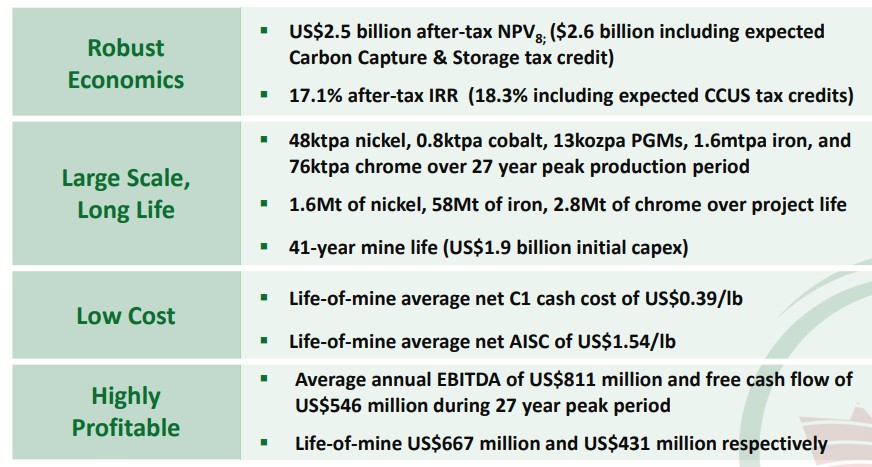

- First quartile on the global cash cost curve

- Lowest decile for carbon intensity globally

- Post-tax Net Present Value (NPV8%) of US$2.6 billion, even using conservative nickel price assumptions of US$8.75/lb17

- Initial capital cost: US$1.9 billion — with financing now significantly de-risked18

- After-tax IRR: 17.1%19

- Annual EBITDA: Projected at over US$550 million in the early years of operation20

These aren’t just optimistic projections.

They’re bank-level numbers, supported by feasibility-stage engineering and an aggressive, institutionally backed buildout strategy.

And when this project hits production — now slated for 2027 — it won’t just be big.

It will be the first large-scale carbon-negative nickel mine in the world.

Permitting Fast Track and Community Buy-In: No Protests. No Delays. No Red Tape.

Anyone who’s followed mining knows what can kill even the best project: permitting delays, community opposition, and endless environmental reviews.

Not here.

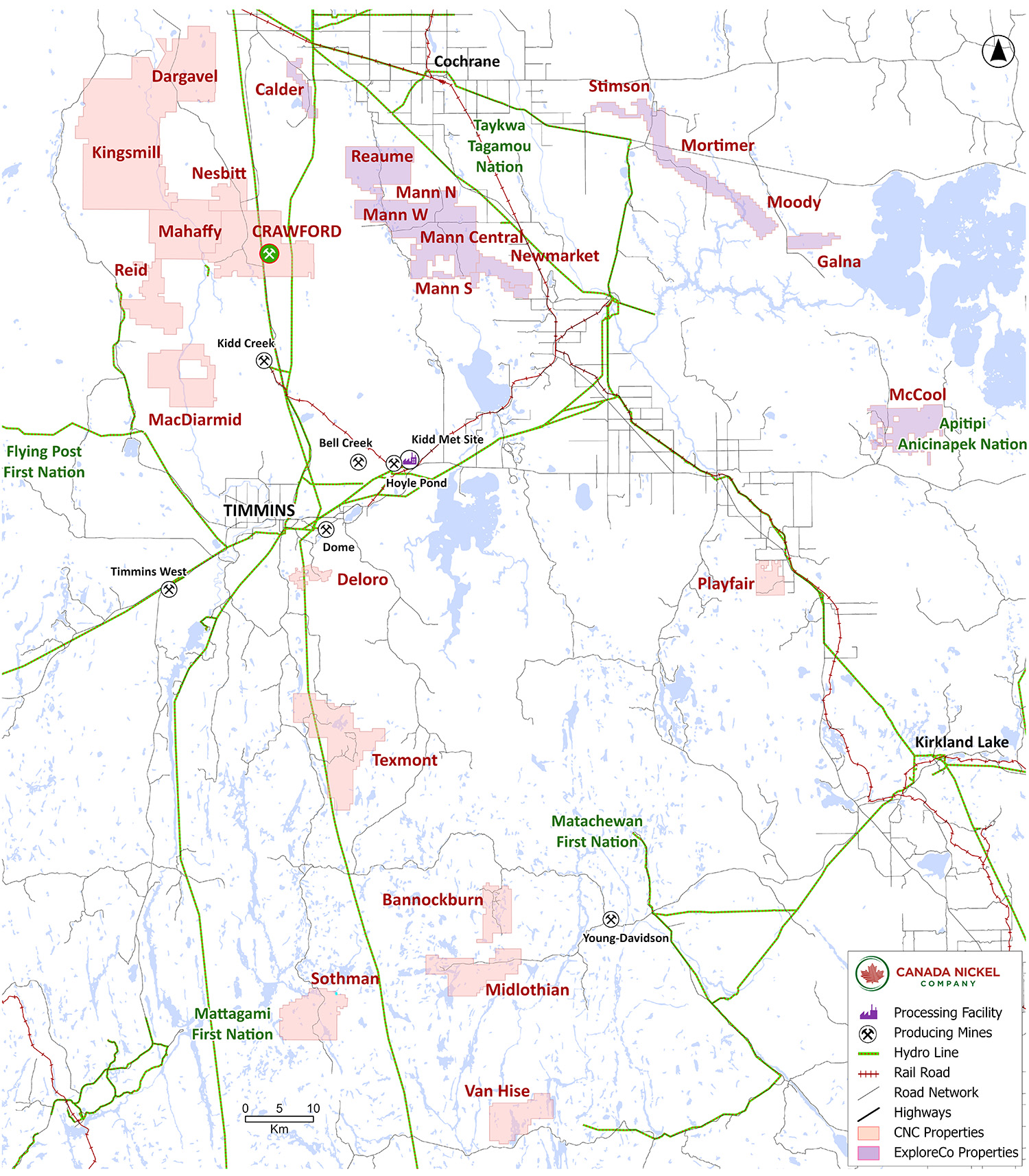

Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) isn’t in the middle of nowhere. Crawford is located just outside Timmins, Ontario — a mining town with 100+ years of operational history, skilled labor, road and rail access, and proximity to low-carbon hydroelectric power.

Here’s what stands out:

- First mining company to file an environmental impact statement (EIS) under Canada’s new 2019 permitting legislation21

- Only 10 people attended the final public consultation — an unheard-of number in an era of NIMBY resistance

- Taykwa Tagamou Nation didn’t just approve the project — they invested via a convertible debenture, a first-of-its-kind commitment22

- Fast-tracked at both the provincial and federal level, with construction readiness on track for 2026 and permits expected by Q4 2025

And this isn’t just good PR.

Permitting certainty translates directly into valuation.

Because majors — like BHP, Vale, and Glencore — don’t just buy ounces in the ground.

They buy de-risked, de-permitted, build-ready assets in friendly jurisdictions.

That’s what Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) has built — and as geopolitical tensions rise around Indonesian and Russian nickel, the value of a scalable, ESG-aligned, North American solution only grows.

Press Releases

- Canada Nickel arranges $8-million private placement

- Canada Nickel Announces Initial Resource at Mann West Nickel Sulphide Project

- Canada Nickel Partners with NetCarb to Advance Next-Generation Carbon Sequestration Technology

- Canada Nickel Announces the Government of Ontario Recognition of Crawford as a Critical Minerals Priority and Nation-Building Project

- Canada Nickel Reports Continued Exploration Success at Reid, Mann West and Deloro

The District-Scale Advantage: Why One Giant Deposit Was Just the Beginning

For most juniors, landing one viable deposit is a once-in-a-decade achievement.

For Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF), it was just the starting point.

Crawford may be the 2nd largest nickel reserve on Earth — but it’s only the tip of the iceberg.

What lies beyond is an emerging nickel belt that could ultimately become one of the largest nickel sulphide districts on the planet.

The scale here isn’t hypothetical.

It’s already happening.

According to CEO Mark Selby,

“Most juniors are lucky to have one good project. We have one great one — and eight more coming.”

Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) has already drilled 18 out of 20 properties across its Timmins nickel district — with a 98% success rate in intersecting target mineralization. That’s an unheard-of hit rate for early-stage nickel exploration.

The crazy part? 10 of those deposits are already shaping up to be even more attractive than Crawford itself.

Drill results are in for what the company calls its “Three Giants”— and they’re nothing short of exceptional.

Reid Deposit: Better Strip Ratio. Shallower Overburden. Better Economics.

Just west of Crawford sits the Reid deposit — and early indications suggest it could be a game-changer.

According to recent internal modeling, Reid has a shallower overburden and a superior strip ratio compared to Crawford. That means lower mining costs, faster development timelines, and better economics.

Canada Nickel’s (TSXV:CNC) (OTCQX:CNIKF) latest NI 43-101 report outlines a massive initial resource: 590 million tonnes (Mt) of Indicated resources at 0.24% nickel, and 990 Mt of Inferred resources at 0.23% nickel — making Reid one of the largest undeveloped nickel sulphide deposits globally.23

While the grade is modest, that’s by design. Reid is a bulk-tonnage, low-strip-ratio deposit engineered for low-cost, scalable open-pit mining and simple processing at massive throughput — similar to the model envisioned for Crawford.

While Crawford is Canada Nickel Company’s flagship, Reid could soon become the crown jewel.

But the story doesn’t end there.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Midlothian, Mann West, and More: Resource Updates Coming Soon

Three of Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) district-scale targets — Midlothian, Mann West, and Mann Central — are quickly emerging as potential flagships in their own right.

All three projects are advancing through aggressive drilling and internal modeling, with early indications suggesting they could rival — or even exceed — Crawford in terms of tonnage potential.

- Mann West & Mann Central: These adjacent targets boast ultramafic trends even larger than Crawford’s, stretching across kilometers of underexplored ground. The company recently launched multi-rig programs across both zones, with drill results confirming wide intercepts of nickel-bearing mineralization and initial resources coming later this month.

- Midlothian: Located in Ontario’s Timmins region, this high-priority target has already shown promising geophysical signatures and mineralization continuity. Its footprint is sizable, and management has hinted that a maiden resource on deck for later this year.

Combined with Reid, these projects represent a pipeline of tier-one scale deposits — each capable of supporting bulk-tonnage mining and low-cost processing.

As Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) works toward its vision of a NetZero Nickel District, these properties are expected to be front and center in upcoming mineral resource updates and development planning.

And the timing couldn’t be better.

The company expects to deliver three new resource updates in Q2 and Q3 of 2025 — timed perfectly to coincide with surging investor demand for domestic, low-carbon battery metals.

There’s a reason why BHP, Rio Tinto, and Glencore are scouring the globe for district-scale opportunities.

They’re not just buying ounces. They’re buying longevity — and geopolitical security.

And no other junior has the same combination of scale, ESG credentials, and execution momentum as Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF).

Here’s why that matters:

- The world’s largest source of Class 1 nickel — Indonesia — is already restricting exports

- China has effectively cornered the low-grade, high-emissions portion of the global supply chain

- Western buyers are now desperate for North American-sourced, ESG-aligned, carbon-negative nickel — and Canada Nickel is years ahead of the pack

If Indonesia tightens supply further (as the Congo just did with cobalt), nickel prices could spike violently.

That’s exactly the kind of backdrop that triggered bidding wars in the past — like the $6.8 billion LionOre acquisition in 2007.24

Except this time, the upside could be even greater.

Why?

Because Canada Nickel (TSXV:CNC) (OTCQX:CNIKF) doesn’t just have one prize asset.

They have a district.

One that’s been quietly de-risked with government alignment, First Nations investment, and an institutional cap table most juniors would kill for.

This is the setup majors wait for.

And when the bids come in — because they will — the premium won’t be based on Crawford alone.

It’ll be based on the entire Timmins Nickel District.

And Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) controls it all.

8 Reasons

This Nickel Stock Could Be The Biggest Sleeper of 2025

1

Second Largest Nickel Reserve and Resource Globally: Crawford is second only to Norilsk — and it’s still early.

2

First Carbon-Negative Nickel Mine: Canada Nickel Company Inc.(TSXV:CNC) (OTCQX:CNIKF) patented process turns mine waste into carbon credits.

3

$1 Billion in Funding LOI’s Secured: Export Development Canada and a top global institution are backing it.25,26

4

Backed by Mining and Battery Giants: Samsung SDI, Agnico Eagle, and Anglo American are on the cap table.

5

18 Properties Successfully Drilled, 98% Targets Hit: The Timmins Nickel District is shaping up as a generational belt.

6

Multiple Deposits May Surpass Crawford: Reed, Midlothian, and Mann West could offer even better economics.

7

Permitting Fast-Tracked by Canadian Government: Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) was the first to file under the new critical minerals framework — shovel-ready by 2026.

8

Still Trading Under $0.91 per Share as of May 30, 2025: A $175M market cap for a billion-dollar-scale asset is a rare disconnect.

Nickel Is Quiet Now. That Won’t Last.

When lithium exploded, most investors missed it.

When uranium started ripping in 2023, few were ready.

Nickel could be next — and the setup looks eerily familiar.

Demand is growing fast.

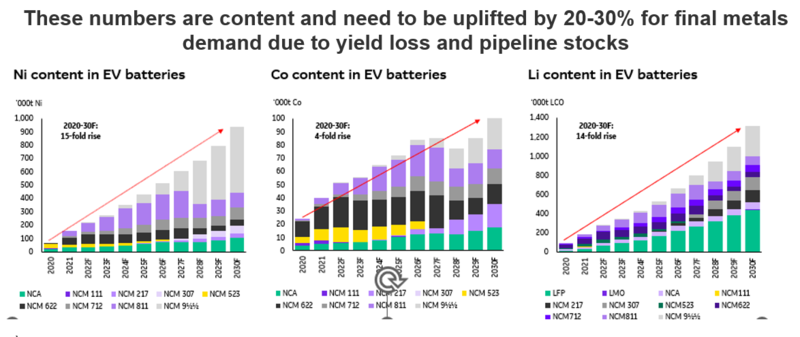

According to BMI, global nickel demand is rising at nearly 6.9% per year,27 led by both stainless steel and EV battery applications — more than double analyst forecasts from just a few years ago.

Benchmark expects battery nickel demand28 to triple by 2030, projecting that nickel-based chemistries will capture 85 per cent battery cell production capacity outside of China by 2030, with production increasingly pivoting towards high-nickel chemistry longer-term.

It’s a dual-use metal now.

Not just for steel, but for high-nickel chemistries used in electric vehicles and grid storage.

Tesla, for example, uses high-nickel NCA and NCM cathodes to maximize energy density — and as this chart shows, batteries are now the second largest driver of nickel demand.

And while the West debates ESG targets and climate goals, one country has already cornered the market.

That country? Indonesia.

Nickel’s version of OPEC.

Indonesia now produces the most nickel globally — but the government has begun restricting raw ore exports to force local processing. Grades are declining, environmental opposition is rising, and China is deepening its control over the region.

Meanwhile, prices still aren’t near incentive levels needed to build new Class 1 projects, the real wildcard is policy.

If the US or Canada mandates domestic sourcing, adds nickel to an incentive list, or blocks Chinese nickel from qualifying for EV subsidies…

Prices could spike 20–30% overnight, just as they did with uranium and rare earths in previous supply crises.

That’s where the opportunity lies.

Because when the market wakes up, the only near-term, large-scale, carbon-negative nickel project in North America — Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) — could be one of the only viable plays left on the board.

And that window may not stay open for long.

The Billion-Dollar Nickel Asset Hiding in a $175 Million Shell

Some juniors get by on hype.

But Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) has what most can’t replicate: real-world backing from institutional giants.

Its cornerstone investors read like the who’s who of global mining and battery powerhouses:

- Samsung SDI — one of the world’s largest EV battery manufacturers

- Agnico Eagle — a $30B gold major with deep project development experience

- Anglo American — a $40B multinational mining conglomerate

- TTN First Nation — invested directly via a convertible debenture — a rare vote of confidence

It’s not just equity support.

Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) has also secured C$1 billion in financing LOIs — C$500 million from Export Development Canada30, and another C$500 million from a top-tier global institution.31

And yet, despite that institutional footprint… the valuation remains absurdly low.

CNC’s current market cap? Just ~C$175million.

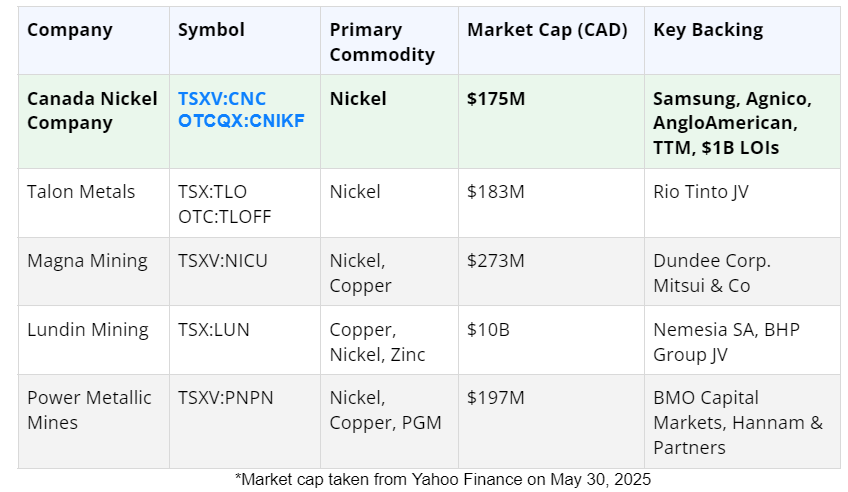

Compare that to what other companies in the critical minerals space are commanding:

While the market bids up lithium and copper names, Canada Nickel holds one of the only scalable, ESG-aligned, near-permitted nickel districts in a G7 country.

Geologically, it’s comparable to Sudbury or even Norilsk — but modernized, engineered for net-zero, and aligned with national security policies in both Canada and the US.

There’s no North American critical mineral asset this far along with this level of institutional, regulatory, and technical de-risking.

And that’s what makes Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) a glaring anomaly.

Because the billion-dollar fundamentals are already there…

The market just hasn’t noticed yet, but these two giants have.

Samsung and Agnico: Two Global Giants Are Quietly Building Their Stake

It’s not just speculative capital driving this story.

Two of the world’s most dominant industrial players are already embedded in the cap table of Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) — and they aren’t here for short-term gains.

🔹 Agnico Eagle Mines, one of the top gold producers on the planet, now owns approximately 10.2% of Canada Nickel.32 Their backing brings deep operational expertise, capital markets credibility, and a long-term development mindset.

🔹 Samsung SDI, the global battery leader, has gone even further. With a US$18.5 million investment, Samsung acquired 15.6 million shares, making it an 8.1% shareholder.33 But the real strategic play is what comes next.

Samsung has also secured the right to acquire 10% of the Crawford Project for US$100.5 million upon final construction decision. If exercised, this would entitle them to:

- 10% of the nickel-cobalt production for the life of mine

- The right to purchase an additional 20% of production for 15 years (extendable by mutual agreement)

This is more than equity ownership.

It’s a long-term offtake agreement — with terms that suggest Samsung is locking down a secure North American supply of battery-grade nickel to support its global EV ambitions.

Together, these two companies represent:

- One of the largest gold producers in the Americas

- One of the top battery manufacturers globally

- And together, they now own nearly 20% of Canada Nickel’s shares outstanding

For investors, that’s more than validation.

It’s a signal that Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) may already be in the early stages of being de-risked — and positioned for eventual integration into the supply chains of giants.

Carbon Capture Is the Wild Card — And CNC Already Holds the Ace

While most miners are racing to cut emissions, Canada Nickel (TSXV:CNC) (OTCQX:CNIKF) is going further — with a proprietary process that permanently sequesters CO₂ into mine tailings, converting waste into carbon credits.

This is where the story starts to separate from every other nickel junior in the sector.

Because that carbon capture process doesn’t just make Crawford ESG-friendly — it makes it profitable.

Thanks to Canada’s Carbon Capture, Utilization and Storage (CCUS) tax credit, the company is eligible for refundable credits covering up to 50% of qualified carbon capture infrastructure costs through 2030.34

And this isn’t theoretical.

Canada Nickel Company has:

- $500 million LOI with Export Development Canada35

- Second $500 million LOI from a major, unnamed international institution36

- Ongoing financing talks with Scotiabank and Deutsche Bank37

This combination of government capital, tax incentive alignment, and carbon monetization gives Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) something no other North American developer has:

A net-zero nickel project with billion-dollar institutional backing before production even begins.

In a world chasing Scope 3 reductions, that’s not just rare. It’s strategic.

Nickel Insiders. Bay Street Builders. ESG Veterans. This Team Has Done It Before.

Behind every great asset is a team that knows how to build — and Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) has assembled one of the strongest benches in the junior resource world.

These aren’t career promoters chasing a trade.

They’re industry insiders with track records that stretch from Inco and Vale, to Kirkland Lake Gold, to billion-dollar financings and full-cycle mine builds.

They’ve done it before.

They’ve taken projects from drill core to production.

And now, they’re doing it again — with one of the largest, cleanest, and most strategically aligned nickel plays in the world.

Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) isn’t betting on luck.

They’re building with veterans who know how this story ends.

One of the Last Great Nickel Prizes — Hiding in Plain Sight

This is the kind of disconnect the market rarely gives you.

A top-tier asset — bigger than LionOre, more advanced than Talon, cleaner than anything coming out of Indonesia…

Backed by Samsung SDI, Agnico Eagle, and Anglo American.

Fast-tracked by Ottawa and aligned with Washington’s national security goals.

With $1 billion in institutional support, carbon-negative economics, and a district-scale land package that could reset the global nickel map for the next 30 years.

And it’s still trading at just $0.65 a share.

There’s no chasing required.

Canada Nickel Company Inc. (TSXV:CNC) (OTCQX:CNIKF) now — before offtake deals are finalized, before construction begins, and before the next leg of the nickel bull cycle hits.

Smart money is already moving in.

But the window for outsized upside — the kind of move early investors saw in companies like LionOre or Foran — is still open.

Now is the time to do your research.

Start by downloading the company’s latest corporate presentation and following the story through the Trading Whisperer newsletter — a free resource tracking high-upside trade ideas every week.

👉 Just subscribe below to get instant access.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Mark SelbyCEO & Director

Mark SelbyCEO & Director Dave SmithChairman

Dave SmithChairman Desmond TranquillaVP, Projects

Desmond TranquillaVP, Projects Stephen BalchVP, Exploration

Stephen BalchVP, Exploration Wendy KaufmanDirector

Wendy KaufmanDirector Pierre-Philippe Dupont VP Sustainability

Pierre-Philippe Dupont VP Sustainability