Back in 2010, stem cells were the next big thing.

Startups promised age reversal, tissue regeneration — even cures for chronic disease. Billions flowed in. But most of those companies faded as science lagged behind the hype.

One didn’t.

While the sector collapsed, this team spent over a decade refining a therapy that uses your own stem cells — not donor tissue — to regenerate the most injury-prone part of the human body: the spinal disc.

Now, the FDA has granted this therapy Fast Track Designation — a move that could accelerate its path to approval.

Why does that matter?

Because chronic back pain is a $100 billion crisis in the US alone.1 It drives more opioid use and unnecessary surgeries than almost any condition — and the treatments don’t fix the cause.

This might.

Breaking News

Even cultural heavyweights like Joe Rogan and Russell Crowe have shared personal stories about how stem cell therapy changed their lives — avoiding surgery and speeding recovery.2

Stem cells aren’t speculative anymore. They’re going mainstream.

And one small-cap US company — trading under $2 with a market cap near $13 million — may have cracked the code on disc repair using a single, in-office injection.

The therapy is already in Phase 2 trials. Early data shows 70–80% improvement in both pain and function. No surgery. No immune rejection. No animal products.

And the company behind it?

BioRestorative Therapies Inc. (NASDAQ:BRTX)

If you’ve heard of Mesoblast (NASDAQ:MESO), the billion-dollar stem cell name chasing the same target — what you’re about to read might change how you think about this entire space.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Why BioRestorative Therapies Inc. (NASDAQ:BRTX) May Leapfrog Mesoblast — at 1/114th the Valuation

When biotech investors think “stem cells for back pain,” they usually point to Mesoblast (NASDAQ:MESO) — the billion-dollar name behind Rexlemestrocel-L.

They’ve completed late-stage trials for degenerative disc disease, attracted major institutional support, and as of May 16, 2025, they trade at $1.46 billion.

But here’s what most are missing:

BioRestorative Therapies Inc. (NASDAQ:BRTX) may have built a more advanced, personalized solution — with fewer risks, stronger early data, and a market cap under $13 million.

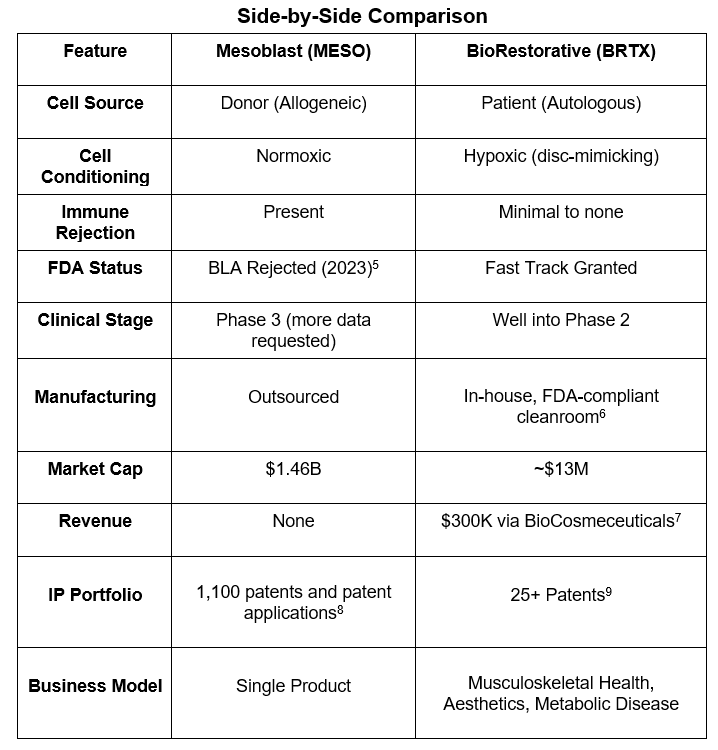

Here’s the breakdown:

- Mesoblast uses allogeneic donor cells, which may increase the risk of immune rejection and limits personalization.

- BRTX uses autologous cells, sourced from the patient and cultured under hypoxic conditions — to better acclimate and build resistance to the harsh and toxic environment of the spinal disc, improving cell survival allowing the cell to do what it is actually intended to do, but can’t on its own.

That’s a biological and regulatory edge.

Mesoblast’s biologics license application was rejected by the FDA not just once, but twice before it was finally approved in December 2024.

BioRestorative Therapies’s lead therapy, BRTX-100, has already received Fast Track designation3 — an accelerated path for therapies addressing serious, unmet medical needs.

Press Releases

- BioRestorative Reports Compelling Preliminary Data for FDA-Fast-Tracked BRTX-100 – an Autologous Stem Cell Therapy to Treat Chronic Lumbar Disc Disease

- BioRestorative Welcomes Serial Regenerative Medicine Entrepreneur, Company Builder and Leader, Sandy Lipkins, to BRTX Team

- BioRestorative to Present Major Update on Promising Preliminary Phase 2 BRTX-100 Data at ISSCR 2025

- BioRestorative Therapies Reports First Quarter 2025 Financial Results and Provides Business Update

- Phase 2 Trial of BRTX-100 in cLDD Continues to Generate Positive Preliminary Blinded Data

Now consider valuation:

- Mesoblast: $1.46 billion

- BRTX: ~$13 million

That’s a 99% discount — despite BioRestorative Therapies Inc. (NASDAQ:BRTX) controlling its own FDA-compliant cleanroom, generating $300K in 2024 revenue from its cosmeceutical division (which just began selling product less than one year ago), a robust, well protected pipeline of cell therapy platforms and owning a growing portfolio of 26+ patents.4

- Disc/Spine (BRTX) – 2 patents issued, 2 patents pending

- Metabolic (ThermoStem) – 23 patents issued, 3 patents pending

If Mesoblast proved the potential of regenerative spine therapy…

BioRestorative Therapies Inc. (NASDAQ:BRTX) may have just perfected it.

BioRestorative (NASDAQ:BRTX) isn’t trailing Mesoblast.

It’s building a smarter, faster, more adaptable model — and the market has barely noticed.

A $100 Billion Problem That Still Has No Real Solution

Chronic lower back pain is the #1 cause of disability worldwide.10

In the US, it affects 65 million people and costs over $100 billion annually,11 often leading to unnecessary surgeries and opioid prescriptions.12

The root cause? In many cases, it’s degenerative disc disease (DDD) — the slow collapse of spinal discs that triggers chronic pain.

That’s where BRTX-100 comes in.

A one-time, in-office injection using autologous, hypoxically cultured stem cells — designed to regenerate damaged discs and restore function. No surgery. No immune rejection. No donor tissue.

Phase 2 data has shown no serious adverse events, and early results already exceed the 30% pain and function improvement threshold set by the FDA for approval benchmarks.

The market potential is massive:

- DDD Treatment: $30.5B in 2024 → $54.1B by 2033 (CAGR: 6.24%)13

- Lower Back Pain: $7.7B → $12.01B by 203414

- Stem Cell Therapy (all indications): $4.45B in 2024 → $9.95B by 203015

Together, that’s a triple-market tailwind.

And while Mesoblast (NASDAQ:MESO) trades at $1.46 billion despite regulatory setbacks, BioRestorative Therapies Inc. (NASDAQ:BRTX) — with Fast Track status and multiple revenue channels — trades under $13 million.

That disconnect may not last much longer.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

8 Reasons

BioRestorative Therapies Inc. (NASDAQ:BRTX) May Be the Best-Kept Secret in Regenerative Medicine

1

Fast Track Status from the FDA: BRTX-100 has earned Fast Track designation for chronic lumbar disc disease — a major credibility boost and regulatory advantage for a micro-cap.

2

Autologous + Hypoxic Stem Cells: Unlike donor-based competitors, BioRestorative Therapies Inc. (NASDAQ:BRTX) uses the patient’s own cells, cultured in low-oxygen to improve survival inside spinal discs.

3

Better Setup Than a $1.46B Peer: Mesoblast uses outdated tech and had its BLA rejected. BRTX has stronger early data — and trades at just 1% of the valuation.

4

Strong Early Efficacy Data: Phase 2 trials show improvement in pain and function from a single injection in 70% of patients — with no major safety issues.

5

Revenue-Producing Aesthetics Division: While many biotechs burn cash, BRTX generated $300K in FY2024 from its exosome-rich serum via Cartessa distribution.

6

In-House Manufacturing Capability: BioRestorative Therapies Inc. (NASDAQ:BRTX) owns and operates an FDA-compliant ISO-7 cleanroom — reducing costs and giving it full control over production.

7

Diversified Pipeline: The company spans spine, aesthetics, and metabolic disorders — including a brown-fat stem cell platform for obesity and diabetes.

8

Tight Float + Insider Alignment: With a ~$13M market cap, ~4.92M float, and 27% insider ownership,16 BioRestorative Therapies Inc. (NASDAQ:BRTX) is well-positioned for a re-rate on any meaningful news.

The Chart Is Coiling for a Breakout — But Few Are Watching

While most investors focus on clinical catalysts, sharp traders are eyeing something else: the chart.

Since February, BioRestorative Therapies Inc. (NASDAQ:BRTX) has formed a symmetrical wedge, with higher lows and lower highs compressing into a tight apex — a setup that often precedes major moves.

As of May 16, BioRestorative Therapies Inc. (NASDAQ:BRTX) is trading around $1.60, just above support. A breakout above $1.72–$1.75 on volume could trigger momentum — especially with:

- Just ~7.5M shares outstanding

- A float under 5M

- 27% insider ownership17

Add to that: all four major moving averages (10, 20, 50, 200-day) are now converging — a rare technical alignment that usually resolves with force.

And it’s not just chart-watchers taking notice.

Analyst Coverage Is Building

- Roth MKM initiated coverage with an $18 price target (August 2024)18

- Consensus targets sit around $13

- Coverage from Maxim Group and Roth Capital19 signals growing institutional attention

Tight float. Clean setup. Analyst buy-in.

BioRestorative Therapies Inc. (NASDAQ:BRTX) may be one catalyst away from a breakout — both on the chart, and in the market’s perception.

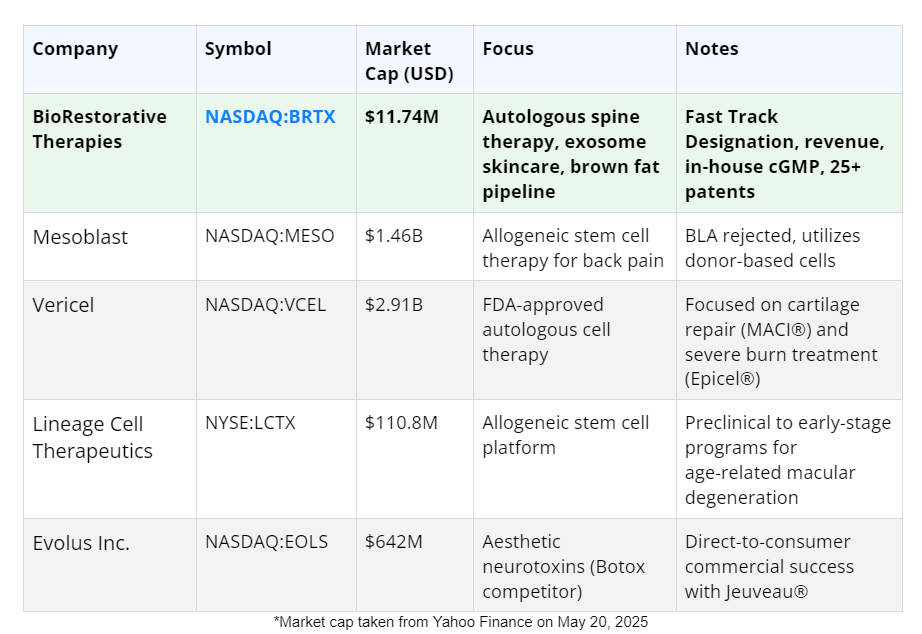

How BRTX Stacks Up Against the Big Names

BioRestorative Therapies Inc. (NASDAQ:BRTX) isn’t alone in the race.

It’s targeting the same multi-billion-dollar challenges as some of the most recognized names in stem cell therapy, aesthetics, and metabolic health.

But while many of those companies trade at sky-high valuations — often with less IP protection, no revenue, or greater regulatory risk — BRTX remains under the radar.

Here’s the difference:

While Mesoblast holds a billion-dollar valuation with donor-based cells and a rejected BLA…

BioRestorative is pushing forward with autologous, immune-compatible therapies — already more than half way through a key Phase 2 trial, already generating revenue, and with in-house manufacturing fully in place.

And it trades at less than 1% of Mesoblast’s market cap.

When the market connects the dots — between its science, its structure, and its strategic positioning — the valuation gap may not last.

A Leadership Team Built to Execute

BioRestorative Therapies Inc. (NASDAQ:BRTX) is led by a team with deep experience in biotech, capital markets, clinical trial strategy, and intellectual property — all essential for advancing a high-potential platform like BRTX-100.

Final Takeaway: This Opportunity Is Hiding in Plain Sight

Strip away the noise — and what’s left is one of the most compelling under-the-radar biotech setups in the market today.

BioRestorative Therapies Inc. (NASDAQ:BRTX) has:

- An FDA Fast Track-designated therapy for chronic back pain

- In-house FDA-compliant manufacturing

- A revenue-producing aesthetics division

- A preclinical and clinical pipeline in metabolic and musculoskeletal disease

- A tight float, strong insider ownership, and analyst coverage pointing to major upside

- And a market cap still hovering around $13 million

This isn’t a biotech still “hoping” for validation.

It’s already executing — and trading like it hasn’t started.

Meanwhile, its main competitor trades at $1.46 billion with more regulatory friction and older tech.

The chart’s tightening. The catalysts are lining up.

And the market hasn’t caught on. Yet.

If BioRestorative Therapies Inc. (NASDAQ:BRTX) delivers on what early data and market positioning suggest, it won’t stay micro-cap for long.

This is the kind of momentum you need to pay close attention to.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Lance AlstodtChairman & CEO

Lance AlstodtChairman & CEO Robert KristalChief Financial Officer

Robert KristalChief Financial Officer Francisco SilvaVice President of R&D

Francisco SilvaVice President of R&D