Copper prices have swung wildly in 2025, plunging from $5.80/lb to $4.35/lb in July, only to roar back to $4.85/lb by October.

That rebound isn’t noise. It’s a signal.

The world’s insatiable demand for copper, from AI data centers to EVs, clean energy, and grid expansion, is colliding with tightening supply.

Chile’s output just saw its steepest drop in years,1 Indonesia’s Grasberg mine has cut ~3% of global supply until 2027,2 and even Freeport is slashing guidance.3

Analysts now warn the market could face a full-blown supply crisis before the decade is out.4

That’s why North America’s copper juniors are suddenly in the spotlight. The winners will be the ones with grade, scale, and gold credits to match.

And that’s exactly where Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) comes in.

Its B26 deposit already hosts nearly 550 million pounds (Mlbs) of copper and 369,000 ounces of gold, combining 532.3 Mlbs copper equivalent (CuEq) Indicated and 348.8 Mlbs CuEq Inferred,5 making it one of Canada’s highest-grade undeveloped copper-gold projects.

And that is just the beginning.

In September, Abitibi drilled its strongest intercept yet: 4.46% CuEq over 21.1m, proof that B26 is still expanding.6

Yet despite this momentum, the company trades at just C$47 million.

With the largest drill program in its history fully funded through 2027, institutions circling, and insiders loading up, this could be the kind of setup investors look back on as the start of the next copper breakout story.

The Next Foran? It’s Starting to Look That Way…

In 2020, Foran Mining (TSX:FOM) was a little-known copper explorer trading at $0.12 per share with a sub-$50 million market cap.

Then copper started to move.

Institutions piled in. BMO backed the story. The McIlvenna Bay VMS deposit gained traction.

And Foran ran from $0.12 to $3.76, hitting a market cap of more than $2 billion.

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) checks all the same boxes:

- High-grade VMS deposit in Quebec’s Abitibi Greenstone Belt

- Tier 1 jurisdiction with mining-friendly infrastructure

- Institutional backing from BMO7

- Tight share structure with nearly 30% insider ownership

- More than 3M shares bought by insiders since January 2025

And the numbers already stack up:

- 11.3Mt @ 2.13% CuEq (Indicated)8

- 7.2Mt @ 2.21% CuEq (Inferred)

- That’s 553M lbs of Copper, 369k oz of Gold, 15M oz of Silver, and 340M lbs of Zinc

All of that… in a Tier 1 jurisdiction, with institutional backing (BMO led their recent $11M financing), and a market cap of just C$47 million.

Foran had similar grades, the same BMO backing, and a $50M valuation—before it ran 2,400%. Could AMQ be next?

Press Releases

- Abitibi Metals 150m Step-Out Extends B26 Western Copper-Gold Zone With 8.16% CuEq Over 3.2m Within 11.0m at 3.93% CuEq, Highlighting Significant Expansion Potential

- Abitibi Metals Welcomes Mining Veteran and Shareholder Craig Parry to Its Advisory Board to Support the Next Phase of Growth

- Abitibi Metals Expands B26 Mineralization: 150m Step-Out Confirms Continued Growth in the Western Down-Plunge

- Abitibi Metals Expands Phase 3 Drill Program to 20,000 Metres Following Final Assays of 4.46% CuEq Over 21.1 Metres from Hole 269W3

- Abitibi Metals Extends B26 Mineralization & Increases Grade: Reports 3.65% CuEq Over 21.1m Within Interval of 1.55% CuEq Over 69.0m

Introducing the Undiscovered Copper Junior Lighting Up Quebec

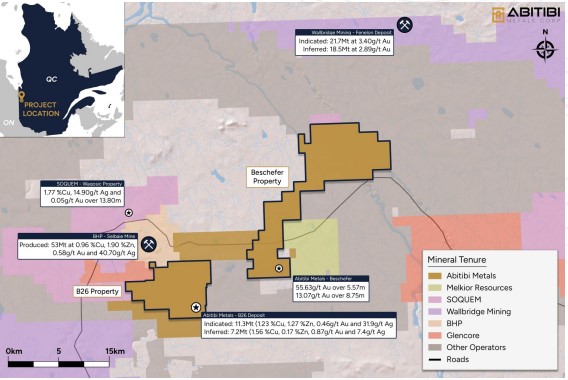

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is a Quebec-focused copper-gold explorer with two major assets:

- The B26 Polymetallic Deposit – a VMS copper-gold system in the heart of Quebec’s Abitibi Greenstone Belt

- The Beschefer Gold Project – a high-grade gold zone near Detour Lake, held 100% by the company

Let’s start with the main prize.

B26: Nearly a Billion Pounds and Growing

B26 is located just 5 km from the past-producing Selbaie Mine (53 Mt of ore) and 140 km from the Horne Smelter.9

It’s a textbook VMS system and one of the highest-grade undeveloped polymetallic deposits in North America.

The December 2024 NI 43-101 resource confirmed:

- 11.3Mt Indicated at 2.13% CuEq

- 7.2Mt Inferred at 2.21% CuEq

That equates to ~920M lbs CuEq at ~2.7% effective grade, including ~370,000 oz Au and 13M oz Ag, one of the highest gold credits of any copper junior in North America.

And the results keep coming.

In September 2025, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) reported its strongest intercept yet: 4.46% CuEq (3.48% Cu, 1.14 g/t Au) over 21.1m within 69.0m at 1.8% CuEq.

Step-out drilling has also extended the deposit footprint by up to 100 metres beyond the 2024 block model, proving B26 is still expanding.

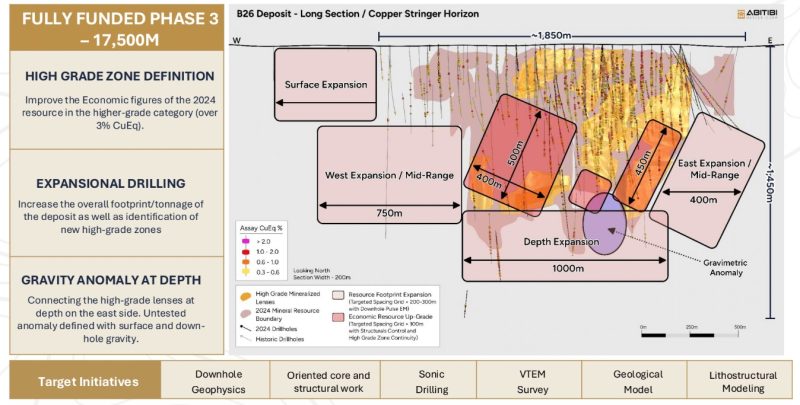

Phase III: Largest Drill Program in Project History

Phase III drilling is fully underway with 20,000 metres planned and 9,060 metres already completed. The campaign is designed to expand lateral and down-plunge extensions, tighten spacing in high-grade zones, and test 8.7 kilometres of newly identified VTEM conductors that remain untested.10

And Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is not stopping there. Another 25,000 metres of Phase IV drilling is already budgeted for 2026, making this the largest exploration push in the history of B26.

Grade, Scale, and Serious Momentum

Drilling has already confirmed both shallow and deep zones of high-grade copper-gold with results such as:

- 10.6m at 11.4% CuEq

- 44.5m at 2.82% CuEq

- 97.5m at 1.47% CuEq near surface

- 17.5m at 2.4% CuEq at depth

- 3.65% CuEq over 21.1m in the latest update

With mineralization open in all directions and new regional targets waiting to be tested, B26 is shaping up as more than just a deposit. It is the center of a system with district-scale upside.

SGS completed the resource estimate in the 2024 NI 43-101 technical report.11

Fully Funded. Fully Focused.

Earlier this year, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) raised $11 million through a financing led by BMO Capital Markets.

The company is now fully funded through Q1 2027, with the next two phases of drilling already locked in.

Management is aligned, insiders have bought more than 3 million shares since January 2025, and institutional support is building.

This isn’t a lifestyle company.

It’s an execution story.

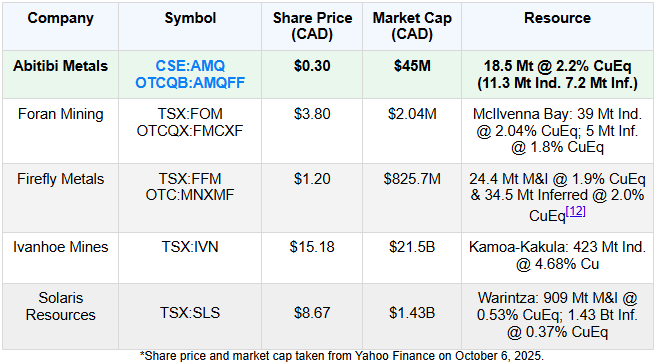

The Valuation Gap Is Absurd

Let’s look at comps.

On a grade-to-valuation basis, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) might be the cheapest high-grade copper junior in Canada.

AMQ’s B26 deposit already compares to Foran’s McIlvenna Bay in grade and style, yet Foran trades at more than 40 times AMQ’s valuation.

Even smaller peers like Arizona Metals carry valuations well above Abitibi Metals despite holding far less copper in the ground.

That kind of valuation gap creates opportunity and history shows it rarely lasts long.

Notable Backers — Including a Billionaire

Abitibi’s (CSE:AMQ) (OTCQB:AMQFF) shareholder base is anchored by long-term, strategic investors:

- The Deluce family office (Porter Airlines), holding close to 30%

- Delbrook Capital, a $1B+ resource-focused fund

- BMO Capital Markets, which led Abitibi’s $11M financing in early 2025

Insiders have also been steadily buying, with more than 3 million shares acquired on the open market since January 2025.

This is heavyweight capital with a long-term view, not fast money.

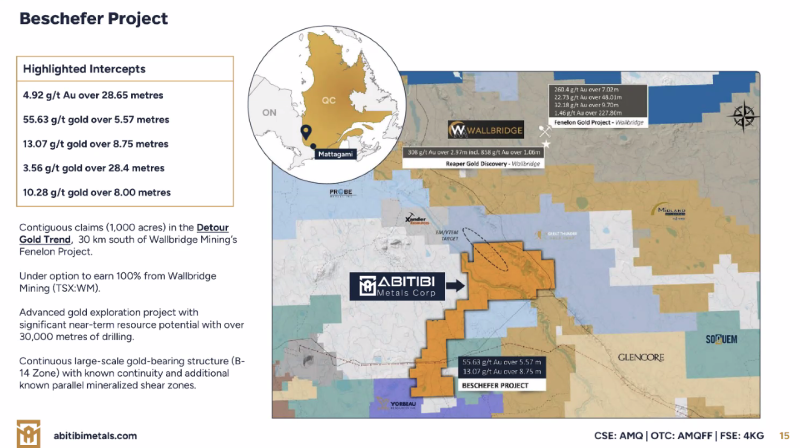

Gold-Leveraged Bonus: The Beschefer Project

While B26 leads the story, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) also owns 100% of the Beschefer Gold Project—near Detour Lake in Quebec.

Historic highlights include:13

- 4.92 g/t Au over 28.65m

- 13.07 g/t Au over 8.75m

- 10.28 g/t Au over 8.00m

It’s an option on rising gold—and adds serious upside as gold surpasses $3,200/oz.

A Veteran Team With Skin in the Game

The rocks may tell the story…

But it’s the people behind Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) that make this one of the most credible copper-gold juniors in the market.

This isn’t a lifestyle company. It’s led by dealmakers, mine builders, and insiders who own real equity—and continue to buy more.

These aren’t figureheads.

They’re operators, builders, and financiers who’ve helped take projects from grassroots to billion-dollar exits.

This is a team that’s aligned, active, and ready to scale.

The Final Word: This Could Be the Most Asymmetric Copper Play in North America

Copper has rebounded to $4.85/lb as supply cracks emerge in Chile and Indonesia.

Demand from electrification, AI data centers, EVs, and clean energy is only accelerating. Institutions are circling, and the market is waking up to a looming supply crisis.

And right in the middle of it is Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) which controls one of the highest-grade undeveloped copper-gold systems in North America.

Yet it trades at just C$47M.

Abitibi is not standing still. It is fully funded through Q1 2027, with the largest drill program in the project’s history underway and another 25,000m already budgeted. Institutions like BMO Capital Markets are backing it, insiders have bought 3M+ shares this year, and the Deluce family office owns nearly 30%.

Grade. Scale. Institutional support. Expansion in progress.

This is the kind of rare copper breakout story investors wait years for.

Do your due diligence. But do it fast.

Because the market won’t sleep on this for much longer.

The B26 Project is at an early stage of exploration & resource development and does not currently have a mineral reserve estimate, feasibility study, or demonstrated economic viability. Any references or comparisons to other mineral projects including Foran Mining’s McIlvenna Bay are intended solely to illustrate potential geological analogues. Such comparisons should not be interpreted as implying that the B26 Project will achieve similar results, development timelines, or economic outcomes. Projects at more advanced stages may have completed technical studies, established mineral reserves, or be under development or in production, which differentiates them from early-stage exploration assets. There is no guarantee that the B26 Project will advance to a similar stage.

Jon DeluceChief Executive Officer & President

Jon DeluceChief Executive Officer & President Louis GariepyVice President of Exploration

Louis GariepyVice President of Exploration Laurent EustacheExecutive Vice President

Laurent EustacheExecutive Vice President